Those quarters and pennies can make you rich over time.

Jefferies analyst Mark Lipacis likes Intel (INTC +3.02%) shares these days. Lipacis doesn't just hold a "buy" rating on the stock with a generous $45 price target; he also calls Intel "our top idea" with plenty of room for dividend growth.

In a research note published last week, Lipacis wrote that Intel will probably raise its payouts by at least 8% over the next two years, and maybe as much as 45%. Since the Jefferies note arrived just days after my own dive into Intel's dividend growth prospects, I'll take this opportunity to compare notes with Lipacis.

First, let's set the table. This is Intel's history of dividend payouts and effective yields over the last 5 years:

INTC Dividend data by YCharts

Intel used to raise its payout like clockwork, on an annual schedule. The increases took a break in 2008-2009, creating a brief flatline on charts like these. The current 11-quarter streak of unchanged payouts is already nearly a full year longer than the 2008 pause.

At the height of the tablet frenzy, when the PC market seemed to be drawing its final breath, Intel shares plunged and dividend yields skyrocketed. Intel's shares have bounced back from those miserable lows, but since the company hasn't followed up with dividend increases, the effective yields have plummeted.

Once challenging the dividend-king telecoms for the title of "the Dow Jones (^DJI 0.09%) Industrial Average's richest yield," Intel now only ranks 15th out of those 30 blue-chip stocks. At the high end of Lipacis's dividend growth estimates, a 45% stronger yield would catapult Intel right back into third place again.

Big dividends ahead!

Jefferies makes a few assumptions to support its Intel dividend analysis.

First, the company should deploy all $12 billion of its recently updated share buyback policy. That would lower the total share count by about 8%, which would result in an 8% higher yield, according to Lipacis.

Then, Intel should deliver about $15 billion in annual free cash flows, and pay out 40% of this in the form of dividend checks.

40% of $15 billion works out to a $6 billion dividend budget, which would be 34% higher than Intel's annual dividend payouts today. Add in the 8% boost that Jefferies sees coming from share buybacks, and you land at 45% higher payouts per share.

That sounds great. As an Intel shareholder myself, I wouldn't mind at all if all of these assumptions payed out over the next couple of years.

However...

It's not that simple, folks

I have a few issues with the note's assumptions.

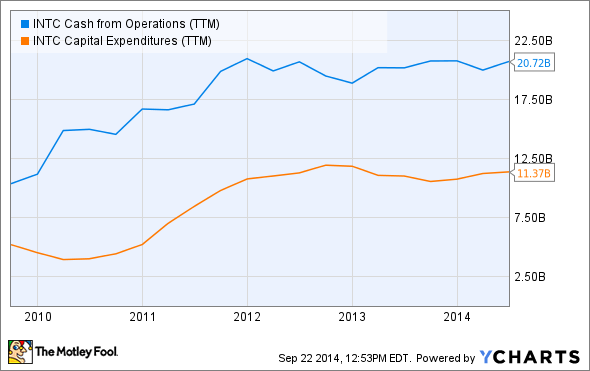

To reach that $15 billion cash flow target, Intel would have to increase its current $9.4 billion free cash flow stream by 60%. For a company that has been stuck near $10 billion of annual cash flows since 2010, that's no easy feat.

Investors should expect cash flows to grow over time, but hoping for a 60% spike in two years seems overly enthusiastic. Intel would have to increase its operating cash flows while pulling back from its very large capital expenses of recent years. One or the other, sure, but doing both at the same time would be tricky. In particular, I don't expect Intel to lower its capital expense budget by significant amounts any time soon.

INTC Cash from Operations (TTM) data by YCharts

And what of the 8% dividend increase that Jefferies expects from an 8% buyback program?

It's true that Intel would earn 8% more headroom for dividend increases, but that doesn't always translate into higher payouts per share. Large buyback programs with steady or slowly rising dividend payouts per share can actually result in lower total dividend payouts.

For an example of this, look at Home Depot (HD 1.00%) in 2007 and 2008.

At the peak of the housing boom, Home Depot raised its dividend per share by 33%. At the same time, the home improvement giant pushed through a truly epic buyback program, retiring $6.7 billion of common shares in 2006 and another $10.8 billion in 2007. So Home Depot's total dividend budget only increased by 22% in 2007, despite the much larger dividend increase per share.

And in 2008, when both buybacks and dividend boosts came to a screeching halt, Home Depot saw the final results of the recent buyback binge. In 2008, dividends per share held steady, but the share count was lower. The total dividend budget decreased by 11%, without touching the per-share payouts at all.

In other words, Intel could reap an 8% cost reduction on the dividend line instead of funneling those $360 million back into higher payouts per share. That's what Home Depot did in 2008, and wouldn't be very different from Intel's own experience in 2002/2003. As payouts per share held steady and share counts decreased, Intel lowered its total dividend costs.

INTC Dividend data by YCharts

The final takeaway

So Jefferies bases its dividend predictions on unrealistic cash flow growth and a far-from-certain dividend boost outcome from lowered share counts.

Moreover, let's say that absolutely everything Lipacis says works out according to plan. We'd end up with a 45% higher payout per share, as noted above -- but also a 29% higher share price at the $45 target level. That's just a 12% dividend yield increase and a 2.9% effective yield. After all these gymnastics, Intel would still be no more than a middling Dow dividend stock, ranked behind 10 of its blue-chip peers.

In the end, I'm encouraged by Lipacis' rosy view of Intel's business prospects, but less impressed by his dividend analysis. Even here, and even if the company somehow ends up raising its payouts per share by 45%, Intel is more of a capital gains play than a fantastic dividend stock.