Source: 3D Systems.

The promise of breakthrough technology is rarely achieved in a straight line. Demand rises and falls as markets develop, and profit surges and sags as competitors elbow one another sharply for market share.

However, knowing that the path for revolutionary companies like 3D Systems (DDD 0.15%) is bumpy is likely little comfort to investors suffering bruises as its shares tumble following a lackluster earnings forecast this week. 3D Systems lowered its outlook for both its third-quarter and full-year results, but there may be one bright spot lurking underneath the surface -- stronger demand for its healthcare business. Let's take a closer look.

First, a bit of background

3D Systems is one of a slate of companies leading the development of 3D printing technology. These printers are increasingly being deployed by consumers to build trinkets, manufacturers to build machine parts, and healthcare providers to create personalized medical implants.

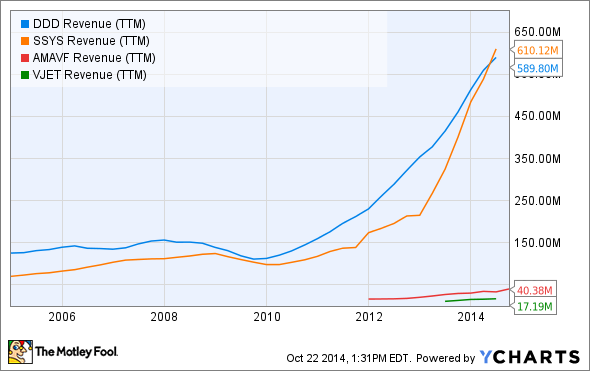

Among companies racing to advance 3D printing, 3D Systems is one of the biggest players in both terms of sales and market cap. During the 12-month period ending June, sales at 3D Systems ran about neck and neck with competitor Stratasys (SSYS 3.02%), but well ahead of smaller niche industry players voxeljet (VJET -10.81%) and Arcam AB (NASDAQOTH: AMAVF).

DDD Revenue (TTM) data by YCharts.

Sales were broadly unchanged across the industry into the late 2000s; however, sales have skyrocketed since 2012, as technology has allowed 3-D printer prices to drop, and for new materials (like metals) to be used. The combination of falling prices and expanding flexibility tied to printing in more mediums is causing sales to surge. But it's also creating bottlenecks for 3D Systems, which has struggled to boost production to meet demand, which led to the company cutting its guidance for this year.

"We are disappointed that we failed to fully capitalize on the robust demand for our direct metal and consumer products during the quarter," said Avi Reichental, President and Chief Executive Officer of 3D Systems. "While we worked very hard to deliver these products sooner, achieving manufacturing scale, quality and user experience targets took significantly longer than we had anticipated."

Source: 3D Systems

Innovating medicine

While 3D Systems' consumer and metals printing businesses struggle to keep pace, the company's healthcare business continues to grow. During 3D Systems' conference call to discuss its lowered guidance, the company called out healthcare as being an area of growing interest. That makes sense given that 3D technology is significantly changing how doctors train and plan for surgery, and how medical devices and implants are made.

Thanks to 3D equipment, doctors can be trained on 3D simulators and practice on 3D-printed versions of vital organs. Heart surgeons can create exact replicas of a patient's heart, look for defects, and improve surgical plans prior to entering the surgery room.

And 3D technology is allowing for similarly game-changing advances in orthopedics, where 3D printers are increasingly being used by companies like Stryker (SYK -0.45%) to build custom-fit knees and joints for patients. Large manufacturers and small mom-and-pop designers are increasingly custom-crafting prosthetics, too.

With the market demand for 3D technology in healthcare accelerating, 3D Systems has orchestrated a series of acquisitions to bolster its healthcare product lineup. In April, 3D Systems acquired Medical Modeling, a 3D simulation and medical printing company and, in August, 3D Systems spent $120 million buying surgical simulation and training company Simbionix. Those acquisitions give 3D Systems one of the largest and deepest capabilities across simulation, training, and printed medical and dental devices.

Based on the company's comments during its conference call, those investments may be beginning to pay off. We'll have to wait until 3D Systems reports complete third-quarter numbers on Nov. 10, but for comparison, 3D Systems' healthcare sales totaled $27.5 million in the second quarter, up 46% from the year before.

Looking ahead

3D Systems' revenue and profit expectation is concerning, but its situation is far from dire. The company is guiding for sales of between $650 million and $690 million, and for EPS of between $0.70 and $0.80 this year.

Given the amount of money the industry is plowing back into R&D and acquisitions, it may be more surprising to see that companies like 3D Systems are making any money at all. After all, plenty of unprofitable companies have endured pops and drops as their markets have developed, yet have gone on to reward investors handsomely over the long haul. Amazon jumps to mind. The Internet shopping Goliath revolutionized how consumers buy goods, spending billions along the way at the expense of earnings.

Whether 3D Systems' potential proves to be as large as Amazon's someday is debatable, but its potential impact on people and companies could be equally disruptive. If it is, then somewhere down the road, long-term investors will happily overlook the company's short-term stumbles this year.