Despite being the biggest of the world's super-major oil companies ExxonMobil (XOM 0.23%) isn't always popular with investors. It tends to go in and out of style as investors seem to have a love/hate relationship with the stock. Here's why some investors hate it while others adore the biggest name in big oil.

Stuck in the mud

Oil production in the U.S. has surged over the past few years as a combination of horizontal drilling and hydraulic fracturing has been used to unlock vast quantities of oil long trapped in tight rocks beneath the U.S.

U.S. Oil Production data by YCharts

This shale revolution has largely been driven by smaller independent oil companies and not big oil giants like Exxon. It's those shale players that offered the best growth opportunities to investors as they could routinely grow their production by double digit annual growth rates while Exxon has barely grown its production over the past few years, which is something a lot of investors hate about the stock.

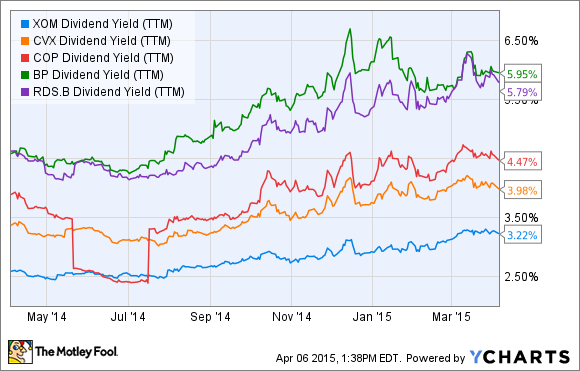

Another thing many investors hate about Exxon is that it offers investors a somewhat less robust dividend yield than its peers. We see this in the following chart as its yield continues to be well below other big oil companies.

XOM Dividend Yield (TTM) data by YCharts

For many investors the limited growth and weaker yield are reasons to hate the stock.

Built to last

That said, what Exxon does offer investors is security, which is worth its weight in gold when oil prices do this:

WTI Crude Oil Spot Price data by YCharts

While the stock prices of many other oil companies fell as far, if not farther, than oil prices Exxon's stock has been largely unaffected by the downturn. It's times like these that the Triple-A rated oil company comes back into favor with investors as they know this is a company that's built to last.

One of the reasons why Exxon has the highest credit rating in the industry is because it produces a prodigious amount of cash each year. Over the past four years it has produced an average of nearly $25 billion in free cash flow, which is about $10 billion more than its closest peer.

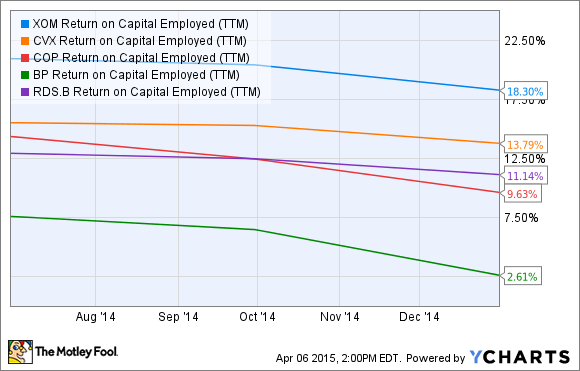

Driving this cash flow strength is Exxon's focus of returns over growth. It's simply the best big oil company when it comes to returns on capital employed, or ROCE as we see on the following chart.

XOM Return on Capital Employed (TTM) data by YCharts

Unlike a lot of other oil companies Exxon doesn't just grow for the sake of growth, but instead invests in projects that will move the needle on profitability. This produces the prodigious cash flow that the company is known for, which it routinely pumps back into its business on other high return projects.

Exxon also uses its cash to buy back stock as opposed to just paying dividends. In fact, last year Exxon's dividend yield of 2.7% might have been below its peer average, but the company bought back enough stock so that its buyback yield was also 2.7% pushing total shareholder distributions up to nearly 6% last year. That combined yield has been well above its peer average over the past four years as Exxon views buybacks as a big value driver for investors as it juices its production growth per share. Add it up and this is a company focused on value creation above all else.

Investor takeaway

A lot of investors hate the fact that Exxon is neither a hot growth stock, nor a dividend dynamo. However, when times get tough investors flock to the company because they know that it's built to last. This love/hate relationship with the stock isn't likely to change as the oil market is known for its booms and busts, with the only constant being the fact that ExxonMobil will continue to create value throughout the cycle.