You invest in your 401(k) to make your money grow over time, but it doesn't always work out that way. When you notice your savings losing value, your first instinct may be to sell everything, but this usually isn't your best option. We will discuss five actionable steps you can take if your 401(k) account starts losing money.

Reasons 401(k)s lose money

Why your 401(k) might be losing value

There are several reasons a 401(k) can lose money. Disruptions to an industry or a recession could hurt stock share prices. If other investors are worried about an economic downturn, they might rush to sell their stocks, sending share prices plummeting. Buying or selling frequently can also cause you to incur more fees, which will eat into your profits.

Whatever the reason for the loss, the important thing is not to panic. Follow the five steps below to try to get your savings back on track.

1. Diversify your portfolio

1. Make sure your investments are well diversified

The first thing you should do if your 401(k) or individual retirement plan (IRA) is losing money is to check that you are well diversified. You want your money distributed among many stocks, bonds, and other investment products. If you have all your savings tied up in a single stock and it plummets, that's a more serious issue than when you're invested in 100 assets and one dips in value.

Few 401(k)s allow you to purchase individual stocks. You'll likely be choosing mutual funds and exchange-traded funds (ETFs). These are groups of investment products you purchase as a package, which is a convenient and affordable way to diversify your portfolio.

You want a mix of stocks and bonds, although your preferred ratio will depend on your goals and risk tolerance. You also need to think about the assets and sectors you invest in. You don't want to invest too heavily in one industry, such as technology. If it has a sector-wide financial crisis, your portfolio could still lose value, even if you're invested in many different assets within the sector.

While some 401(k)s may offer sector-specific funds, you're more likely to have a choice between U.S. and international stocks or among large-, mid-, or small-cap funds.

If you suspect a lack of diversification is partly to blame for your 401(k) or IRA taking a hit, ask a financial advisor for tailored recommendations.

2. Don't panic sell

2. Don't panic sell

If you're young and your investments are well diversified, the best thing to do when you see your 401(k) or IRA losing value may be nothing. All investments have ups and downs, and it's never wise to judge long-term growth potential by recent performance.

Even if your investments take a short-term hit, their values could rise again long before you need the funds. Unless you no longer think the investment is suitable for your risk tolerance or you question its long-term stability -- for example, you own stock in a company that keeps losing market share to competitors -- you should leave your portfolio alone.

Continue making contributions and don't get too hung up on short-term dips. They could actually benefit you in the long run if you purchase shares when prices are low and they rise later.

3. Choose more stable investments

3. Move your money to more stable investments

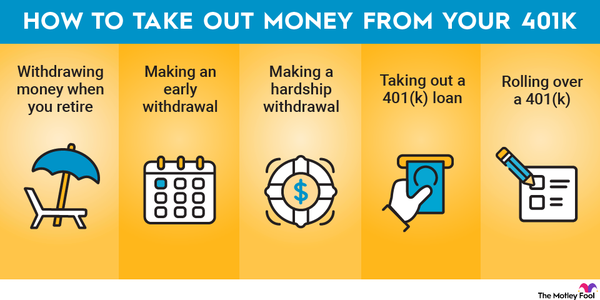

If you're nearing retirement age and see your 401(k) declining, you may be unable to wait for your portfolio to recover before you need to use that money. In this case, move more of your money to more stable investments, such as bonds.

When you buy a corporation's or government's bonds, you're lending money to that entity, which it promises to pay back with interest over time. The only way you wouldn't be repaid would be if the entity defaults on the loan, which doesn't happen often -- unless you're talking about junk bonds.

Another option for the conservative investor is a low-volatility ETF, also known as a minimum variance ETF. These are known for experiencing fewer ups and downs than most ETFs. These investment products may not provide as large a return as individual stocks, but they tend to be more stable, so there's less risk of them losing a ton of value.

4. Claim a tax deduction

4. Sometimes you can get a tax deduction, but it may not be worth it

The government allows you to claim a tax deduction if your 401(k) or other retirement plan has lost value, but there are rules you must follow. First, you must have basis. In this case, basis refers to nondeductible contributions you've made.

Deductible contributions -- those that reduce your taxable income for the year -- do not count. You haven't paid taxes on that money yet, so the government won't give you a tax deduction on the amount you lost.

You also must close all retirement accounts of the same type to calculate the loss. So, if you're trying to claim a loss on your 401(k), you must close all your 401(k)s. Then, total your nondeductible contributions and the current value of the accounts, and you can write off the difference if the current value of the accounts is lower.

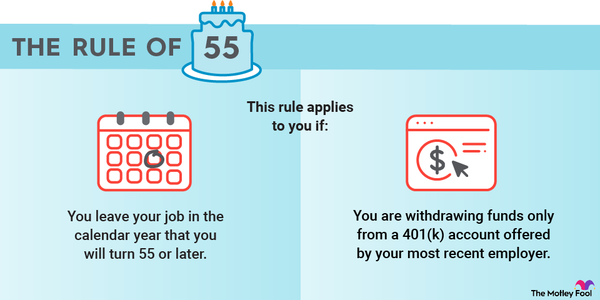

But this is inconvenient for two reasons. First, if you withdraw money from your 401(k) before age 59 1/2, you will pay a 10% early withdrawal penalty. This may negate some of the benefits of writing off the loss. Second, if you take the money out of your 401(k), you're giving up the tax advantages it offers, and your money will no longer grow as quickly unless you invest it in something else.

For these reasons, it's unwise to claim a tax deduction on a 401(k) loss unless you're older than 59 1/2 and plan to use the money to cover your retirement expenses in the near future. Otherwise, try one of the suggestions above.

5. Evaluate your risk tolerance

5. Evaluate your risk tolerance

Risk tolerance can change throughout your life. Generally, younger adults have a higher risk tolerance because they don't need their savings for a while. This means they can invest more aggressively, but it also makes their portfolios more prone to short-term dips.

When you're nearing retirement age, you still want to grow your wealth, but you must also protect what you have. As discussed above, investing a little more conservatively helps you strike that balance.

Understanding these principles can help you clarify whether a 401(k) loss is truly something to worry about. If you believe it's purely down to your high risk tolerance, you may not have to make any changes.

But if you believe you're investing too aggressively for your risk tolerance, you may want to move your money around. This could mean investing in more conservative assets, as discussed above, or even keeping a bit of your savings in cash if you're older than 59 1/2 and plan to use it to cover your expenses within the next few years.

It might not be as bad as you think

You can't control the stock market, and that's never more apparent than when your 401(k) is losing money. But it's important to put that loss in perspective. It's possible that you may not have done anything wrong. Investments have their ups and downs. Some losses are inevitable, but most aren't permanent.

Related investing topics

If you believe your loss is due to a mistake on your part, take a breath and try to see it as a learning opportunity. Correct the error and let what you've learned make you an even better investor going forward.

FAQ

What to do if your 401(k) loses money: FAQ

Can I lose my 401(k) if the market crashes?

Stock market crashes can lead to 401(k) losses, but often, these are only short-term setbacks. As long as you've diversified your savings among many companies and sectors and you're not investing too aggressively for your risk tolerance, you will likely see your portfolio rebound in time. Patience is key here.

Why did my 401(k) drop so much?

There can be several reasons your 401(k) lost money, including a recession or stock market correction, your portfolio not being diversified enough, or investing too aggressively for your risk tolerance.

Where should I put my 401(k) during a recession?

It's best to keep your money diversified during a recession. Spread your money among several companies and sectors so that no single stock weighs too heavily on your portfolio. If you're nearing retirement age, you may also want to move more of your savings to less risky investments, like bonds, to protect what you already have.