After two relatively mild winters, Jack Frost delivered a polar vortex to the Midwest, Southeast, and Northeast U.S. during the winter of 2013-14. While the bone-chilling cold and heavy snowfall were mostly unwelcome to most of us, it sent cities scrambling to replenish their deicing salt inventories. This was just in the nick of time for Compass Minerals (CMP 3.53%), whose salt inventories began to become bloated after the drought and mild winter of 2012-13 despite steep production cuts. The 13.2 million tons of salt sold in 2013 provided much-needed inventory relief.

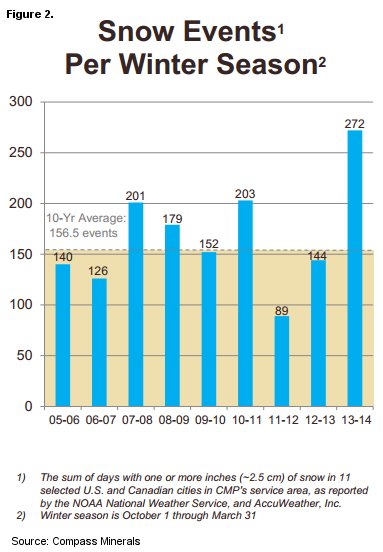

What drove the 37% increase in tons sold was a super-sized 88% increase in the number of snow events in the 11 cities in which the company operates. As figure 2 illustrates, the 272 snow events during the last winter was well above the 10-year average for the company's service area and follows two straight years of below-trend snow events.

The company's much smaller specialty fertilizer business had held up relatively well, but potash demand had begun to weaken due to persistently high prices. The stock finally gave way to industry pricing pressures in July 2013, however, potash pricing for Compass Minerals has been relatively firm. The relative pricing power is likely due to the type of fertilizer, sulfate of potash, that the firm sells. Intrepid Potash (IPI 1.64%) is the only other company in the U.S. that sells this variety of potash. Sulfate of Potash generally sells at a premium to Muriate of Potash or KCI, which industry giant Potash Corp (POT) sells. Sulfate of Potash has a low chloride content, which makes it great for growing crops with a low tolerance for salt. This value proposition gives both Compass Minerals and Intrepid Potash the ability to price their potash at a premium to Potash Corps Muriate of Potash.

Where do they go from here?

In November of last year I penned a piece entitled "Will Jack Frost Help Compass Minerals Offset Slumping Potash Sales?" and wrote the following:

If there is average to above average snowfall in Compass Minerals' representative markets, the stock price may pile on top of the snow and climb toward the stock's 52-week high of $91.88 per share in my opinion.

The snow came and the stock did indeed hit that 52-week high before setting a new high of $94.33. At a recent close of $92.94 per share, the stock is around 4% from its all-time high of $97.61. Where the company goes from here is the next question. With a leading P/E of 21, and a negative five-year earnings and EPS growth rate, it seems likely that the stock stalls at these lofty levels.

While the company operates a dependable, non-cyclical business, adverse weather can introduce earnings volatility. The stock's current dividend yield of 2.6% is roughly equal to 10-year treasury rates and should offer some support to the stock as long as interest rates don't rise. Weather trends suggest a winter favorable to the company, although it is doubtful that the company's service area will repeat the record number of snow events of last season. One thing that would boost the stock price would be a share buyback. However, in contrast to current Wall Street trends, the number of outstanding shares has increased and not declined. In my opinion, any material new growth from here is unlikely until a new catalyst emerges.