The U.S. telehealth market will grow from $240 million in 2013 to $1.9 billion by 2018, according to research firm IHS, at an annual growth rate of 56%. RNCOS Business Consultancy Services expects the worldwide telehealth market to grow 18.5% annually.

Those impressive growth rates indicate that the soaring adoption of mobile devices will allow more doctors to treat a higher number of patients via the Internet. Onboard cameras, motion sensors, fitness tracking apps, and attached peripherals on smartphones and tablets can now help doctors remotely monitor a wider array of health conditions than ever before.

Therefore, it makes sense for insurers and tech companies to develop software which streamlines telehealth services for doctors and patients. Let's take a closer look at four notable efforts from Cigna (CI +0.00%), WellPoint (WLP 1.13%), UnitedHealth Group (UNH 0.37%), and Google (GOOG +1.88%) (GOOGL +1.68%).

Cigna and MD Live

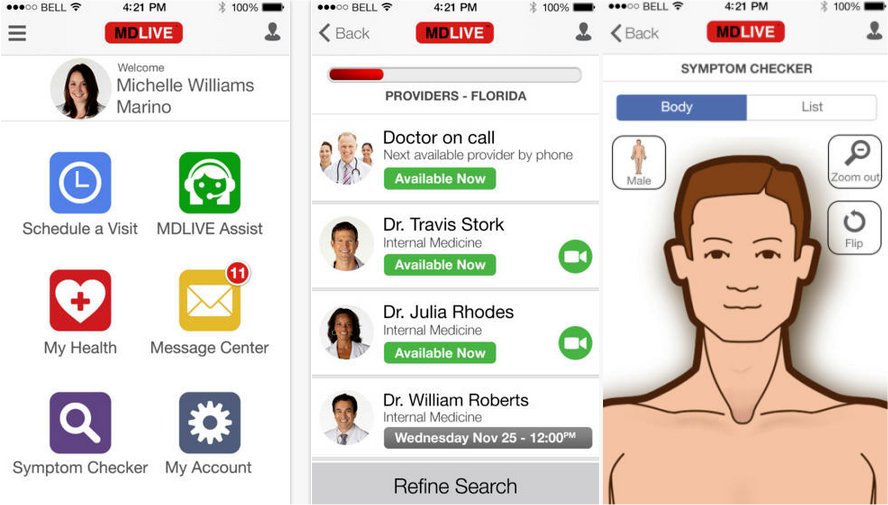

Last April, Cigna signed a deal with MDLive, a telehealth service which provides patient-to-doctor remote visits via iOS devices and PCs. MDLive's remote consultations can be conducted via email, video chat, or phone conversations. The results are then recorded with the patient's primary care provider.

MDLive's iPhone app. Source: iTunes

Cigna's members will have access to MDLive's 2,200 on-call physicians across the country. Cigna members can either schedule an appointment or request an immediate consultation, which requires an average wait of 11 minutes. A waiting patient is then notified both via a text message and email when the doctor is available. These services only cover nonemergency issues such as colds, the flu, rashes, sinus issues, and headaches.

In an interview at Mobihealth, MDLive CEO Randy Parker stated that 70% of ER visits could have been avoided with the help of a remote consultation like MDLive. Since ER visits can be costly for both the patient and the insurer (often topping $1,500), it makes sound business sense for Cigna to offer its members a service that can resolve potential problems at home.

WellPoint and UnitedHealth

WellPoint has partnered with American Well, which provides a telehealth service called LiveHealth Online to members in 44 states and Washington, D.C.

American Well's 10-minute sessions are conducted over video chat with on-call, board-certified doctors. Physicians can prescribe medications if the state allows prescriptions via online video sessions. WellPoint launched its version of American Well's software in California and Ohio last year, and plans to deploy the service to more states over the next few years.

UnitedHealth Group's OptumHealth has also launched a similar telehealth effort, NowClinic, which is now available in two dozen states. Like Cigna and WellPoint's partnerships, NowClinic is conducted over video chat, only used for nonemergency situations, and physicians in certain states can prescribe medications. Rite Aid, the third largest pharmacy in America, now offers NowClinic services (online diagnosis and prescriptions) at select locations.

NowHealth's iPhone app. Source: iTunes

Google Helpouts

Last November, Google launched Helpouts, a marketplace for certified experts to charge clients for consultations in various fields. These consultations can be charged per session, per minute, or both, and are paid via a client's Google Wallet. Members must access the service via a Google+ account.

Google usually takes a 20% cut of the fee, but it has waived that fee for health-related questions. One Medical, a network of medical practices that emphasizes the use of telehealth, provides Google Helpouts members remote access to dozens of clinics and hundreds of doctors within its network. One Medical's sessions, which also focus on nonemergency conditions, generally last for 20 minutes.

One Medical's network accepts health plans from most major insurers -- including Cigna, WellPoint, and UnitedHealth -- which means that Helpouts could be another way for insurers to expand into regions which their telehealth partners have not reached yet.

The road ahead

In closing, telehealth is appealing to insurers because it can keep patients healthy while reducing the number of costly hospital visits. It also prevents members from erroneously self-diagnosing themselves and scrambling to the ER in a panic. In the near future, biometric data collected from fitness trackers, medical devices, and mobile apps will likely play key roles in telehealth as well.

But before that happens, telehealth providers and insurers must secure their patient-doctor exchanges to remain compliant with HIPAA regulations. Medicare coverage of telehealth should be expanded to include more features, including the exchange of digital images. Moreover, all states still have to legalize telehealth and allow the prescriptions of basic medications via video chat. Only then can the U.S. telehealth market achieve the double-digit growth that IHS expects.