Alcoa shares didn't rocket up today. A reverse stock split could make it look like big gains in your portfolio. Image source: Getty Images.

What happened

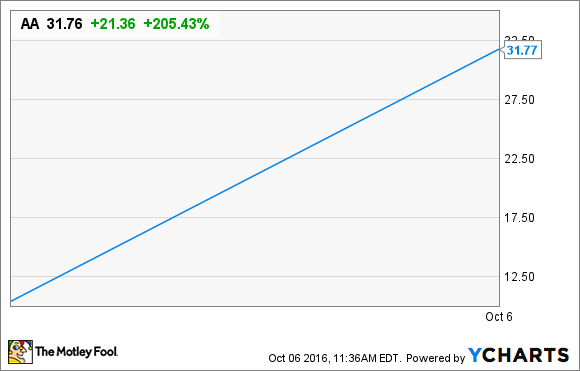

Shares of Alcoa Inc. (AA) are trading for nearly $32 on Oct. 6, 2016, after closing at around $10.41 per share yesterday. Depending on your online broker or financial news source, the stock may look like it's up more than 200% today:

So what?

Short version: Alcoa shares aren't actually up 205% today.

Yesterday (Oct. 5), Alcoa shareholders approved a 1-for-3 reverse stock split, reducing the number of shares outstanding to one-third the quantity prior to the vote. As a result, the share price today is up roughly triple (plus the usual daily volatility), since a single share today is worth three times as much Alcoa ownership as it was yesterday. In other words, someone who owned 300 shares of Alcoa yesterday would own 100 today. But they would own exactly the same percentage of Alcoa they held before the reverse stock split.

Now what?

This isn't really an actionable, material change in Alcoa's business, but it is a step toward a very big one happening soon.

On Nov. 5, 2016, Alcoa is splitting into two separate businesses. It will spin out its bauxite mining and aluminum-making business into a separate company that it will name Alcoa, while renaming the existing company -- which will be comprised of the highly engineered products manufacturing business and hold 20% of the "new" Alcoa -- Arconic.

If you're looking for more information on Alcoa's plans to separate its business in two, look here for an in-depth look at what's going to happen -- as well as my take on what it means for investors going forward.