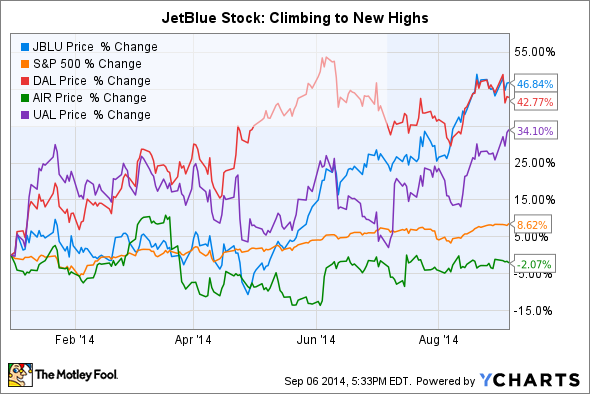

When it comes to airline stocks, few are as well positioned as JetBlue Airways Corporation (JBLU -3.21%) is right now. The stock is up about 47% as I write, outperforming the returns of larger peers AAR Corp. (AIR -0.75%), Delta Air Lines (DAL 4.05%), and United Continental (UAL 1.59%).

Can the rally continue? I think so. A strong service record coupled with new services could help the carrier take share from its peers and push JetBlue stock to higher altitudes.

JetBlue stock may be climbing higher over the next few years. Credit: JetBlue.

Always in the "best airline" conversation

A handful of carriers tend to dominate each year's list of the best airlines, and JetBlue usually makes the cut. But don't take my word for it. Here's a closer look at Airfarewatchdog's list from the past three years:

Source: Airfarewatchdog.com.

Why should you care? Airfarewatchdog doesn't just track prices. From baggage handling to on-time statistics and general customer satisfaction scores, the site keeps close tabs on the performance of the entire U.S. airline industry.

Its findings also tend to jibe with other researchers. SKYTRAX, for example, gave JetBlue four out of five stars in its most recent rankings. For perspective, only Virgin America scored as well among the major U.S. carriers. It's fair to say that, when it comes to overall performance, JetBlue ranks among the elite. And that tends to show up in the financials.

Earnings from continuing operations have soared more than 266% over the trailing 12 months. Operating margin is up over the past two fiscal years and the trailing 12 months. Revenue is up by at least 10% in three of the past four fiscal years and over the trailing 12 months, according to S&P Capital IQ. JetBlue is climbing in an industry that's spent years descending.

Making a bid for business travelers

Importantly, management isn't satisfied with the current state of JetBlue's business. Last year the company announced plans to introduce premium cabin service on high-trafficked transcontinental routes, including New York to Los Angeles. As my Foolish colleague Adam Levine-Weinberg wrote at the time:

JetBlue has stated that industry revenue on the JFK-Los Angeles and JFK-San Francisco routes is more than 50% higher than for any other domestic route, [because of] the high concentration of premium passengers -- and premium seats. This creates an alluring opportunity for JetBlue that fits with its gradual migration from being purely leisure-oriented to a leisure-business-hybrid carrier.

Alluring? That's putting it mildly. During the most recent earnings conference call, co-founder and CEO David Barger said JetBlue's "Mint" first-class service was drawing "very strong" bookings and that a "significant number" of these ticket buyers had never before flown JetBlue.

Lie-flat seats in JetBlue's Mint cabin. Next month, the carrier expands service to New York-San Francisco. Credit: JetBlue.

Foolish takeaway

We can't say for sure whether those bookings reflect JetBlue's ability to take share from American, Delta, and United, but the upside is clearly there. As Barger put it on the conference call:

Our target customers for this product include high-value leisure and small business travelers whom are underserved by our competitors. Premium fares in these markets are often in excess of $2,000 per one-way ticket. We believe offering a premium product will help us significantly improve returns in these markets, where we have historically underperformed relative to our competitors in unit revenue and profitability.

Just the sort of aggressiveness Fools should love. If he's right -- and the early signs say he is -- today's investors should do well as premium market share gains manifest as bigger profits.