Nearing retirement can feel freeing. You've worked your entire career for this! Naturally, the stressful part of retiring is protecting your saved money. It's arguably more important to prevent steep losses than to continue building wealth.

While no stock or investment is risk-free, you can find blue-chip stocks in industries like healthcare that will always be in demand because they're a pillar of modern society.

Here are three fabulous healthcare stocks with ironclad financials. You can buy and hold these stalwarts with confidence. And the best part is they can offer a combination of safety and enough that can grow your nest egg safely in a diversified portfolio.

1. UnitedHealth Group

Healthcare conglomerate UnitedHealth Group (UNH 0.30%) might be the central cog in the U.S. healthcare machine. It's not only an insurance company, but also provides healthcare services, analytics, and solutions throughout different levels of care. If you're looking for an impressive resume, check out the company's smooth upward trajectory of revenue and earnings growth over the past several decades:

UNH Revenue (TTM) data by YCharts

The company's financials are rock-solid. UnitedHealth has nearly $30 billion in cash on its balance sheet, and its debt is just 1.8 times its EBITDA, a healthy ratio that signals the company isn't borrowing too much money. Investors also get a solid dividend that yields 1.4% today and comes with a 14-year streak of consecutive increases.

UnitedHealth is so large and healthcare is such a fragmented and complex business that the company is poised to continue growing as it uses its size and expertise to provide more services at a lower cost to its hospitals and care providers throughout the industry. Analysts are calling for 13% annualized earnings growth moving forward, and the stock's 0.54 beta means the stock is far less volatile than the broader market. Investors can feel confident owning the stock for years to come.

2. Johnson & Johnson

Another household name, Johnson & Johnson (JNJ -0.46%) is a model of consistency. The company has paid and raised its dividends for 62 years, supported by decades of steady growth. Today Johnson & Johnson is split into two business units: Innovative Medicine, its pharmaceutical business, and MedTech, which designs and sells medical devices and products.

Johnson & Johnson has $23 billion in cash on the balance sheet. Its borrowing is modest; long-term debt is just 1.6 times EBITDA. The company's balance sheet has a sterling reputation. It's one of two public companies with an AAA credit rating, surpassing even the United States government. In other words, there is a higher perceived chance that the United States government collapses than Johnson & Johnson defaults on its bills.

JNJ Revenue (TTM) data by YCharts

Johnson & Johnson has a beta of just 0.53, meaning owning the stock should be a pretty smooth ride. Analysts also believe the company's earnings will compound at 5% to 6% moving forward. Frankly, that's what Johnson & Johnson does best: grind out modest growth while being a force of stability in investors' portfolios.

3. Abbott Labs

Abbott Labs (ABT 0.63%) is the last company on this list, and it's another diversified healthcare giant. The diversity in its business means more stable revenue and profits, so investors don't have to worry as much about huge swings. Abbott's stock is also less volatile than the broader market, with a beta of 0.75. Abbott sells consumer products, medical devices worldwide, and generic pharmaceuticals to emerging markets.

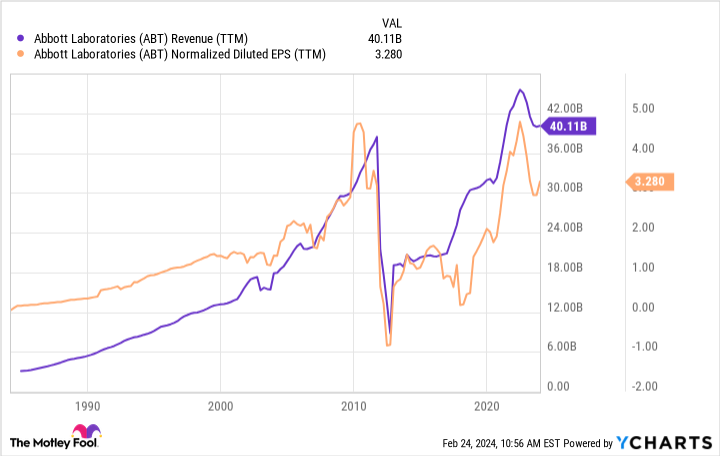

Abbott Labs has a more volatile history of revenue and earnings performance. The company spun off its primary pharmaceutical unit as AbbVie a decade ago, and filled that hole with significant acquisitions. However, the business never wavered in returning capital to shareholders. Abbott is a Dividend King with 52 years of dividend growth.

ABT Revenue (TTM) data by YCharts

Like good companies do, it got its balance sheet back in good shape. Today, there is over $7 billion in cash, and debt is just 1.6 times EBITDA. Meanwhile, earnings are poised to grow by 9% annually, giving investors a blue-chip stock with long-term growth potential. Investors can lock in Abbott's 1.8% dividend yield today and enjoy a likely continuation of annual increases.