The economy continues to be at the forefront of the news cycle, with lots of new concepts being thrown around for people who haven't really been interested in economics before. Along with things like inflation and the JOLTS report, a term we often hear is quantitative easing.

What is quantitative easing?

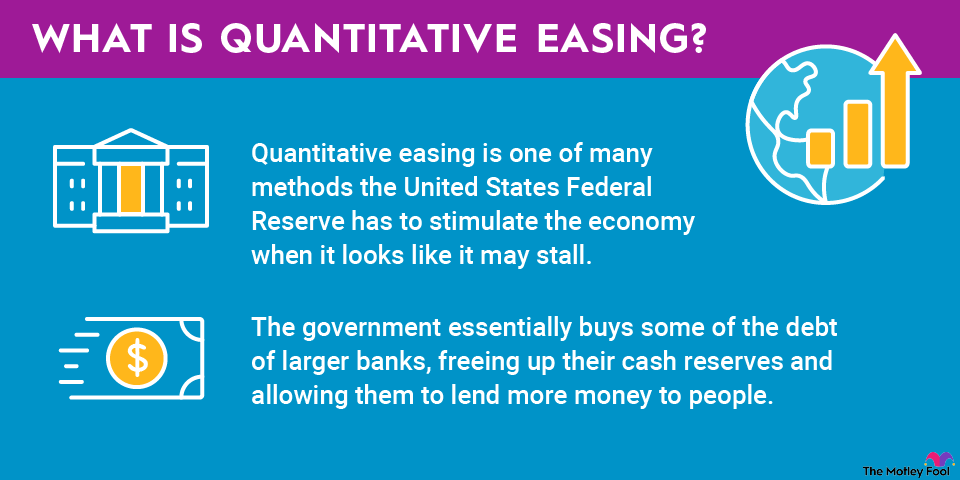

Quantitative easing is one of many methods the United States Federal Reserve has to stimulate the economy when it looks like it may stall. Generally, quantitative easing isn't put into play unless the federal funds rate has already been lowered pretty much as far as it can go. Although it's a concept that's been in play for a while, it wasn't used widely before the 2007–2009 recession (otherwise known as the Great Recession or the housing market crash).

Other central governments also use quantitative easing when they need to stimulate their economies beyond what's possible by lowering interest rates; this is not remotely an American-exclusive concept.

Interest Rate

What is the goal of quantitative easing?

Ultimately, quantitative easing aims to stimulate the economy through increased borrowing activity. It's far more difficult to do this when interest rates are low, as the incentive is already there for people to borrow cheap money for things they want. The difficulty sometimes lies in the ability to borrow, often caused by banks being stricter about who they will loan money to because they have less liquidity than they are generally comfortable with.

Under quantitative easing, the government essentially buys some of the debt of larger banks, freeing up their cash reserves and allowing them to lend more money to people – for anything from cars and houses to new televisions and living room furniture. The additional buying activity stimulates the economy and spreads money around.

Capitalism only really works if there's a constant churn of buying and selling. So when this activity grinds to a halt due to a lack of willingness or ability to buy things, it can be problematic for the economy. Companies can't grow if no one is buying their products or services, meaning they can't hire more people or spend more money on raw materials, either. Everything just kind of stagnates.

How does quantitative easing work?

Quantitative easing is much more complicated than simply “printing money,” as some people accuse the government of doing. Rather than making money out of thin air, the Federal Reserve uses its immense resources to repurchase Treasury securities like government bonds, as well as mortgage-backed securities from government-sponsored enterprises like Fannie Mae and Freddie Mac, from large banks and other private investors.

With those banks freed from the securities tying up liquidity, they can loan money out yet again. So, for example, if The Motley Fool Bank held $200 million in Treasury bonds but only $50 million in reserve funds (cash or other liquid assets) and the Federal Reserve bought $100 million of those Treasury bonds back, suddenly we'd have $150 million in reserves, which we could then loan to our customers.

As the Federal Reserve buys increasingly more of these Treasury bonds and securities, the price of the instruments increases, pushing the bond yields down and encouraging investors to invest in stocks. Generally, stocks then rise in value due to the increased market activity and help improve the values of things like 401(k)s and other retirement funds. They also give companies additional ways to generate cash without selling too many new shares.

Treasury Bills (T-Bills)

The drawbacks of quantitative reasoning

Although quantitative easing is a useful tool for central banks across the globe, it's not always a perfect weapon in the fight against economic stagnation. A few things can go wrong, potentially creating a problem in the local economy that the central bank is trying to stimulate. For example, banks are under no obligation to lend their newfound liquidity to people within their local economy, however you want to define 'local economy.'

Instead of lending money to people within the same regional or national economy to start businesses or make major purchases, the bank might choose to invest overseas. Rather than stimulating the economy, the bank would be sending that newly found cash reserve to another economy entirely, defeating the purpose of quantitative easing.

Expert views

Academic views on quantitative easing

Another major risk is simply causing inflation to increase by putting too much money into the system too quickly. When there's a lot of cheap money lying around, it's easy for people to get whipped up into a frenzy and buy whatever they please. But if everyone is doing that, it can have the unintended effect of driving up prices because supply can't keep up with demand.