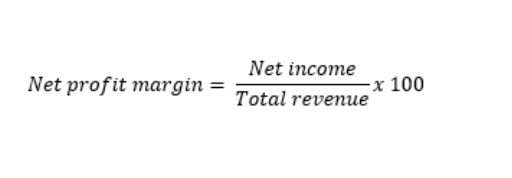

To determine their profitability, businesses look at their total net income relative to their total sales or gross revenue. This figure, expressed as a percentage, is also known as the business's net profit margin. It can be useful for comparing similar businesses or for comparing a business's performance to its own historical results.

For example, if your business generally has a 10% net profit margin and has a 12% margin this month, you can infer that you did a good job of controlling costs.

To determine their profitability, businesses look at their total net income relative to their total sales or gross revenue. This figure, expressed as a percentage, is also known as the business's net profit margin. It can be useful for comparing similar businesses or for comparing a business's performance to its own historical results.

For example, if your business generally has a 10% net profit margin and has a 12% margin this month, you can infer that you did a good job of controlling costs.

How to calculate

How to calculate

The first thing you'll need to do is determine your monthly revenue. This is basically all the money your business earned from sales and other sources.

To calculate your gross profit, subtract the cost of goods sold. For example, if you own a restaurant, this would include all ingredients, packaging, and other items sold to customers.

Next, you'll need to subtract your operating expenses, taxes, and the interest you paid on any business debts in order to determine your net income. Operating expenses include any costs of running the building, and can include (but are not limited to):

- Salaries and wages paid.

- Rent or lease payments.

- Depreciation of equipment, real estate, vehicles, and other capital items.

- Accounting costs.

- License fees.

- Maintenance and repair expenses.

- Advertising.

- Office supplies.

- Legal fees.

- Utilities (electric, gas, water, telephone, etc.).

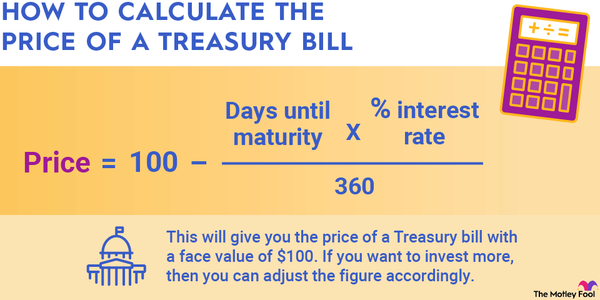

Once you've calculated the net income (profit), simply divide this amount by the total revenue. To convert it to a percentage, multiply by 100.

Example

An example

To illustrate this, let's say that you own a restaurant. During the month of January, your total revenue was $50,000, and your cost of goods sold was $15,000. So, your gross profit was $35,000 for the month.

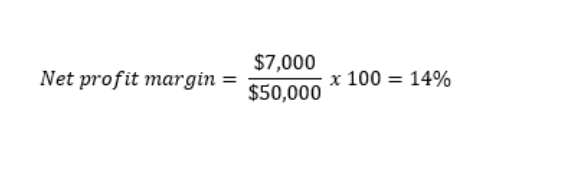

Your various operating expenses came to $20,000, and you paid $8,000 in taxes and interest expenses. Subtracting these items shows net income of $7,000 for the month. Using this information, we can calculate your net profit margin as:

In a nutshell, net income is the amount of money your business generates after paying all expenses. And, expressing this as a percentage can be a good way to assess profitability.

Profitable businesses can make for good investments, so if you'd like to get started investing today, head over to our broker center.

Related investing topics

Related investing topics

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest, better! Email us at [email protected]. Thanks -- and Fool on!