Unlike many others, income investors will probably remember 2016 fondly. After all, the year was stuffed full of dividend raises. True to form, its final weeks saw a clutch of companies hike their payouts. Here are three notables that upped their distributions as the year came to a close.

Image source: Getty Images.

Waste Management

The top name in rubbish disposal, Waste Management (WM 1.08%), has lifted its quarterly payout by 4% to just under $0.43 per share. Additionally, the company's board authorized a stock repurchase program of up to $750 million, which is effective immediately.

Waste Management's business isn't glamorous, but it's necessary, and the company's sharp management has made it the king of its industry over the years. It's had its struggles, of course. Recycling, one of its major segments, was hit by the decline in commodity prices (which reduces the take for recycled material such as aluminum and paper). These difficulties put a dent in total revenue, which declined by 7% in the company's most recently completed fiscal year.

WM Revenue (TTM) data by YCharts.

Regardless, Waste Management is good at turning garbage into money, managing to consistently grow operating and free cash flow over the past few years. It's done so at rates high enough to cover both the increased dividend and a big chunk of that new share buyback program. No one should worry, then, about the viability of this enhanced payout.

Waste Management has not yet set a record or payment date for its new dividend. The company said it will do so in February, and that the distribution is expected to be paid in March. The payout would yield 2.4% at the most recent closing share price, beating the current 2% average of dividend-paying stocks on the S&P 500.

Waste Management did not specify an end date for its latest stock repurchase program.

Pfizer

Like Waste Management, pharmaceutical company Pfizer (PFE -3.85%) is a big dog in its industry. And like its trash-hauling peer, Pfizer is raising its quarterly dividend. That payout will increase by 7% to $0.32 per share.

The company is an old pro at the dividend game; the upcoming distribution will be its 313th in a row. And it's been more than willing to spend money lately. 2016 was a year of acquisitions for Pfizer, as the company opened its coffers to buy Anacor Pharmaceuticals for $5.2 billion, then struck a deal for a cool $14 billion to purchase Medivation. Those buys have widened the portfolio nicely (Anacor has a promising dermatitis treatment, crisaborole, under review, while owning Medivation lands Pfizer blockbuster prostate cancer drug Xtandi).

The Medivation deal in particular is pricey (too pricey, some say), and in combination with the Anacor buy it will dent the company's finances. We should keep in mind, though, that Pfizer has been down the big-acquisition road before, and managed to stay in the black.

More crucially for its shareholders, it has lately generated enough free cash flow to take care of the payout and recurrent stock repurchases. One of the big reasons investors hold Pfizer is its dependable, and relatively generous, dividend. I think the company will find a way to at least maintain it going forward.

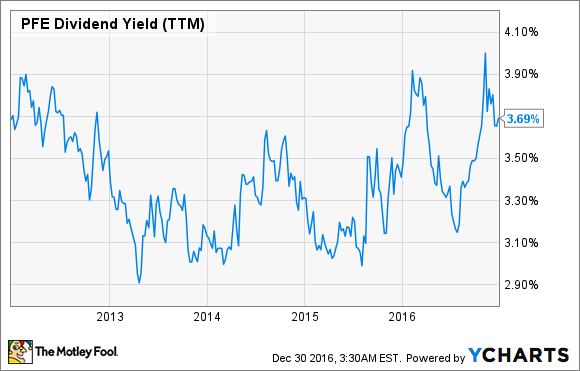

PFE Dividend Yield (TTM) data by YCharts.

Pfizer's upcoming payout will be dispensed on March 1 to stockholders of record as of Feb. 3. It yields a theoretical 3.9% on the current stock price.

Realty Income

Sturdy real estate investment trust Realty Income (O 0.24%) is a frequent dividend payer. Happily for its investors, the company is also a frequent dividend raiser. It has announced an incremental lift in its famous monthly distribution to slightly over $0.20 per share.

That might seem like a counterintuitive move, given the challenges currently facing the retail sector the REIT specializes in. At the moment, online retailers are taking a bite out of their brick-and-mortar peers, while discounters in the clothing segment represent another competitive headache for incumbents. On top of that, the Fed's recent interest rate hike will theoretically shave profit margins across the REIT world.

But Realty Income is good at what it does, and the company's recent numbers tell the tale. In its latest reported quarter, the REIT grew its revenue by 7% (to more than $277 million), while funds from operations advanced 16% to $188 million.

REITs are required to distribute nearly all of their bottom line as shareholder dividends. Happily for Realty Income investors, the company has done a very good job over the years of growing its bottom line. I think the current challenges in the business will be overcome by this very nimble operator, and so I believe its dividend is safe and will likely be raised again before long.

O Net Income (TTM) data by YCharts.

Realty Income's next monthly distribution is to be paid on Jan. 13 to shareholders of record as of Dec. 29. It would yield 4.3% on the most recent closing share price.