Are you looking for a stock to buy that's generating strong growth and trading at a low valuation? It's not easy to find that combination given the current economic conditions, but one that could fit the bill is InMode (INMD -0.23%). The business has been performing exceptionally well, but its shares are still undervalued. It may even be the best healthcare stock to buy now, and here's why.

An impressive growth rate

With U.S. economic growth slowing, many fast-growing businesses have been laying off staff to cut costs after previously overestimating their growth opportunities. InMode, however, is still firing on all cylinders.

The company, known for machines that perform minimally invasive cosmetic procedures and body treatments, posted impressive first-quarter results this month. Sales were up 23.5% year over year to $106.1 million, and for 2023 management projects revenue of between $525 million and $530 million, up at least 16% from the $454 million it reported last year.

But while the growth rate looks strong, it has been slowing down, at least compared with where it was during the early stages of the pandemic and when consumer spending was still strong:

INMD Revenue (Quarterly YoY Growth) data by YCharts

As the business' growth rate has slowed down, the stock has also fallen in value as well. But the growth rate was unsustainable to begin with at those elevated levels in 2021 and now it's tracking at a more reasonable pace.

More importantly, however, is that this is a business I would expect should be able to continue to do well even in a recession. Aesthetics appear to be growing even more important to people thanks to the ever-widening prevalence of social media, and InMode offers consumers more cost-efficient options for aesthetic treatments. If the company can continue generating these types of results, it may only be a matter of time before the stock takes off, especially given how strong its profit margin is.

InMode's margins are fantastic

What I really love about InMode are its margins. It's one thing for a company to grow its sales, but it's quite another for it to do so while maintaining high profit margins.

With net profit margins of close to 40%, InMode is a profit-making machine. That's the type of business investors should be bullish on, and that makes for a great long-term growth stock holding.

INMD Gross Profit Margin (Quarterly) data by YCharts.

It's also a cheap stock

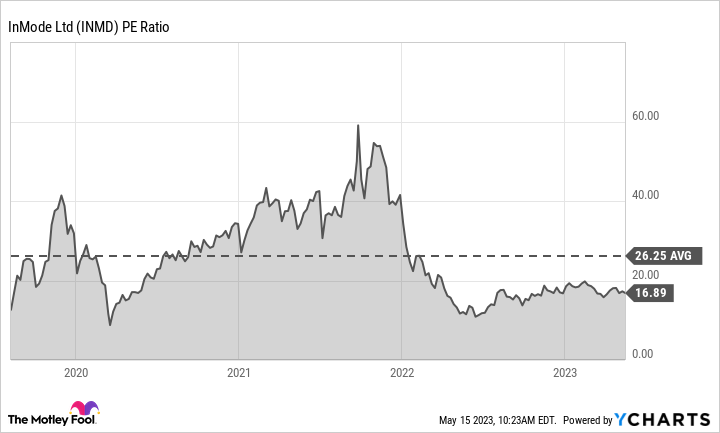

One of the best features of InMode's stock is its low valuation. At 17 times earnings, it trades below the S&P 500's average of 18. Given its growth profile, I'd argue that it warrants a higher multiple -- and it has averaged one in the past.

INMD PE Ratio data by YCharts.

A no-brainer buy?

InMode trades at a modest valuation, and it's down some 20% from its 52-week high, so it could make for a solid investment to hang on to for years. While I wouldn't necessarily say it's the best healthcare stock to buy, as its growth depends on consumer demand, which could waver in a downturn, it's definitely among the best stocks in the healthcare industry to buy right now.