If you follow any kind of financial news, you’ve probably heard the name at least a few times before: Bernard L. Madoff. Thanks to years of news coverage and countless documentaries, he’s become a household name, albeit for all the wrong reasons.

Here, we’ll go into who Bernie Madoff was and why his story was so important in the context of financial history.

Who was Bernie Madoff?

Who was Bernie Madoff?

Bernard (“Bernie”) Madoff was an American financier convicted of running the largest organized Ponzi scheme in history. It’s estimated that he ran the scheme for more than 20 years and defrauded thousands of investors (many of them charitable organizations) of more than $60 billion.

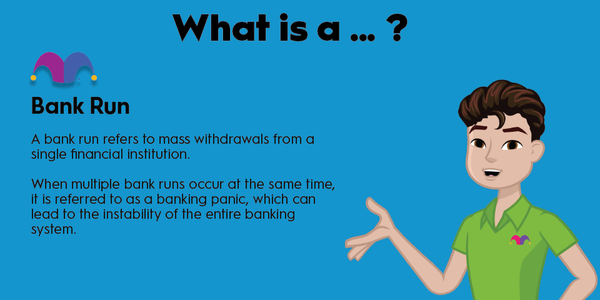

To be clear, a Ponzi scheme -- sometimes called a “pyramid scheme” -- involves using later investors’ money to pay off earlier investors in place of legitimate investment income. Ultimately, if too many people demand withdrawals at once, the Ponzi scheme collapses, with the majority of investors losing everything.

Bernie Madoff was once considered one of the titans of Wall Street, building a career spanning several decades and rising to the heights of the financial industry. He created a legitimate investment and trading firm, Bernard L. Madoff Securities, LLC, and at one time was also the chairman of Nasdaq.

Madoff’s wealth management operation, however, was a complete racket. Rather than placing trades for investors to generate true investment returns, he gathered (and commingled) money in a Chase bank account that he used to pay clients who requested withdrawals.

The Ponzi scheme continued for around 20 years before the Great Recession. Falling markets across the globe sparked panic selling, with many of Madoff’s clients demanding immediate withdrawals. Knowing he was underwater in the scheme, Madoff surrendered and was ultimately arrested at his home in Manhattan.

Why does the Bernie Madoff story matter now?

Why does the Bernie Madoff story matter now?

The breadth and depth of Bernie Madoff’s fraud have been documented by several movies and television shows.

Madoff made his inroads with wealthy circles in Long Island, New York, and Palm Beach, Florida. Using his status as one of Wall Street’s most successful investors, he lured exceptionally wealthy people into investing money with him. Unfortunately, plenty of regular investors with only small retirement accounts found their way to investing with Madoff, as well as a number of institutional investors like charities and foundations.

Madoff would print and mail crudely constructed statements showing steady -- and strong -- investment returns for all of his investors, mathematically impossible given the broader market’s performance over the same period. A whistleblower, Harry Markopolos of Rampart Investment Management, had pointed this out to the Securities and Exchange Commission (SEC) but received a lukewarm response.

SEC (Securities and Exchange Commission)

Bernie Madoff’s financial malfeasance spurred one of the strongest regulatory responses in decades. Since then, the SEC’s policies and procedures have been updated to seriously investigate complaints and tips sent to the organization. More thorough third-party reviews have also been implemented to assure investors that their assets actually exist in the form that their statements indicate.

It’s reasonable to imagine that without the worst economic downturn in a generation, Bernie Madoff may never have been found out. If the market had continued to churn higher as it did in the first half of the 2000s, it’s conceivable that the fraud could still be going on. Fortunately, it seems unlikely that some of his behavior would fly in the digital age as it did two decades ago, but we will never know for sure.

What can the common investor learn from the Bernie Madoff story?

For the common investor, it’s absolutely essential to understand how and where your money is invested, as well as who is responsible for it. This speaks mainly to people who use financial advisors, but even DIY investors should be aware of how their assets are protected.

Be sure you are confident that any financial advisor you use is a fiduciary at all times; in other words, they always have your best interests as their top priority. Look for some of the more common financial designations, like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), for added assurance.

Know that financial frauds have happened and do exist. It’s always critical to do proper research on any financial product or opportunity before doling out your hard-earned money.