News from the Food and Drug Administration (FDA) can often make or break a stock. This month, it broke Sage Therapeutics (SAGE 0.81%).

Although the company obtained approval for its depression treatment zuranolone, it was for postpartum depression only. The FDA didn't approve it for major depressive disorder.

The partial approval significantly limits the upside for the drug and it sent growth investors into a panic. As a result, the stock price has crashed more than 50% in just the past month. Does Sage Therapeutics make for a good contrarian buy, or is the business in real trouble?

Sage isn't likely to get out of the red anytime soon

A big problem with many small biotech stocks is that they're fairly risky due to their high costs and lack of significant revenue. Sage Therapeutics is no exception, as the company typically generates no more than a few million dollars in revenue each quarter.

Last quarter, for the period ending June 30, it brought in less than $2.5 million from the sale of another postpartum depression drug, Zulresso. That's nowhere near enough to cover its $97.2 million in selling, general, and administrative costs, plus $75.6 million in research and development costs.

Zulresso was approved in 2019 but hasn't been nearly enough to transform Sage into a profitable company. Failing to get approval for zuranolone to treat major depressive disorder is a big hit on Sage's growth prospects.

Without that indication, the drug's peak sales could be between $250 million and $500 million for just postpartum depression, versus $1 billion if a major depressive disorder was also covered. Zuranolone is the first oral drug for postpartum depression, but it was its potential as a treatment for major depressive disorder that had investors bullish on the company.

The company's cash position is strong -- for now

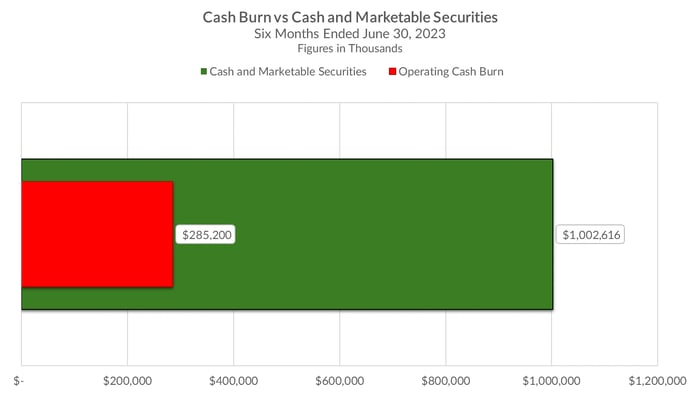

Another thing biotech investors should look at when evaluating a stock is its cash position. As of the end of June, Sage Therapeutics had over $1 billion in cash and marketable securities.

The company's rate of cash burn, which was around $285 million over the past six months, could give the business close to two years of runway before potentially needing a big cash infusion (i.e., a share issuance). That's assuming the company's rate of cash burn won't worsen, or it won't need to invest heavily in property and equipment.

Image source: Company filings. Chart by author.

There's nothing else in the company's pipeline that's in phase 3, so it could be inevitable that cash becomes an issue down the road. It would likely take multiple years for Sage to get any one of its other products to market to generate revenue -- assuming they obtain approval. Even then, it may still not be enough to cover the company's operating expenses.

Is Sage Therapeutics stock too risky to invest in?

Not obtaining regulatory approval for zuranolone to treat a major depressive disorder is a big blow to Sage's business. That was the one big catalyst it had going and was a key reason Biogen invested in the company back in 2020.

Sage's cash-burning business is looking even riskier today. Investors shouldn't take a chance on this beaten-down healthcare stock as things may not get better anytime soon.