During the past year, Seadrill, Ltd. (SDRL) has seen its stock price get pummeled. Currently, it's down about 50% from where it was in January:

The cause? A double whammy.

Demand for offshore drillers has slowed during the past year, and is expected to remain slow through at least 2015. Furthermore, onshore U.S. shale oil production has exploded during the past few years. This has coincided recently with three things: a weak European recovery, Japan -- one of the world's largest oil importers -- falling into recession, and slowing growth in Asia.

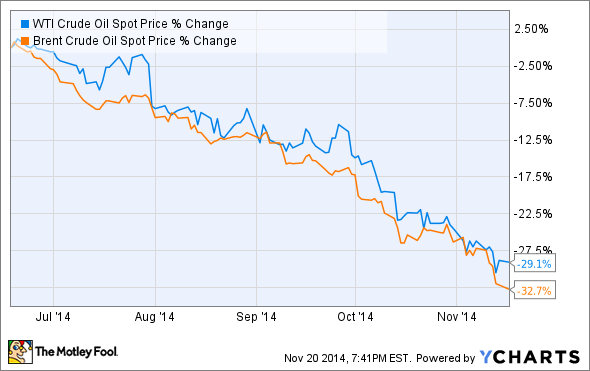

The result? Oil prices have been crushed since June:

WTI Crude Oil Spot Price data by YCharts.

Now, domestic producers are in a standoff with OPEC to see who will cut production first, because the economic reality is that today's oil prices aren't really sustainable for many of the largest producers. Something's got to give.

Seadrill is set to report third-quarter earnings on Nov. 26: Let's take a look at the things that investors should be looking most closely at.

Where Seadrill fits in the mix

What does OPEC and domestic shale have to do with Seadrill? A lot more than you'd expect.

During the past year, offshore development projects have been very slow to materialize, as oil and gas producers all across the industry have made serious efforts to improve the returns of new projects.

The most hard-hit area has been offshore drilling. This has happened in large part because new technical capabilities have made onshore production cheaper and more effective, while new offshore discoveries have been largely found in areas that are more expensive and dangerous to operate in.

In a way, this is great for Seadrill, which has easily the newest and most capable fleet of offshore rigs on the market. However, sub-$80 oil, flattening global demand, and improving techniques to produce cheaper onshore oil, all add uncertainty to the real value of Seadrill's competitive advantage.

1. Backlog strength

Seadrill has proven to be resilient at keeping its rigs under contract and working, and has maintained a strong backlog that has translated to utilization rates that have consistently stayed in the high 90% range. Last quarter, the backlog was $20 billion, and that bodes well. However, many of these deals have no cancellation terms, but until the work has been delivered, there are no guarantees. If the backlog has fallen, this could be a sign that the industry's weakness is affecting Seadrill, as well.

2. Dividend plans

Seadrill has been an appealing investment for two classes of investors: those looking for growth, and those looking for income. Management has been steadfast that its current $4 per year payout -- which equates to an insane 20% yield on today's share price -- is sustainable; but that's not guaranteed to remain the case.

As fellow Fool Travis Hoium wrote recently, the company pays a huge amount of its cash flows to sustain the current payout level, and that's not necessarily the smartest course of action in the current market. It's not a reach to see demand grow even softer in the short term, and there's no real promise that oil prices will rebound anytime soon.

Added together, this uncertainty could lead down the path of earnings that no longer support the current payout. It's time that management address that real concern.

3. Capital allocation plans

Seadrill's newbuild program during the past several years has been easily the most aggressive in the industry; but management was prudent in announcing last quarter that it was putting a halt to any more new orders for the time being. However, the same release pointed out that the company still had another 18 ships in some stage of construction, at a combined future cost of $5.5 billion.

With all indications that 2015 will be a bad year for offshore drillers, Seadrill must take steps to be sure its capital position is strong going forward. Otherwise, its cost of debt will increase, putting further pressure on the dividend and newbuild program.

Long-term thoughts: Still best-positioned offshore operator, but the market is far from certain

It's rarely a mistake to invest in the best company in a given business; but offshore can be incredibly cyclical. Until there is more certainty in the market, it's very hard to predict the outcome.

Looking out past 2015, the market is likely to be much more stable, and prices are likely to rebound to sustainable levels. But until this happens, Seadrill needs to show investors that it's prepared to take the necessary steps to protect the long-term interests of the business. And that starts with the three things above.