This January, new federal regulations will go into effect restricting the burning of natural gas in America's oilfields. "Flaring," as it is called, is necessary when natural gas is produced along with crude oil but without any means of transporting the gas to market. Unlike crude oil, natural gas can't be put into a tank for later delivery; it must be moved or burned quickly. For companies operating in North Dakota, new flaring restrictions from the state kick in on October 1.

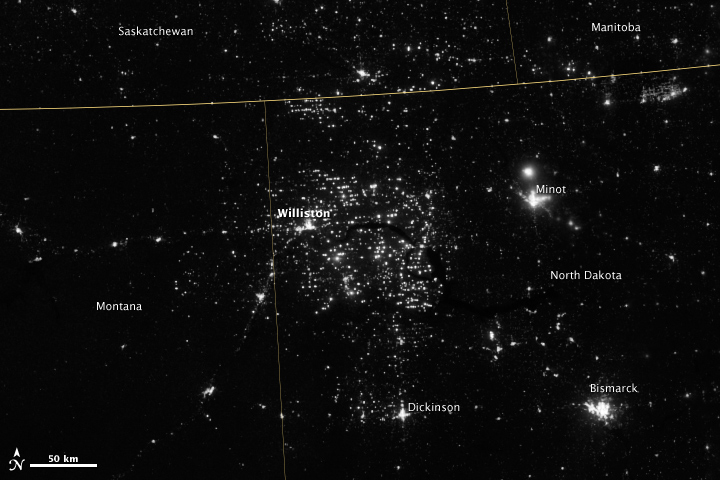

It's not a trivial problem. An estimated 30% of all gas produced in North Dakota is flared and NASA can see the Bakken oilfields around Williston at night courtesy of this flaring.

Image courtesy of NASA Earth Observatory

With these new restrictions, there are opportunities. A company such as Whiting Petroleum Corporation (WLL) certainly will not want to pay fines or shut down production over flaring. The company's latest earnings report shows production, revenues and earnings all growing over last year's levels. The last quarter's earnings were a record, in fact. Whiting is on a roll in North Dakota, but what options does it have regarding these new regulations?

Using natural gas at the drilling pad

One option is Whiting can use the natural gas as fuel onsite. That is, natural gas produced at the wellhead can be burned to produce electricity or as a vehicle fuel. This offers an attractive alternative to diesel fuel, which is commonly used for both purposes in an oil field.

General Electric (GE 1.30%) recently launched its "CNG in a box" product to capture natural gas and make it available for onsite use. The product offers a simple way to provide compressed natural gas, or CNG, for vehicle or generator use. Relatedly, GE also offers its Micro LNG system that can liquefy natural gas and, again, make it available for immediate use. These products are just two of GE's portfolio of natural gas related products. From home back-up generators to industrial sized generators, from locomotives to natural gas compressors, GE looks to capitalize on what it calls "The Age of Gas." GE foresees growing production and demand for natural gas, led by electrical power generation.

For perspective, in its latest quarter, GE reported $27.3 billion in sales. Natural gas related products are hard to evaluate as part of its overall sales picture since they come from GE's transportation, oil and gas, and power and water divisions and these all were reported separately. While sales of CNG in a box and MicroLNG systems will help, it's hard to see them being blockbuster products against a backdrop of $27.3 billion in quarterly sales.

Another company making natural gas burning equipment is Power Solutions International (PSIX -6.67%). In contrast to GE, Power Solutions latest quarter saw sales of $66.7 million. The company estimates that Whiting and other drillers spend $14 billion in diesel fuel each year, a market where its natural gas generators and engines can grow.

In its latest earnings conference call, Power Solutions management noted that sales of natural gas power generators to oil and gas drillers were a significant driver of revenue growth. In fact, in answer to a question, Power Solutions CFO Dan Gorey indicated revenues from oil and gas doubled on a year over year basis. These developments and others had management brimming with confidence during its conference call.

One potentially big development centers on the recent acquisition of Professional Power Products, Inc, a company with significant sales to the oil and gas industry for power generation. Prior to this acquisition, the biggest electric generator Power Solutions could offer the oil and gas industry was 431 kW. There is demand for larger generators and Professional Power Products offers such systems. So there is great anticipation that Power Solutions will continue growing in the oil and gas power generation market.

Sending gas to market

The other option Whiting has is to transport its natural gas through pipelines. It's no secret that natural gas pipeline infrastructure hasn't kept up with production. Gas production volumes and prices combine to make it tough to not flare even if you wanted to sell the stuff.

One company actively working to connect this North Dakota natural gas production to markets is Oneok Inc (OKE 0.53%). Oneok operates natural gas and natural gas liquids pipelines in the Bakken shale play. Its income is largely fee-based, limiting its exposure to commodity prices. $6 billion in growth projects are under way, and its Bakken assets will receive $3.6 billion of that capital expenditure.

One appealing aspect of Oneok is its dividend. The company currently yields around 3.4%, but the company has declared a goal of growing its dividend by 20-25% through 2016. Which is not to knock the performance of its stock in terms of capital gains. Oneok stock grew 80% over the past two years, and if its dividend grows 20% a year, expect more capital gains as well.

Final Foolish thoughts

Many regard government regulations as a pain in the neck. However, regulations also create investment opportunities. Of the three companies presented here, Oneok looks like the best combination of income and capital gains. Flared gas soon will have to go somewhere, and Oneok seems well positioned to deliver both gas to customers and returns to investors.