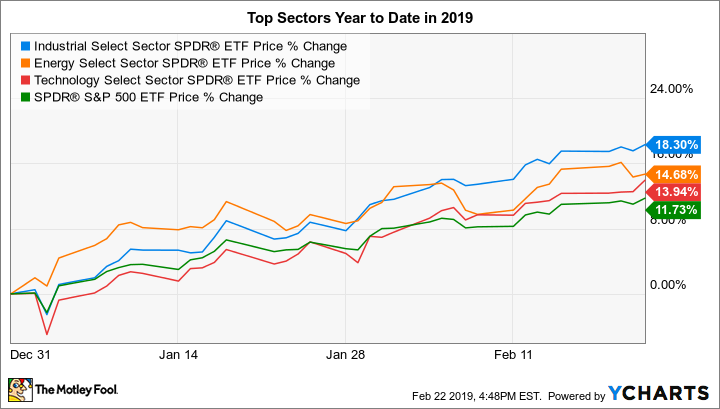

The stock market has delivered impressive returns so far in 2019, with several key market benchmarks posting double-digit percentage gains. For the most part, the rally has been broad-based, and it's hard to find pockets of the market that have seen outright losses this year.

Nevertheless, some sectors of the market are doing better than others. When it comes to the 11 sectors that the company behind the Select Sector SPDR line of ETFs tracks, the best returns so far have come from Industrials Select Sector SPDR (XLI 0.67%), Energy Select Sector SPDR (XLE 0.68%), and Technology Select Sector SPDR (XLK 0.43%).

Powering ahead with industrials

The industrials sector has been the big winner so far in 2019, and a quick look at the performance of stocks within the sector makes it easy to see why. Solid gains in stocks from aerospace and railroads to heavy equipment and delivery services have helped power the industrials ETF higher by close to 20% when you include dividend income.

Among top stocks in the space, two stand out. Boeing has been a big winner from the rising demand for commercial aircraft, and many see future purchases staying steady or growing further even from today's attractive levels. At the other end of the spectrum, General Electric has seen its stock bounce back substantially from its big losses in 2018, and investors are increasingly excited that a new CEO can come up with a viable strategic direction that will result in a lasting recovery.

Energy picks up steam

Energy stocks have also done well, which comes as somewhat of a surprise given recent price trends. Natural gas prices have given up their recent gains, and even crude oil hasn't made a whole lot of progress, albeit rising from their worst levels of the year late in 2018.

Energy has started 2019 a close second to industrial stocks. Image source: Getty Images.

The energy ETF has almost 40% of its assets invested in the top two U.S. integrated oil giants in the market, and they've both managed to post double-digit percentage returns for the year. But some even better performance has come from other parts of the space, including select companies in the oil services, midstream pipeline, and exploration and production areas. If West Texas intermediate crude can continue to make progress toward the $60s on a per-barrel basis, it could bode well for the energy sector throughout 2019.

A tech rebound

Finally, the technology sector just managed to edge out some other rivals to claim the No. 3 spot. Performance in tech has been a mixed bag, with several big-name giants in the space lagging the overall market. But a couple of areas have seen noteworthy rebounds in the first two months of the year.

The biggest is the chip space, where Micron Technology has been able to post a 30% rise so far in 2019. After a big drop on fears that the memory cycle had run its course, Micron and its peers have found new life as investors reassess the chances of a tech downturn.

At the same time, bets on turnarounds have also picked up steam. IBM is one of the best performers in the Dow, as investors believe that Big Blue might finally be poised to reverse its multi-year streak of sluggish business. Some fear that the company has bounced back too far too fast, but for now, shareholders are buying into the idea that IBM can turn its acquisition of Red Hat into new growth opportunities. If that proves to be the case, it could mark a major upward reversal for Big Blue's shares.

Check out the latest earnings call transcripts for companies we cover.

Will these trends last throughout 2019?

It's too early to decide whether industrials, energy, and technology will be able to sustain their outperformance and end up being the big winners in 2019. But based on early signs, things are looking good for these sectors. If the market keeps rising, it'll probably be because these areas of the economy keep leading the way higher.