Hedge funds use a lot of strategies to make money, but one manager is doing something we've never seen before in order to make a profit -- challenging a company's patents and shorting its stock simultaneously. How exactly does it work, and will it pay off?

How it works and why he's doing it

Kyle Bass, the head of Hayman Capital Management LP is targeting the patents of pharmaceutical companies, which he claims do nothing other than drive up the prices of prescription drugs.

Using a process called Inter Partes Review, or IPR, Bass challenges certain patents held by these companies, and then uses a two-sided investment strategy. First, he shorts the stock of the companies whose patents he challenges. Then, he buys the stock of companies that would profit in the event the patents are invalidated.

Bass insists he is doing this to help reduce drug prices, which he said the patent system keeps artificially high, and that he will continue to pursue his cases no matter what happens with the company's share prices. Obviously there are people who are skeptical of Bass' motives. As one biotechnology industry insider recently said, "There's nothing in this man's history to suggest he has any interest in lowering healthcare costs."

An early victim

Whatever his true motivation is, his strategy is looking like it could be rather lucrative. In February, it was announced that Bass had challenged certain patents held by Acorda Therapuetics (ACOR), a pharmaceutical company that gets almost all of its revenue from multiple sclerosis drug Ampyra.

On the day the news was announced, shares of Acorda plunged 10%, and are currently 17.5% below the share price on Feb. 1.

A few things to note. First, Bass isn't completely alone here. Eight generic drug makers have also challenged the Ampyra patents, not necessarily to profit from shorting Acorda's stock, but to produce their own low-cost version of the drug which comes with a six-month exclusivity win to the generic company that successfully challenges a patent in court. If any of them were to win, it would also cause Bass' short to be a success, but this can be a lengthy and complicated process.

Furthermore, even if Bass succeeds in his own challenge, there will still be four other patents protecting Ampyra from generic competition (Bass is only challenging two).

New targets

On April 1, Bass filed two petitions for IPR against Shire PLC (NASDAQ: SHPG) challenging its patents on two drugs, including the only patent protecting Shire's Lialda in the United States. Currently set to expire in 2020, it could cost Shire about five years of exclusivity if Bass succeeds.

Bass' latest IRP action is against Jazz Pharmaceuticals (JAZZ 2.91%) and a patent on its narcolepsy drug Xyrem, which made up two-thirds of the company's revenue last year.

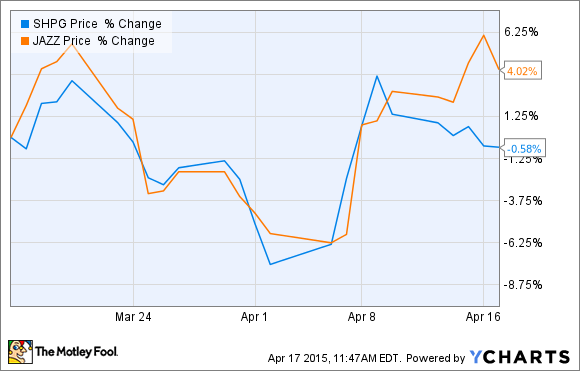

However, unlike Acorda, neither of these stocks seemed to react much at all. Shire dropped slightly after the announcement was made, but has since made back all of the loss and then some. Jazz is actually up slightly after initially dropping as the news of the patent challenge was filed on April 6.

Will it be successful?

It's hard to tell if Bass' strategy will be successful on a long-term basis, but it doesn't sound like we've seen the last of the patent challenges just yet. Bass has reportedly been raising investments for a dedicated fund with a sole purpose of shorting those companies whose patents Bass plans to challenge, and to bet on the companies that stand to benefit from the challenges.

As I said earlier, this is definitely a new and unique strategy. But, it could just be crazy enough to work.