Investors seek out a certain criteria for long-term positions in the stock market. Many look for a combination of brand strength, a history of dividend payments, and a solid valuation. And while Coca-Cola (KO) and PepsiCo (PEP -0.62%) may have the first two attributes, the valuation for both stocks is becoming a different story.

Historically, Coca-Cola and Pepsi have been known as long-term value plays with handsome dividend payouts.

But even as revenue and net income growth stalls, the prices for these stocks continue to move higher.

Generally, the valuation for these two stocks has remained relatively low. But in early to mid 2013, the valuation, on a price-to-earnings basis, quickly moved higher. Have a look below:

KO P/E Ratio (TTM) data by YCharts

As you can see, Coca-Cola and PepsiCo are trading with current P/E ratios of roughly 22 and 21, respectively. Last time the valuations were this high, the stocks pulled back through the second half of 2013 and into early 2014.

The average P/E ratio for Coca-Cola over the previous five years is 18.3, while PepsiCo's is 17.2, according to MorningStar.

While not egregiously overpriced, other metrics aside from the P/E ratio would appear to support the overvalued argument.

In fact, on a price-to-book, price-to-sales, and price-to-cash flow basis, both stocks are valued higher than compared to the five year average, S&P 500, and industry average. The sole exception is PepsiCo on a price-to-sales basis compared to its industry average, (all of these stats can found in the MorningStar links above).

But the point is relatively clear: While not being outrageously expensive, such as a fly by-night technology stock, Coca-Cola and PepsiCo are getting relatively expensive compared to their historic norms and the industry.

The valuations are getting seemingly more expensive simply because the earnings per share haven't risen significantly for either company. Although admittedly, PepsiCo's 10% EPS growth from 2012 to 2013 is impressive. Here is a look at the EPS over the past three years:

KO EPS Diluted (TTM) data by YCharts

At least the dividend is solid

While the valuations may not be as attractive for these two stocks, several other parts are. For instance, both stocks have a higher dividend yield than industry peers, the S&P 500, and the five-year average for each company.

The companies have also been very consistent in raising those dividend payouts to investors. Have a look below to see the annual dividend increases over the past five years:

|

Year |

KO Annual Dividend |

Change to KO Dividend |

PEP Annual Dividend |

Change to PEP Dividend |

|

2009 |

$0.84 |

10.5% |

$1.80 |

4.7% |

|

2010 |

$0.88 |

4.8% |

$1.92 |

6.7% |

|

2011 |

$0.96 |

9.1% |

$2.08 |

7.7% |

|

2012 |

$1.04 |

8.3% |

$2.16 |

3.8% |

|

2013 |

$1.12 |

7.7% |

$2.28 |

5.6% |

Source: Data from Thomson Reuters, table made by author.

Not only were Coca-Cola and PepsiCo able to make it through the financial crisis in 2007-08 without reducing or suspending dividend payments, they were actually able to raise the annual payouts.

Talk about consistent. Even during the worst of times, these companies maintained and raised their dividends, something investors certainly find appealing.

Valuation still tough to swallow

One way to justify paying up for a stock is to see growth, but these two don't have a whole lot of that at the moment. PepsiCo has its snacks division, which is doing well, and Coca-Cola is making investments in Keurig Green Mountain and Monster Beverage as a means for growth.

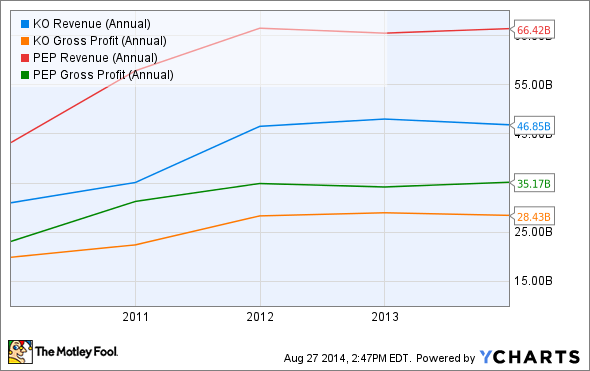

Looking at fiscal years, the past three years have featured essential zero growth in revenues or net income for either company. Have a look below at these metrics for each company over the previous five years:

KO Revenue (Annual) data by YCharts

As you can see, starting in 2012 each company appears to have hit a brick wall when it comes to net income and revenue growth.

And while these companies are trying to spur growth, the main concern lingers: Soda volume is in decline and that's a problem for these two companies. I know they are making investments in other drinks segments -- such as juices, teas and water -- but this has to result in actual sales growth.

The Foolish takeaway

Companies like Coca-Cola and PepsiCo have long-standing and powerful brands. The dividend payouts are both attractive and generally speaking, relatively secure.

However, is that worth paying a premium for the stocks, even premiums that, historically, don't tend to stay this high over the ensuing years?

For now the market says yes, but I would argue that these two iconic companies are somewhat overvalued. These stocks are expensive compared to the historic valuations.

Let's be clear here: Coca-Cola and PepsiCo are great companies that are both focusing on finding future growth. But I think investors looking to initiate new positions can find better places to park their money at this time.