Transferring money between domestic bank accounts requires a little know-how about how routing and bank account numbers work, but if you’re looking to perform an international transaction, you’ll need a bit more information than that.

What is an International Bank Account Number?

What is an International Bank Account Number?

Transferring money between domestic banks can be an easy and fast process since the banks in a single country follow the same rules and procedures. Many large American banks have even banded together to create a quick and accurate payment system to simplify bank-to-bank transfers even more.

This is great for domestic transactions, but if you need to make an international transaction, it becomes an entirely different and far more complicated process. When an international banking transaction is initiated, you need a whole different system of identification, part of which could include the International Bank Account Number (IBAN).

IBAN originated in Europe but has been spreading to other countries, including some located in Central America, South America, the Caribbean, and the Middle East. Currently, 83 countries are listed in the Society for Worldwide Interbank Financial Telecommunication (SWIFT) IBAN registry.

How does an IBAN work?

How does an IBAN work?

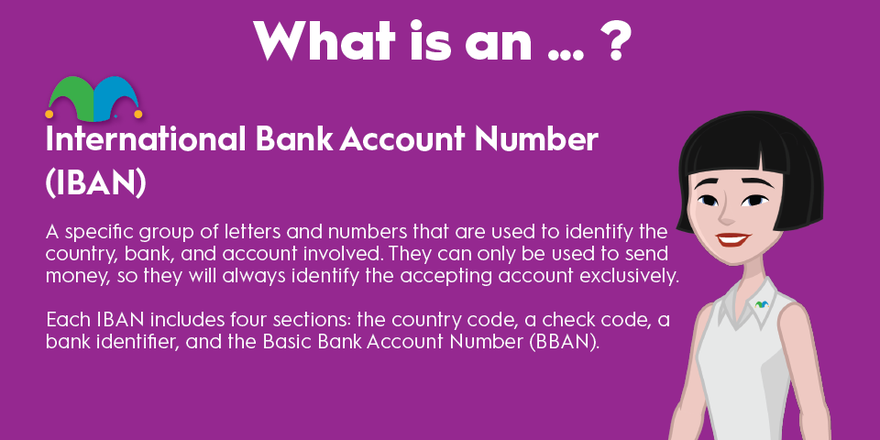

International Bank Account Numbers are made up of a specific group of letters and numbers that are used to identify the country, bank, and account involved. They can only be used to send money, so they will always identify the accepting account exclusively.

Each IBAN includes four sections: the country code, a check code, a bank identifier, and the Basic Bank Account Number (BBAN). The country code is a two-digit letter code from the International Organization for Standardization’s (ISO) registry. The check code is a set of digits provided by the issuing bank to ensure the rest of the code has been transferred correctly. The rest is what you’d expect, something essentially like a routing and bank account number.

Why is the IBAN important?

Why is the IBAN important?

International banking can be fraught with confusion since different countries have different internal standards for everything from account number formatting to wire transfer processes. This can create real problems when you’re trying to send money between countries. Even using the IBAN requires some flexibility, as there are various lengths of IBAN for banks located in different countries.

Before the IBAN was established in 1997, it wasn’t unusual for an international bank transfer to end up in the wrong bank account, the wrong bank, or even the wrong country. This was very costly for banks trying to claw back the money that was misrouted and was understandably distressing for account holders. The IBAN has greatly reduced these types of unintentional errors in processing international wires.

IBAN versus SWIFT

IBAN versus SWIFT

Both IBAN and SWIFT codes are used to send money between countries, but they’re not the same. SWIFT codes only reference specific banks, even to the branch level, but never the account number that’s involved in a transaction. The SWIFT system was put into play in the early 1970s when there was not nearly as much international banking traffic as there is today. It’s still in exclusive use in many countries but is also often paired alongside an IBAN to ensure an accurate transfer.

IBANs, on the other hand, are explicitly designed to identify the bank account specifically being referenced in the transfer. The inclusion of the bank account number is the biggest difference between IBANs and SWIFT business identifier codes. IBAN became the standard for the Eurozone in 1997 but has since expanded to many countries in the developing world.