A sampling of the company's DRAM probe cards. Image source: FormFactor.

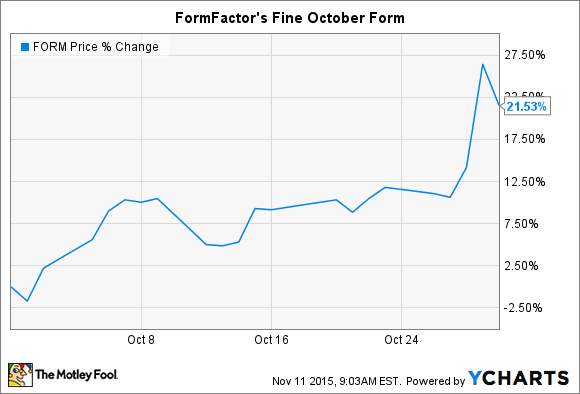

What: Shares of semiconductor probe card products manufacturer FormFactor (FORM 1.14%) rose 21.5% during the month of October, according to S&P Capital I.Q. data. The company's stock climbed steadily through the month in anticipation of fiscal third-quarter earnings. The day after FormFactor's October 28th earnings release, shares gained another 11%, followed by a bit of profit taking by investors on the final trading day in October:

So what: FormFactor's revenue and earnings both declined versus the prior year. Revenue of $65.9 million decreased 11% from Q3 2014, and a net loss of $2.5 million outstripped the $277,000 loss in the comparable 2014 period.

Yet revenue hit the higher end of the company's guided range of between $63 million and $68 million. In addition, while FormFactor posted negative earnings of negative $0.04 per diluted share, investors appreciated that non-GAAP net income of $0.06 outpaced management's previous guidance range of $0.01 to $0.05.

FormFactor's revenue is concentrated in two product lines: testing for DRAM, or Direct Random Access Memory devices, and testing for SoC, or System-on-Chip, devices. DRAM probe card revenue comprised 42% of total sales and declined sequentially from Q2 2015 by 22%, which management attributed to a weak PC market.

SoC probe card revenue, in contrast, made up 55% of total sales and increased 5% sequentially from Q2 2015. Company executives cited a new design that spurred higher mobile processor revenue as the driving force behind the gain in overall SoC revenue.

FormFactor is clearly benefiting from its 2012 acquisition of Astria Semiconductor Holdings, parent company of SoC manufacturer MicroProbe. The purchase has enabled FormFactor to diversify out of its concentration in the DRAM market, which management currently describes as a headwind against total revenue because of a soft demand environment.

Now what: With a net loss of $904,000 on $210.5 million in revenue through the first nine months of the year, FormFactor's business sits close to a break-even point so far in 2015. This holds up nicely against a $17.3 million net loss on $197.2 in revenue in the first three quarters of 2014. FormFactor also achieved $29.2 million in operating cash flow during the current nine-month period.

Management seems reasonably optimistic that the current momentum will continue into the fourth quarter. In the company's third-quarter earnings call with analysts, CFO Mike Ludwig cited a continued robust SoC environment, as well as a favorable product mix, in forecasting adjusted diluted earnings per share next quarter of between $0.07 and $0.12. Investors should now look for signs in 2016 that FormFactor will continue to increase its top-line revenue -- the surest way to pull appreciably past the break-even point.