Advance Auto Parts (AAP 0.47%) offers a lot to investors in 2016: It's a deep-value stock in a recession-resistant industry. Same-store sales increased during the last recession for it, O'Reilly Automotive (ORLY -0.74%), and AutoZone (AZO 0.45%), and through its 2014 acquisition of General Parts International (owner of Carquest and Worldpac), the company has an opportunity to raise its margin to the level of its peers.

Let's take a look at the latest fourth-quarter results and asses the investment proposition.

The case for buying Advance Auto Parts stock

Key points:

- The acquisition and integration of Carquest's mostly do-it-for-me (DIFM) stores will help Advance fulfill its strategic aim of expanding DIFM sales.

- Integrating Carquest will enable it to follow the dual-market model (selling DIFM and DIY from the same store) that O'Reilly successfully rolled out with its 2008 acquisition of CSK Automotive.

- Advance Auto Parts' operational metrics, such as operating margin and return on invested capital, are trailing AutoZone's and O'Reilly's, and the company has the chance to play catch-up.

Putting these points into context, consider management's target of 12% earnings before interest and tax (EBIT) margin by 2017. Advance Auto ended 2015 with an adjusted EBIT margin of around 10%, so the intended move to 12% by the end of the year represents a significant step.

Here's a look at enterprise value (market cap plus net debt) to EBIT:

AZO EV to EBIT (TTM) data by YCharts.

Analyst estimates are for $9.83 billion in revenue for 2016, so if Advance Auto hits the 12% target (for argument's sake, let's assume investors will price it as 12% for the full year) then EBIT gets to $1.18 billion.

Arguably, Advance Auto should trade at a multiple closer to O'Reilly's than AutoZone's, because its DIFM and DIY sales are more balanced (actually, Advance Auto already has a larger share of revenue from DIFM), and AutoZone has more than 80% of its sales in the less-attractive DIY market.

No matter, assuming AutoZone's 13.4 times multiple and O'Reilly's 17.3 times (and using the $1.18 billion figure above) gives an EV of $15.83 billion to $20.41 billion. These figures imply a price target range of $200 to $262 -- a 40% to 85% upside to the stock price.

What management needs to do

In the recent fourth-quarter earnings presentation, management did the following:

- Maintained the target of 12% EBIT margin by 2017, implying a 180-basis-point (where 100 basis points equals 1%) improvement from the full-year 2015 figure of 10.2%.

- Forecast modest reported revenue growth for 2016.

- Predicted comparable-store sales growth in the "low single digits."

The EBIT margin improvement is intended to include 100 basis points from selling, general, and administrative (SG&A) expenses (including 50 basis points of cost synergies), and the rest is dependent on leverage from increased sales. Here's CEO George Sherman on the earnings call: "Yes, we know the size of the improvement that it represents, 10% to 12%, and it certainly would be aided quite a bit by the top line that we expect. So the leverage portion of this is important, but we have clearly over-indexed on the expense side."

Clearly, the company needs the "modest" revenue growth (which tallies with the 1% growth expected by analysts) management predicted for 2016 -- cost savings will not be enough.

The tricky bit

Unfortunately, the integration of Carquest is proving more complex than expected, and the company has reported three disappointing earnings reports in a row and cited customer disruptions caused by integrating Carquest.

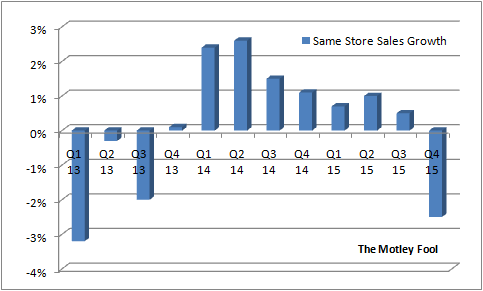

Consequently, sales growth has been hard to come by recently. Adjusted reported sales fell 2.6% in the fourth quarter, and same-store sales growth has turned negative.

Data source: Advance Auto Parts presentations.

Moreover, current trading isn't much better. According to Sherman on the earnings call: "If you look at Q1 so far, sequentially we've seen some progress, but it is not up to what our expectations are right now."

And this comes at a time when AutoZone's same-store sales increased 3.5% in its last reported quarter, while O'Reilly Automotive (recall that it's a DIFM-heavy company like Advance Auto) increased same-store sales by 7.7% in its fourth quarter.

Two scenarios

Looking ahead, there are two possible outcomes in 2016. The first involves a lowering of full-year expectations -- Advance Auto is searching for a new CEO, and he might do that if/when appointed -- which would hit the stock price in the near term.

The second scenario is that the company successfully executes on its collocation (Carquest stores are closed and relocated in nearby Advance Auto stores) and conversion (Carquest stores are converted to Advance Auto stores) plans, and management hits 12% EBIT margin and sales growth in 2016 -- the stock would go higher.

A buy?

In a sense, it's a classic deep-value investing conundrum: near-term risk vs. long-term value. Frankly, I think investors should view the proposition favorably, because O'Reilly And AutoZone are giving good sales numbers -- evidence that the environment remains favorable -- and investing in a company that could benefit from low gasoline prices (more miles driven equals more automobile wear and tear) is a good place to be in the current environment. Advance Auto may well disappoint operationally, but on balance, it's a good value.