Teekay LNG's new MEGI LNG carrier Creole Spirit will begin operating in 2016. Source: Teekay Flickr

Teekay LNG Partners LP (TGP), the master limited partnership that's controlled by global shipping behemoth Teekay Corporation, reported second quarter earnings today, exceeding expectations in distributable cash flow produced, up 7% from last year. But the partnership's stock was down on the day and is off more than 42% from the beginning of the year, largely on falling natural gas prices around the world.

Frankly, the market could be giving investors a great opportunity to buy Teekay LNG Partners right now, and for three big reasons:

- Teekay LNG is growing its fleet and cash flows rapidly as companies take steps to lock up long term, predictable shipping capacity.

- The partnership has a solid history of strong shareholder returns through dividend growth.

- The planned increase of U.S. gas exports in coming years looks to be a tremendous opportunity, and now is a great time to invest in it.

Let's take a closer look.

1. Shippers are locking up shipping capacity right now and Teekay LNG is taking advantage

Between fear of a Chinese economic collapse, continuing weakness in Japan, and a huge global natural gas supply, prices have fallen sharply over the past year or so. But this isn't really a bad thing for Teekay either in the short or long term. To start, the nature of Teekay LNG's contracts offers it significant protection. As of its most recent quarter, the company's LNG vessel contracts have 13 years remaining, on average, and the company has a huge backlog of contracts set to produce remarkably strong predictable cash flow growth over the next five years:

Source: Teekay LNG earnings presentation

The partnerships says these new contracts are worth roughly 12% compounded annual cash flow growth, and it's these contracts that will help fund the 29 newbuildings Teekay LNG has on order.

2. Teekay LNG has a history of strong returns

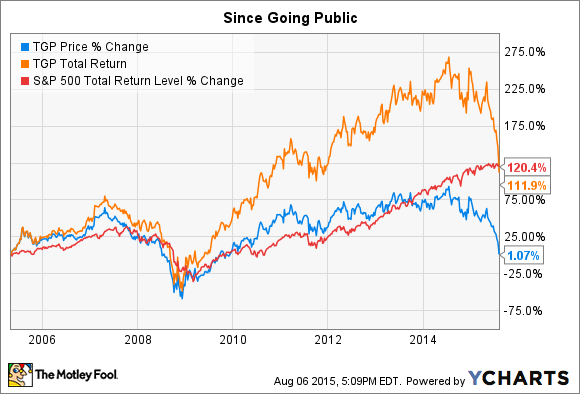

Over the past decade, Teekay LNG has grown a lot, and it has paid for a lot of that growth selling units (MLP-speak for shares). The unit price is actually almost the same today as it was when the partnership went public about 10 years ago:

But when you factor in the consistent dividend growth, you see that historically Teekay LNG has crushed the S&P 500 total return. It's only the recent sell-off that has caused it to underperform since being taken public in 2005. The bottom line is the partnership has been able to consistently increase how much it pays shareholders:

The reason why the share price has stayed flat? Dilution. Over the past decade, Teekay LNG has used unit offerings to pay for new vessels and not as much debt. The share count has more than doubled since 2005, while long-term debt is actually below its $2.5 billion peak in 2008.

This is a common approach for master limited partnerships, which often use share offerings to grow. While this dilution has kept the share price from rising, it has made Teekay LNG a solid income investment.

3. Strong trends remain in Teekay LNG's favor

I won't beat around the bush -- until a ship hits the water and begins operating under contract, there's a certain amount of risk baked into those 29 newbuilds and the contracts tied to them. The recent drop in LNG prices in Asia has rattled the market, and there's a lot of fear that a prolonged Chinese economic slowdown would be bad news for LNG exporters.

But looking at the bigger picture and the longer term, these are minor squalls, and they have essentially no impact on Teekay's business today. What does matter is that global demand for natural gas is far more likely to continue increasing than it is to weaken, especially as China makes efforts to reduce pollution.

This is a much bigger trend than the recent weakness in LNG prices, and Teekay is positioned to incrementally grow its stake in that business. Factor in the company's well-established position in the industry and a solid leadership team that's proven it can manage growth while making sure investors get paid, and the prospects for Teekay look very sound.

Investor's takeaway

The sell-off this year looks overdone, but the stock could fall even further as uncertainty remains with commodity prices. With that said, Teekay LNG looks like a great buy now, especially for income investors. I wouldn't bet the farm, because there is some risk that all those newbuilds and contracts don't come to fruition.

Considering the risks and the opportunities, I think the odds are much better than even that Teekay LNG is paying out more income per share in five years than it is today.