It seems we're experiencing a steady flow of dividend raises in these fading days of spring. Last week, like the week before, saw a nice handful of companies lifting their payouts.

This week, our three firms represent a lot of variety on the stock market: One is a health insurance giant, another is in the food service sector, and the third is a big-spending tech firm. Let's go over these three dividend hikes that investors should know about.

UnitedHealth Group (UNH 1.35%)

These are good times to be a shareholder in America's largest health insurer, not least because it just declared a substantial quarterly dividend raise. UnitedHealth Group is to lift said distribution a mighty 33% to $0.50 per share.

Trends are favoring the company. Insurance enrollment is up thanks to Obamacare, while the massive baby boomer generation is reaching its twilight years (and therefore requiring more health services). The firm's Q1 results reflect these factors: Revenue was up 13% on a year-over-year basis (to almost $36 billion), while net income leaped nearly 30% higher to $1.4 billion ($1.46 per share).

Those two big trends should continue to goose the top and bottom lines. UnitedHealth Group has raised its expectations for full-year 2015 results, adding $2 billion to its previous revenue forecast for a new tally of $143 billion. Per-share net earnings are expected to be $6.15 to $6.30, up from the previous estimate of $6 to $6.25.

The company's on an upswing, and it has plenty of money coming down the pipe to keep the dividend alive: Its free cash flow of over $6.5 billion in fiscal 2014 was nearly five times what it paid out in total distributions. Considering all of that, I'd say the company's new payout can easily be maintained. I'd even expect it to grow further before long.

UnitedHealth Group's upcoming dividend is to be handed out on June 24 to shareholders of record as of June 15.

Cracker Barrel (CBRL -0.62%)

There's nothing like getting an unexpected bonus as a side dish to a dividend raise. Cracker Barrel not only increased its quarterly payout by 10% to $1.10 per share, but also declared a special dividend of $3 per share.

What has the company done to inspire such generosity?

Lately, it has raised prices and lowered expenses (through cost-cutting measures), widening its net profit margin. This is an effective one-two punch that jolted its Q3 2015 bottom line 23% higher on a year-over-year basis to $35 million ($1.47 per share). Revenue advanced by 6% to nearly $684 million. Both figures beat the average analyst estimates.

Cracker Barrel is anticipating that the good times will continue to (sorry) roll. Like UnitedHealth Group, it adjusted its full-year earnings estimates upward to $6.60-$6.70 in per-share net profit, a nice lift from the former projection of $6.40 to $6.60.

The company's doing well, but that special dividend would concern me if I were a shareholder. All told, that bonus plus the regular payout will result in a total dividend expenditure of roughly $98 million -- well above the level of free cash flow in most recent quarters and notably higher than the $86 million of fiscal 2014. That's a lot of money draining out of the Barrel.

For those who don't mind a precariously high payout ratio, Cracker Barrel will distribute both its new quarterly dividend and the special payout on Aug. 5 to stockholders of record as of July 17.

Avago Technologies (AVGO 2.99%)

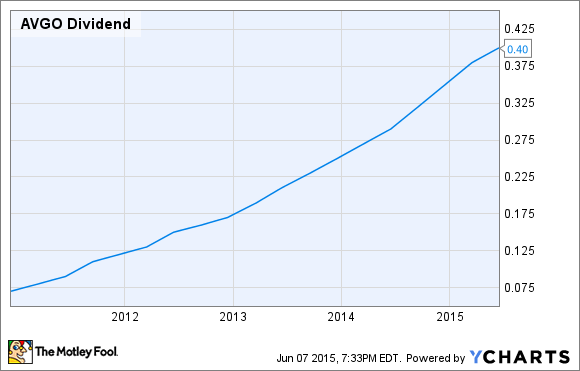

No one can accuse this chipmaker of being cheap. Mere days after announcing a monster acquisition of a fellow chip manufacturer, Broadcom (NASDAQ: BRCM), Avago said it would add 5% to its quarterly dividend. This will amount to a total per-share payout of $0.40.

Avago clearly likes spending money. It has reached its present size ($37 billion in market capitalization) through a series of acquisitions. That has helped more than double the top line over the last five fiscal years (to 2014's nearly $4.3 billion) and keep net profit comfortably in the black -- last year's tally was $309 million. Big, bulky Broadcom will help add to those numbers.

Avago also likes shelling out for its dividend, and despite those acquisitions it has managed to raise its payout every quarter since initiating it in late 2010.

But the Broadcom deal is a real budget-buster, even if only a portion ($17 billion) of the buy will be effected in cash, as opposed to shares. Combined, at the end of their most recently reported quarters, Broadcom and Avago had total cash and short-term investments of just under $5.5 billion. Meanwhile, the fused company is to take on $9 billion in debt, and as chipmakers, they'll surely continue to spend plenty on research and development.

Avago is a scrappy and resourceful company that always seems to do well reward its shareholders appropriately. Although at the end of the day it'll probably work out a way to keep that dividend growing, I'm not sure I'd count on it, given the huge price tag on Broadcom.

Regardless, Avago's enhanced distribution is to be paid on June 30 to shareholders of record as of June 19.