Last year witnessed the end of a nine-year run for stocks that saw the S&P 500 deliver a remarkable 259% in total returns and gain 10% or more in seven of those nine years. And while 2018 hobbled the bulls to the tune of almost 5% in losses, the stock market remains one of the best ways for people to build wealth.

Furthermore, the stock market sell-off during the last quarter of the year that ended the bull run has also created some interesting opportunities. This includes two stocks known for paying high-dividend yields: Ford Motor Company (F -1.04%) and Hospitality Properties Trust (SVC -1.28%).

Image source: Getty Images.

As a matter of fact, these two have gotten so attractive, I bought them for the first time recently. Keep reading to learn why I've put my money where my mouth is on these two high-yield stocks.

The value of an acceptable rate of return

I've followed Ford for years, having been a fan of its vehicles (I own one Ford car) and having watched the company go from troubled to profitable under former CEO Alan Mulally. However, since his departure in July 2014, Ford's total revenues have barely grown, and its earnings have fallen by two-thirds:

F Revenue (TTM) data by YCharts.

Moreover, investors have taken a pummeling:

The stock price is down by half, and even when adding in dividends paid, shareholders have lost about one-third of their investment. At the same time, the opportunity cost of owning Ford while the market has gone gangbusters has meant nearly 86% in underperformance versus the S&P 500.

So why buy stock in a company that's likely to continue to face challenges in important markets like China and Europe? In short, because at current levels, the quality of its cash flows, the strength of its balance sheet, and the price you can buy a portion of it for was simply too good to pass up.

F Price to Free Cash Flow (TTM) data by YCharts.

At recent prices, Ford shares trade below 4.8 times trailing free cash flow and 2.3 times cash from operations. Even after weaker recent results, it still only pays out 40% of cash flows to support the base dividend, and it has almost $34 billion in cash on the balance sheet, in large part as a hedge against a big cyclical downturn in demand that puts cash flows at risk.

Put it all together and I'm happy to own Ford at the current valuation and collect a nearly 7% yield. That's a more-than-acceptable predictable return for a portion of my portfolio, and I expect Ford will deliver far better over time.

Check out the latest earnings call transcript for Ford and Hospitality Properties Trust.

Short-term pain for long-term gain

Hospitality Properties Trust has also seen its cash flows weaken over the past year or so.

HPT CFO Per Share (TTM) data by YCharts.

But unlike Ford, which is clearly struggling in parts of the world and dealing with weakening demand in North America, its most-profitable market, Hospitality Properties Trust, a real estate investment trust (REIT), which owns hotels and roadside travel centers, is operating in a strong demand environment and a healthy economy.

So what gives? In short, the company is taking advantage of the opportunity to reinvest back into its properties. It's used a combination of added debt and cash flows to fund renovations of a large number of its properties, and as CEO John Murray pointed out on the third-quarter earnings call, hotels undergoing renovation often command lower room rates than hotels not undergoing renovation efforts.

The result is a double-edged sword of reduced cash flows from rooms being renovated and not available for rent, and lower per-night rents on available rooms at the same property. Not to mention the added expense from taking on more debt.

Yet once renovations are complete, those hotels quickly see room rates bounce back, and over time the upgraded properties will almost certainly deliver stronger returns. With hotels making up about two-thirds of the minimum rent base, this is an important initiative for the long-term health of the company's cash flows.

On the one hand, this should pay off over time. On the other, economic uncertainty, along with a bit of an oversupply, especially for more upscale hotels, has cast a bit of a cloud over many hotel-centric REITs.

But my expectations are that even if we see those things take a bite out of HPT's hotel results in the near term, its long-term prospects remain quite strong. Furthermore, it also counts on travel centers for about one-third of its cash flows, and these assets should help offset cyclical weakness from hotels during an economic downturn.

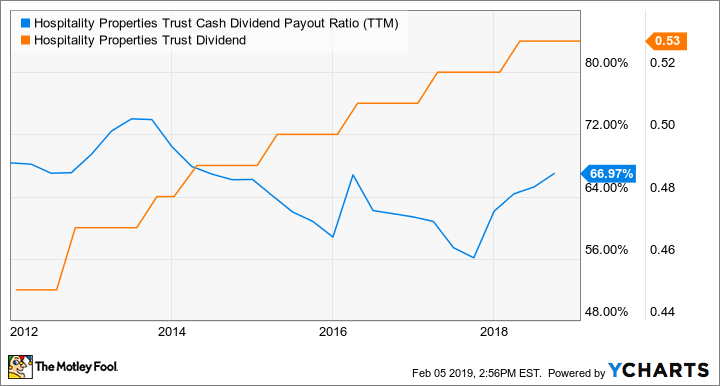

But most importantly, it has a substantial margin of safety in its cash flows to support its dividend:

HPT Cash Dividend Payout Ratio (TTM) data by YCharts.

And once the bulk of renovations are completed, the combination of increased cash inflows and reduced capital expenditures should further expand that margin of safety. Normalized for nonrecurring spending and recent acquisitions, management says only about half of normalized funds from operations are required to cover the dividend.

Trading for less than nine times trailing operating cash flows, paying a nearly 8% dividend yield, and only needing about half of expected 2019 cash flows to keep the current payout, Hospitality Properties Trust offers an incredible risk-reward profile. I've gone so far as to call it my best real estate stock idea for 2019. Even if its results suffer in the near term, a secure 7.8% dividend yield will make it much easier to sit on my hands and wait for the eventual recovery.