Source: Flickr user Tax Credits.

Most Americans are coming up short in saving for retirement, and that may mean retirees will have to look for new ways to bridge the gap between their retirement income and their expenses. According to Statistic Brain, the average 50-year-old has set aside just $43,797 in savings for retirement, and a whopping 36% of Americans don't have anything put away for their golden years. Although those statistics are worrisome, three of our Motley Fool contributors have ideas on how retirees can boost their income and make up some of that shortfall.

Matt Frankel: One of the most certain ways to increase your income in retirement is to start investing in high-quality, dividend growth stocks. The problem is that many investors tend to think of these companies as "boring".

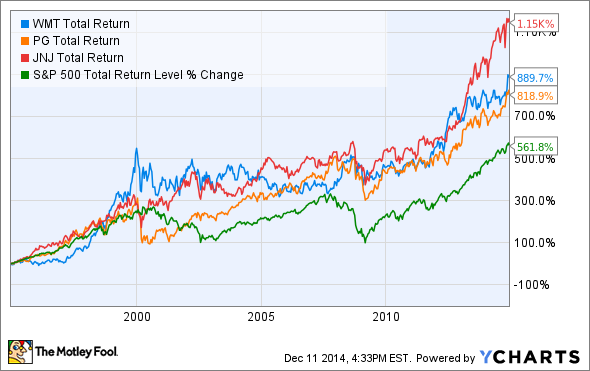

Good examples include Johnson & Johnson (NYSE: JNJ), Procter & Gamble (NYSE: PG), and Wal-Mart (NYSE: WMT). First of all, while none of these are "high-dividend" stocks, consider that they have raised their payouts like clockwork with 51, 57, and 39 consecutive annual dividend increases, respectively.

These companies all have an excellent track record of producing steady, market-beating growth. Over the past 20 years, the S&P 500 has averaged an annual total return of 9.6%. All three of these stocks handily beat that, with averages of 13% (JNJ), 11.5% (WMT), and 11.1% (PG). Over time, that kind of performance can really add up.

When you consider that over time, stocks like these can handily beat the market's return while increasing your income every year once you retire, these don't seem like such boring investments anymore. High-quality dividend growth investing is the most certain way to wealth and is an excellent way to create a steady and growing income stream for your retirement.

Selena Maranjian: One good way to boost your income in retirement is simply to keep working. This can take a wide variety of forms. You might retire but still work part-time for your last employer. Or you might find a new part-time job in retirement. Some ideas: consulting, freelance writing, preparing tax returns, filling seasonal positions at retailers and elsewhere, tutoring, providing home healthcare, bookkeeping, driving a school bus, taking on handyperson jobs, selling items you make (such as sweaters or furniture), and so on.

You may hate the thought of not quitting working altogether when the time comes, but many people have found that after a while, retirement is more boring than expected. Some folks do well with more structure to their days and like having places to go and things to do -- not to mention people to socialize with. Working at least a little during retirement can not only provide welcome income, but it can also make your retirement happier. Working might also permit you to delay starting to receive Social Security benefits so that you receive larger ones later.

A caution: If you do work in retirement while you're younger than your full retirement age and you're collecting Social Security at the same time, know that too much work can end up costing you. In 2014, for example, $1 will be deducted from your benefit check for each $2 you earn above $15,480. The Social Security Administration wants you to know, though, that, "these benefit reductions are not truly lost" since "your benefit will be increased at your full retirement age to account for benefits withheld" because of earlier earnings.

Dan Caplinger: One great way to increase your income in retirement is to wait longer before taking Social Security benefits. Social Security makes up a huge portion of most retirees' overall income, and so taking steps to boost your monthly payments can have a dramatic impact on your financial situation.

The differences in what Social Security will pay you at certain starting ages are huge. If you take benefits four years early at age 62 instead of waiting for full retirement age at 66, then you'll take a 25% haircut on your monthly benefits. On the other hand, if you wait until age 70, you'll get 32% more than your full retirement benefit. For someone who would ordinarily have a $1,000 monthly benefit, that means the difference between a $750 monthly check and a $1,320 benefit -- with the latter representing 76% higher retirement income than the former.

Admittedly, waiting longer to take Social Security has a downside: You forgo the money you would have received by beginning your benefits earlier. But if you have other income or financial resources you can use before you claim your Social Security benefits, doing so makes it easier to wait on Social Security and enjoy the automatic increase in benefits that delaying your Social Security application will give you. With higher Social Security payments lasting for the rest of your life -- and often for your spouse's life as well -- it's well worth considering a delay in taking benefits if you can swing it financially.