A 401(k) is a retirement savings plan sponsored by employers. You fund the account with money from your paycheck, you can invest that money in the stock market, and you earn some tax perks for participating. That's the basic (and slightly boring) definition of a 401(k).

What is a 401(k)?

The more interesting angle is what a 401(k) can do for you. The 401(k) is a powerful resource for achieving financial independence, especially when you start using it early in your career. Put another way, if you like money and wish to have more of it in the future, you can use a 401(k) to make that happen.

Read on for a closer look at how the 401(k) works, when you can withdraw funds from a 401(k), and what happens to your 401(k) if you change jobs.

How does a 401(k) work?

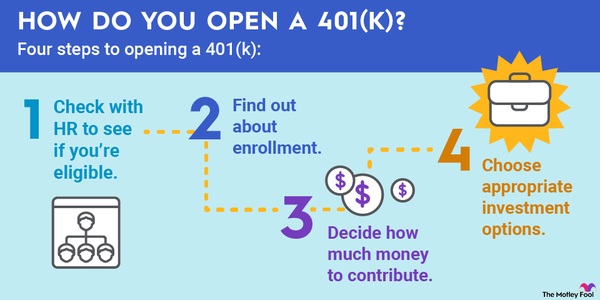

Eligibility to participate in your company 401(k) usually involves a minimum employment period. Many employers allow you to participate in the 401(k) within a month or two of your hire date.

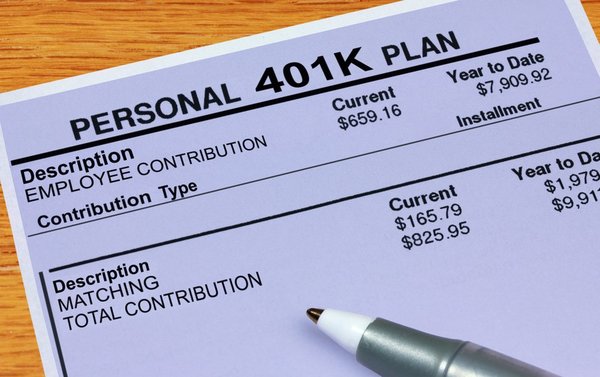

The amount you deposit into your 401(k) with each paycheck is calculated from your contribution rate. Your contribution rate is the percentage of your salary you will contribute. Say you make $45,000 annually, or $3,750 gross monthly. A 10% contribution rate would mean you contribute $375 from your monthly paycheck toward this retirement plan.

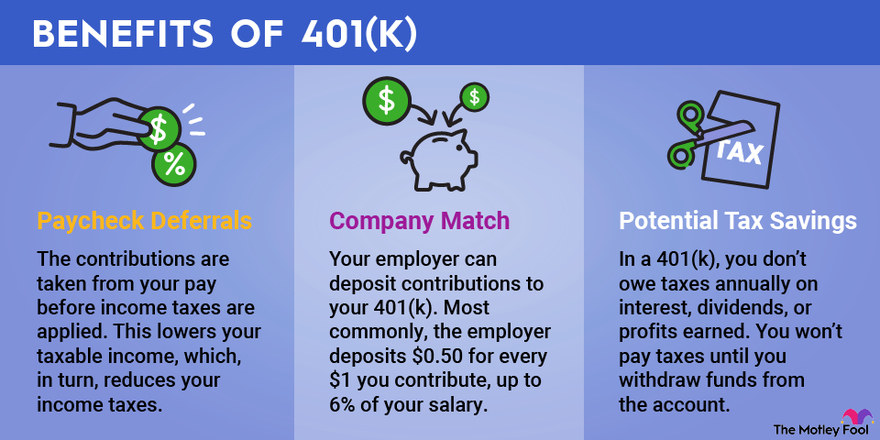

Don't panic if that seems like too much money to carve out of your income. Thanks to the 401(k)'s tax advantages, a $375 paycheck deferral will cost you something less than $375. The contributions from your paycheck are tax-deductible. Known as paycheck deferrals, these amounts are taken from your pay before income taxes are applied. That lowers your taxable income, which, in turn, reduces your income taxes.

Some 401(k) plans offer matching contributions, also known as an employer match. These are deposits to your 401(k) account that are funded by your employer -- basically free money. Matching contributions follow a formula that your employer defines. A common structure is for the employer to deposit $0.50 for every $1 you contribute, up to 6% of your salary.

Those are just a couple of the rules for 401(k). You also get tax-deferred investment earnings. Normally, you'd owe taxes annually on interest, dividends, and profits earned on investments you've sold. You don't have to worry about any of that in a 401(k). You can make as much as you want on your 401(k) investments and you won't pay taxes until you withdraw funds from the account.

How much can I contribute to a 401(k)?

Even if you wanted to, you probably can’t put all of your paycheck into your 401(k). This is because the IRS sets limits on 401(k) contributions. There are caps on how much you can contribute from your paycheck and on how much you and your employer can contribute in total. The numbers can change from year to year, but the limits for 2023 and 2024 are below.

- You can contribute up to $22,500 (2023) and $23,000 (2024) from your salary to your 401(k). Exceptions apply to highly compensated employees, or HCEs.

- If you are 50 or older, you'll be allowed additional paycheck deferrals of $7,500 per year in both 2023 and 2024. These are called catch-up contributions.

- Total contributions cannot exceed your pay, or $66,000 (2023) and $69,000 (2024), whichever is less. These limits don't include catch-up contributions. Total contributions include your paycheck deferrals, matching contributions, and any other employer-funded contributions.

- If you overcontribute to your 401(k), make sure to contact your plan administrator.

- You can contribute to both a 401(k) and IRA or Roth IRA, but there are certain limitations.

What is a Roth 401(k)?

Some 401(k)s allow you to make Roth contributions. A Roth 401(k) contribution has a different tax structure than your standard 401(k) deposit. While the traditional 401(k) contribution is tax-deductible up front and taxable when you withdraw funds, the Roth contribution is the opposite. You get no tax deduction for a Roth contribution, but your withdrawals in retirement are tax-free.

Withdrawing from your 401(k)

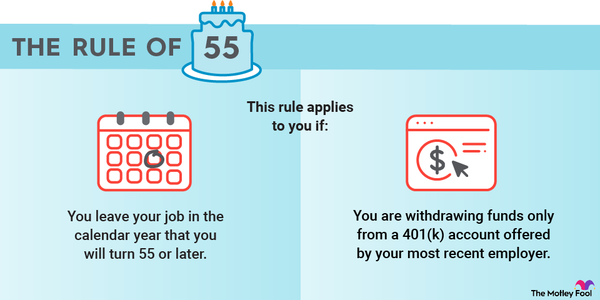

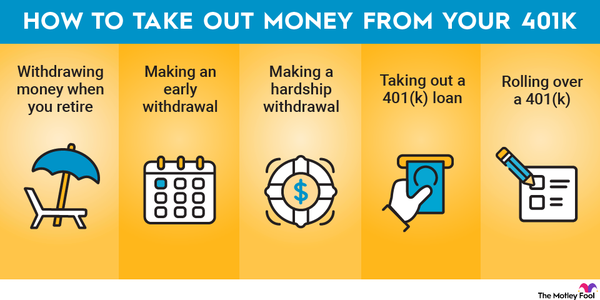

The 401(k) is intended to be a retirement plan, so withdrawals are restricted in your younger years. There are a few exceptions, but most withdrawals before age 59 1/2 come with a 10% penalty.

Retirement withdrawals: You can start taking retirement withdrawals once you've reached age 59 1/2. You may be able to begin withdrawals at age 55 without penalty if you no longer work for the company. These withdrawals are taxed as ordinary income.

Required minimum distributions: If you don't need the money, you can leave it in the account until April 1 of the year after you turn 73 (previously 72). After that, you must take annual distributions by Dec. 31 every year. These are known as required minimum distributions, or RMDs. The amount of your 401(k) RMD for each year is based on your age and your year-end account balance.

401(k) loan: Your plan may allow you to borrow against your 401(k) balance, which would not incur a penalty. You do pay interest on the loan; however, you’re paying interest to yourself. And, if you change jobs, you normally must repay the loan by the time your next tax return is due.

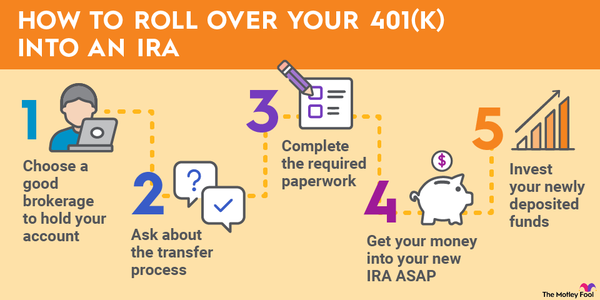

401(k) rollovers

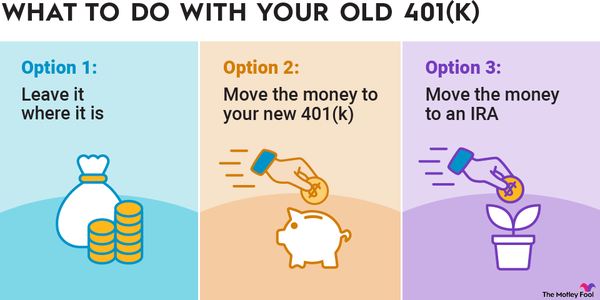

Your job may not be a keeper, but your 401(k) balance is. If you change jobs, you can take your retirement money with you. Depending on your account balance, your former employer may even require you to take your funds out of the plan.

Either way, you'll want to do what's called a 401(k) rollover so you can avoid any taxes or penalties. There are two main types of rollovers:

- Direct rollover: You ask your plan administrator to send your funds directly to a different retirement account -- either an individual retirement account (IRA) or a 401(k) plan with your new employer. No taxes are withheld from your funds.

- 60-day rollover: If your old employer sends your 401(k) funds to you directly, you have 60 days to deposit those rollover funds to an IRA or a different 401(k). This gets tricky because your plan will withhold 20% in taxes from the direct payment. But the amount you must deposit in a new account is the full account balance, including the withheld taxes. If you deposit a lesser amount, you will report the difference as taxable income on your next tax return.

Here's an example to clarify the 60-day rollover. Say your 401(k) balance is $5,000 when you leave your job. Your employer sends you a check for $4,000, with $1,000 withheld for taxes. You have 60 days to deposit the full $5,000 into another retirement account. If you deposit only the $4,000 you received, you will report $1,000 as taxable income. You’d also owe a 10% penalty if it’s an early withdrawal.

Understand all the ways you can take money out of your 401(k)

401(k) for financial independence in retirement

The 401(k) makes it easy to build wealth for retirement. Once you set your preferences, the work of saving and investing happens behind the scenes. Plus, you have tax savings and, possibly, matching contributions that expedite your savings momentum.

Here's what it comes down to: The earlier you start contributing to a 401(k), the more you'll get from its benefits and the wealthier you can be when you retire.

401(k) vs other retirement accounts

Compare the 401(k) to other retirement plans:

More Retirement Topics

401(k) FAQs

What is a 401(k)?

A 401(k) is a type of retirement plan offered by employers. It allows you to save for retirement using pre-tax dollars from your paycheck. Frequently employers will match contributions up to a certain percentage, allowing you to save even more. Then you pay taxes when you take withdrawals from the account in retirement.

What are 401(k) contribution limits?

You may contribute up to $20,500 to a 401(k) in 2022 and $22,500 in 2023, unless you are 50 or older, in which case you may make an extra catch-up contribution of up to $6,500 in 2022 and $7,500 in 2023. These contribution limits can change yearly.

What is a Roth 401(k)?

A Roth 401k plan is much the same as a traditional 401(k) except employee contributions are made with after-tax dollars. Roth contributions don't reduce your taxable income for the current year but are distributed tax-free in retirement. More on a 401(k) vs Roth 401(k)