Sprint's (S +0.00%) new CEO, Marcelo Claure, is at the beginning stages of building back the beleaguered carrier, and on the latest quarterly earnings call, he and management explained how they're changing the future of Sprint, and what it'll take to overcome current obstacles.

Source: Sprint.

It's not business as usual at Sprint

On the call, Claure said one of the first things he wanted to change when he took over about 85 days ago was Sprint's complicated pricing.

He said, "We found ourselves at a disadvantage on two fundamental drivers of purchase decision in wireless, price and network. Our family pricing was confusing, complex, and not competitive on price." He went on to add that, "Customer perception of our network hadn't caught up with the actual performance improvement we've delivered."

To combat this, Claure's taken three steps to make Sprint more competitive: He changed credit requirements for postpaid customers, simplified its plans, and built up its relationship with Apple with exclusive plans for the new iPhones.

Each one these changes may not seem transformational on their own, but Claure insists Sprint is already seeing the effects.

Involuntary churn is dropping

In the company's fiscal Q2, Sprint lost 500,000 postpaid phone subscribers. The company's overall postpaid churn rate -- the rate at which customers leave the company for another carrier -- is at an industry high of 2.18%.

One problem with Sprint's churn rate is that some customers don't have the best credit, which has led some to not be able to pay their bills, and Sprint has had to let them go. This is called involuntary churn rate. Claure said on the call that, "the credit quality of the customer we were acquiring was below industry standards," but they've tightened those standards now.

"The subprime base that we added in the previous month to my appointment, you know, that is the main cause of why we have such a high involuntary churn, and we expect that that's going to remedy. That takes three to six months to remedy, and you're going to see that come down in the first quarter of 2015."

While it's a small step to improving postpaid net subscriber numbers, tightening credit credentials is a good strategy for making sure new subscribers are able to stick with Sprint for the long term.

Upgrade rates are moving in the right direction

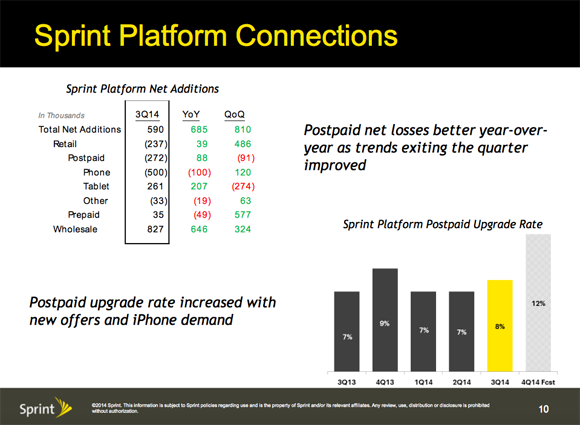

While it's hard to tell from Sprint's negative postpaid subscriber numbers, the percentage of customers upgrading their phones increased in the most recent quarter ending, mainly because of the iPhones, and it should jump even higher in the current quarter. Claure said, "We think consumer demand for Apple products [remains] high, and we made some strategic moves to better position ourselves in that market."

Sprint offers one of the lowest monthly plans for the new iPhone 6 and 6 Plus, at $50 per month for unlimited talk, text and data. As a result, Sprint said it had the best iPhone launch on its network to date. The company saw its iPhone subscribers upgrade nearly 2.5 times more in fiscal Q2 than during last year's new iPhone launch.

But that's not all. In the next quarter, Sprint expects record high upgrade rates beucase of higher sales volumes and seasonally higher gross additions. Sprint says that could push upgrade rates as high as 12% in the calendar fourth quarter -- up from 8% in the most recent quarter.

Source: Sprint.

Sprint's CFO, Joe Euteneuer, said on the call, "The higher upgrade rates this quarter and the anticipation of our highest ever upgrade rate in the fourth quarter are good indications that our customers are recommitting to Sprint and the great value we provide."

New plans are paying off

Though Sprint lost an astounding 500,000 postpaid phone subscribers in fiscal Q2, it was significantly less than the losses in the previous two quarters -- which were 693,000 and 620,000, respectively. September was the first month in 2014 where Sprint delivered a year-over-year growth in net phone additions.

Claure said, "In the month of September, we delivered our highest monthly postpaid phone gross addition since December of 2012, representing a nearly 40% increase over a monthly run rate through August this year, and in October, we grew another 7% sequentially."

Not out of the woods yet

While Sprint's management talked up the positive moves it's making to turn the company around, they didn't dodge the fact that things aren't particularly rosy for the company right now.

Claure admitted the negative trends won't be turned around quickly. "We stil have a long way to go in our journey, and our first objective is to get back to retail net additions followed by postpaid net addition, which will mean more customers are finally coming to Sprint than are leaving."

He said some of the new changes will put a strain on near-term financial results, but that Sprint's leadership is "going to manage for the long term, and I'm focused on delivering long-term shareholder value."

Investors shouldn't expect a great fiscal Q3, but under Claure, it appears they should be at least a little optimistic that the company is trying to move in the right direction.