An IRA is an investment account that provides tax breaks for retirement savings. Investing money in an IRA is one of the best ways to prepare for your later years because anyone with earned income can open one -- even those without access to an employer-sponsored retirement plan.

However, before you contribute to an IRA, you should have a sense of which type is right for your situation, and you should learn the rules for both deductible contributions and penalty-free withdrawals.

What is an IRA?

IRA stands for individual retirement account. There are several different types, but each one allows you to make tax-advantaged contributions from income you earn to build a nest egg for retirement.

The different kinds of IRAs have different contribution limits, and some also impose income limits on contributors. For example, the two most commonly used IRAs -- traditional and Roth -- have an aggregate contribution limit of $6,500 in 2023 and $7,000 in 2024, although those 50 or older can make an additional catch-up contribution annually. The catch-up contribution amount is $1,000 for both years, so workers 50 and older could contribute a maximum of $7,500 in 2023 and $8,000 in 2024.

IRAs can be opened with any financial institution, including:

- Discount online brokers

- Traditional banks

- Robo-advisors

- Investment management firms

Once you’ve made a contribution, you can purchase any assets your brokerage allows, including stocks, bonds, and mutual funds.

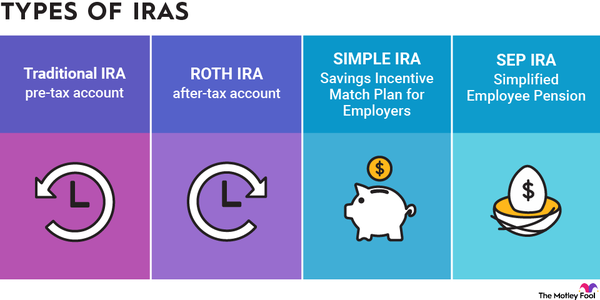

Types of IRAs

There are several kinds of IRAs available and they all work a little bit differently. Some common types of IRAs are:

Traditional IRAs

Traditional IRAs allow you to invest pre-tax income toward your retirement. These contributions can grow tax-deferred until you withdraw them, and they can be tax-deductible, too. While anyone can contribute to this type of IRA (regardless of income), there are some restrictions.

You can deduct up to $6,500 in 2023, or $7,500 if you’re 50 or older. For 2024, you can deduct up to $7,000, or $8,000 if you're at least 50. These are the maximum amounts you can contribute for the year between both traditional and Roth IRAs. Contributions are also fully tax-deductible if neither you nor your spouse has a workplace retirement plan.

Your eligibility to deduct contributions begins to phase out at the following income levels in 2023:

- $73,000 for single filers

- $116,000 for a married joint filer with a workplace plan

- $218,000 for a married joint filer whose spouse has a workplace plan

Your eligibility to deduct contributions begins to phase out at the following income levels in 2024:

- $77,000 for single filers

- $123,000 for a married joint filer with a workplace plan

- $230,000 for a married joint filer whose spouse has a workplace plan

A traditional IRA has many benefits and can be an ideal choice if you feel that your tax bracket is likely to be lower in retirement than it currently is. If you expect your tax rate to drop, it makes sense to claim your tax benefits up front when they are worth more and to be taxed on distributions at your ordinary income tax rate later when your rate is lower.

Roth IRAs

The main difference between a traditional IRA and a Roth IRA is that contributions to a Roth IRA are made with after-tax dollars. While contributions aren’t deductible in the year they’re made, this money grows tax-free and withdrawals aren’t taxed in retirement. Roth IRAs are also subject to the same aggregate contribution limit as traditional IRAs: $6,500 in 2023, or $7,500 if you're 50 or older, and $7,000 in 2024, or $8,000 if you're 50 or older. Unlike traditional IRAs, Roth IRAs have income limits on who can contribute.

If you expect your tax rate to increase in retirement, a Roth IRA is a good choice. That's because you will be able to make tax-free withdrawals later on when your money would otherwise be taxed at a higher rate.

If you are worried about crossing the income threshold where Social Security benefits become taxable, then a Roth IRA can also be a good idea. That's because distributions from a Roth IRA are not counted when determining if your Social Security is taxed.

SEP IRAs

Simplified employee pension IRAs, or SEP IRAs, can be set up by small business owners or self-employed individuals. Only employers and the self-employed can make contributions to this type of account.

The annual contribution limit is the lesser of 25% of employee compensation, or $66,000 in 2023 and $69,000 in 2024. There are no income limits for contributing to a SEP IRA. Contributions are deductible in the year they are made.

SEP IRAs are a good choice if you are a self-employed worker or small-business owner and you want to contribute the maximum amount of money to your retirement account. However, you must contribute the same percentage to all employees eligible to participate. If you have a large staff, you could be required to contribute a significant amount to their retirement accounts if you want to maximize your own retirement contributions.

SIMPLE IRAs

Just as with SEP IRAs, employers and the self-employed can set up SIMPLE IRAs, but both employers and employees can contribute to this type of account. Employees may contribute up to $15,500 in 2023 and $16,000 in 2024. People 50 and older can make catch-up contributions of up to $3,500 in both 2023 and 2024 if their plan permits it. There are no income limits for contributions to this type of account.

This account may have lower contribution limits than the SIMPLE IRA, but you have more flexibility in how you structure contributions to employees.

Rollover IRAs

A rollover IRA is a type of IRA that you move money into from another retirement account. For example, if you leave a job and you had a 401(k) at your workplace, you can move the money from your 401(k) into a rollover IRA.

You do not need to open a specific "rollover IRA" in order to move your money from your existing retirement account. You can move your funds into any pre-existing IRA that you have open. However, rolling over money can sometimes have tax consequences.

If you do not want to owe taxes, move your money into the same type of account that you currently have. For example, you can roll over a traditional 401(k) into a traditional IRA or a Roth 401(k) into a Roth IRA.

Spousal IRAs

A spousal IRA is a regular IRA that’s funded on behalf of a spouse who has little or no earned income. You can use either a traditional or Roth IRA to save for a non-working spouse. The contribution limit is the same as it is for a traditional and Roth IRA that you would open for yourself -- $6,500 in 2023 and $7,000 in 2024, plus an additional $1,000 in catch-up contributions for those who are 50 and older.

If you or your spouse do not have enough earned income to contribute to your own IRAs, a spousal IRA can be an ideal choice.

Advantages of IRAs

IRAs have several advantages, such as:

- You have a choice of investment accounts: You can decide between traditional and Roth IRAs, depending on whether you would prefer your tax break up front during the year that you contribute or would prefer to defer your tax savings until you are a retiree. You also have the choice to contribute to accounts that provide higher contribution limits if you are self-employed or if you own your own business.

- Contributions provide significant tax advantages: Traditional IRAs allow you to contribute to your account with pre-tax dollars, while Roth IRAs allow you to benefit from tax-free withdrawals in retirement. You can choose whether to save on taxes now or in your later years.

- You do not need an employer to open an IRA for you: Although there are a few types of IRAs that employers can offer for employees, you can set up the most common IRA account types (traditional and Roth) for yourself. You have the option to use an IRA as a supplement to a workplace savings plan, or you can open one to take advantage of tax breaks for retirement savings if your employer doesn’t offer a 401(k) or similar plan type.

- Opening an IRA is simple: If you are a self-employed worker or you own your own business, SEP and Simple IRAs can be much easier to establish than other types of workplace retirement plans such as a 401(k).

- You have more flexibility in investment options: You can choose from a wide variety of financial institutions to hold your IRA, including brokerage accounts, robo-advisors, banks, and self-directed IRAs. These types of accounts also usually offer several different investments to choose from, so you can invest your money in a much broader variety of assets than would be available in a typical workplace 401(k) plan.

- Most institutions allow you to open an IRA with no fees and no minimum balance: Many brokers and banks make it easy to get started investing, with few or no costs associated with opening or maintaining your account.

- You can borrow from your account. This is an option as long as you follow the rules about borrowing from your IRA.