There are more than 23,000 cryptocurrencies, according to CoinMarketCap. That's a far cry from a decade ago, when there were just seven.

However, that astonishing growth rate isn't entirely good news. Many new cryptocurrencies have little purpose other than making money for their developers. Overall, it's still a very top-heavy market. A small number of cryptocurrencies are responsible for most of the market's total value.

Why has the number of cryptocurrencies been growing so rapidly? We'll answer that and cover the most important and influential cryptocurrencies below.

The most valuable and influential cryptocurrencies

| Cryptocurrency | Description |

|---|---|

| Bitcoin (CRYPTO:BTC) | The first cryptocurrency and the largest by market cap. |

| Ethereum (CRYPTO:ETH) | The cryptocurrency with the first programmable blockchain that developers can use to build decentralized apps (dApps). |

| Tether (CRYPTO:USDT) | A stablecoin that follows the U.S. dollar and the cryptocurrency with the most trading volume. |

| BNB (CRYPTO:BNB) | The native cryptocurrency on the BNB Chain, which was built by the popular Binance exchange. |

| XRP (CRYPTO:XRP) | The native cryptocurrency for Ripple and the subject of an SEC lawsuit alleging that it's an unregistered security. |

| Cardano (CRYPTO:ADA) | A research-based cryptocurrency that uses less energy than many others. |

| Dogecoin (CRYPTO:DOGE) | The first meme coin to gain widespread popularity. |

| Solana (CRYPTO:SOL) | A cryptocurrency with a high-performance blockchain capable of ultrafast and inexpensive transaction processing. |

| Polkadot (CRYPTO:DOT) | A cryptocurrency designed to allow different blockchains to communicate and work with each other. |

| Monero (CRYPTO:XMR) | A donation-based cryptocurrency intended to provide total privacy through untraceable transactions. |

Why are there so many different cryptocurrencies?

The biggest reason there are so many different cryptocurrencies is that there's practically no barrier to entry. Anyone who wants to create a cryptocurrency can do it. Even if you have zero technical know-how, you could hire someone on Fiverr (FVRR 3.74%), say, to make a cryptocurrency for less than $20.

It wasn't always this way. In the early days, there was only Bitcoin. Then developers started creating altcoins. An altcoin is any cryptocurrency other than Bitcoin. Early altcoins were intended to improve on Bitcoin's performance or serve some other purpose.

Most successful cryptocurrencies still have a purpose or goal. Developers create cryptocurrencies in hopes of using blockchain technology to solve a real-world problem. But since it's extremely easy to make cryptocurrencies, the amount of money in crypto has attracted people trying to make a quick buck.

If you're looking for a good cryptocurrency investment, or if you're just interested in knowing about some notable projects, here are the cryptocurrencies that have had the greatest impact.

Bitcoin

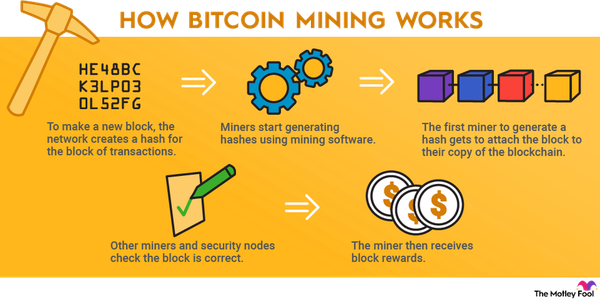

Bitcoin was the world's first cryptocurrency. An anonymous founder (or founders) who went by the name Satoshi Nakamoto launched Bitcoin in 2009. It was designed to be a decentralized digital currency that didn't rely on banks or financial institutions.

Newer cryptocurrencies are more technologically advanced and offer much more efficient transactions, so Bitcoin is now primarily used as a store of value. It has enjoyed a significant first-mover advantage since it's the best-known and most valuable cryptocurrency by a wide margin.

Ethereum

Ethereum introduced the idea of an open-source, programmable blockchain. Developers are able to build on the Ethereum blockchain to make their own cryptocurrency tokens and decentralized apps (dApps). This has led to the creation of decentralized finance (DeFi) -- platforms that offer decentralized versions of traditional financial services.

Although there are now more cryptocurrencies with programmable blockchains, Ethereum started it all. Its early development has helped it become firmly entrenched as the second-largest cryptocurrency.

Tether

Tether is the largest stablecoin. A stablecoin is a type of cryptocurrency designed to follow the value of another asset. In Tether's case, that is the U.S. dollar, meaning one Tether normally has a value of $1.

This cryptocurrency isn't without controversy. The company behind it, Tether Limited, lied about its reserves when it falsely claimed that every Tether was backed by a U.S. dollar. Despite that and other problems, Tether is typically the cryptocurrency with the largest daily trading volume.

BNB

BNB, which used to be known as Binance Coin, is the native cryptocurrency on the BNB Chain. This blockchain platform was created by Binance, one of the world's best-known crypto exchanges. It quickly became a popular alternative to Ethereum due to its significantly cheaper gas fees (transaction fees).

Gas fees on the BNB Chain are paid in BNB, so you need to have it to use that blockchain. The Binance exchange also offers trading fee discounts for clients who own Binance Coin.

XRP

XRP is the native cryptocurrency for Ripple, a payment protocol built for fast, low-cost transactions. It's specifically intended for international money transfers, and there are hundreds of financial institutions that have partnered with Ripple to use its technology.

At the end of 2020, the SEC filed a lawsuit against Ripple, claiming it sold unregistered securities in the form of XRP. Although Ripple denied the allegations, many top crypto exchanges stopped offering XRP trading in response.

Cardano

Cardano is an open-source blockchain platform made by one of the co-founders of Ethereum. It is intended to solve a wide range of problems, including making financial services and identity records accessible to everyone. Cardano development is based on peer-reviewed research, so it tends to move more slowly than other projects.

This was one of the first major cryptocurrencies to use proof of stake to verify transactions. Proof of stake is a more energy-efficient alternative to proof of work, which is used by Bitcoin and many other major cryptos.

Proof of Stake (PoS)

Dogecoin

Dogecoin is a cryptocurrency based on the Doge meme. The coin's creators launched it in 2013 to poke fun at crypto price speculation. It's widely considered the first meme coin, and it has spawned many imitators over the years.

Even though Dogecoin has no competitive advantage or unique use case, it has managed to become one of the most popular cryptocurrencies. Dogecoin and the meme coins that have followed it are proof of how much hype can matter in the crypto market.

Solana

Solana is a blockchain platform built for speed and efficiency. It regularly processes thousands of transactions per second and is capable of handling 65,000 transactions per second. The average cost per transaction is less than a penny.

While Solana uses proof of stake to validate transactions, it also introduced a new method called proof of history. The method creates a historical record of transactions, and it's one of the keys to Solana's fast performance.

Polkadot

Polkadot is a platform meant to expand interoperability between blockchains. Blockchains that connect to Polkadot are able to transfer any type of data or asset among one another.

While Polkadot has similarities to Ethereum in that it's a programmable blockchain, it takes things a step further. Developers can build their own custom blockchains on Polkadot. It also allows for parachains, parallel blockchains working together that each have their own specific uses.

Monero

Monero is a cryptocurrency that uses privacy-enhancing technologies for transactions. This renders transactions anonymous and untraceable. Most cryptocurrencies have public blockchains that provide all transaction data, but with Monero, observers can't see any of this information.

That has made Monero extremely popular among privacy-conscious crypto enthusiasts, but it can also be used for criminal activities such as money laundering and tax evasion. The IRS has previously offered sizable bounties for anyone who can crack Monero.

Related investing topics

Why are cryptocurrencies important?

Cryptocurrencies improve on aspects of traditional fiat currency. They don't need the backing of a federal government, and they process transactions entirely on their own, without financial institutions. Using a cryptocurrency, people on opposite sides of the world can transfer funds quickly, at low costs, and without any payment services.

Although the original purpose of cryptocurrency was to be an alternative to traditional currency, that's no longer the only use. Developers are continually finding new ways to use cryptocurrencies and blockchain technology to solve real-world problems.

With so many cryptocurrencies available, it can be hard to know where to invest. It's important to carefully research any cryptocurrency that you're thinking about buying. When in doubt, cryptocurrency stocks and larger coins tend to be the safest investment options.