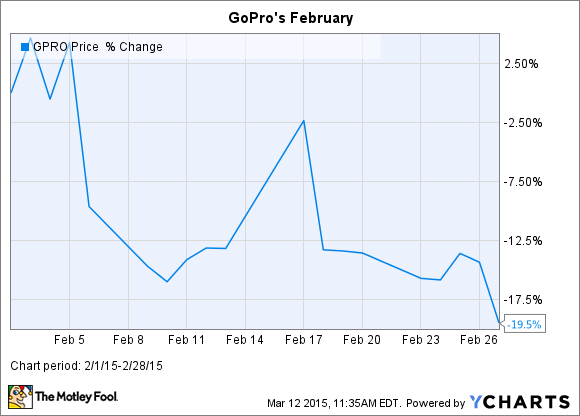

What: Shares of action camcorder maker GoPro (GPRO +1.27%) fell 19.5% in February, according to S&P Capital IQ data, as Mr. Market ignored a positive quarter and disappointing first-quarter guidance, a surprise C-level executive departure, and a lockup expiration took their toll on the stock's returns.

So What: The first big drop for GoPro came following its earnings report in the after-hours market on Feb 5. After running up as much as 15% while reporting its fourth-quarter earnings of $0.99 per share, up from $0.33 the year prior and above the consensus estimate of $0.70, the stock quickly reversed after estimating first-quarter earnings of $0.15 to $0.17 per share, lower than the consensus estimate of $0.17. In addition, the surprise resignation of COO Nina Richardson added to investor skittishness. GoPro opened trading on Feb. 6 down 11.7%.

The stock took another downturn on Feb. 18 after a secondary lockup expiration. On that date, 76 million shares were placed in the market for the first time. The added supply drove down shares 11.2% that day, although it should be noted shares were bid up by the matching amount before the expiration.

Now what: GoPro's story can be best summarized by the first downturn. After playing up its social-media ambitions, without a well-formed plan to monetize content, the stock was bid up to atmospheric valuations any consumer electronics company would have problems maintaining. And that's why GoPro fell 12% after blowing past analyst expectations, because so much growth was baked into its valuations. Considering the company is now valued at less than half of its all-time highs, the stock is no longer dependent on eye-popping growth to enrich investors.

Recently, I took a position in GoPro as I feel the falling stock price -- it's continued to fall in March -- and incessant bullishness has worn off and the company continues to operate well fundamentally. GoPro will continue to be a volatile stock, but I feel its brand cachet and unique value proposition will enrich patient, long-term investors.