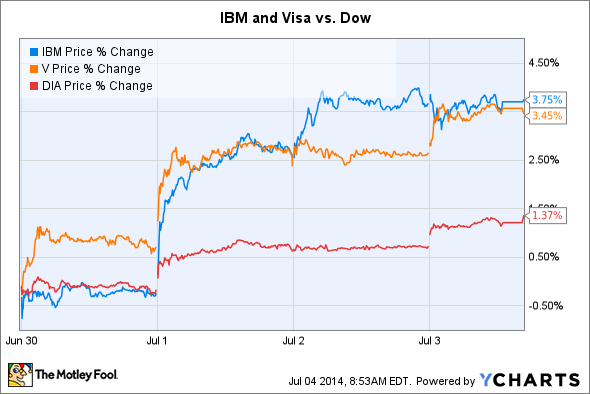

By now, just about everyone knows that the Dow Jones Industrials (^DJI 0.40%) jumped above the 17,000 mark for the first time Thursday, capping a strong week for the stock market. Even with a day off for the Independence Day holiday, the Dow managed to climb 216 points, or about 1.25%, with three straight record closes to finish the week. As second-quarter earnings season begins, investors are optimistic that the strength we've seen in the U.S. economy will translate to much better results for individual companies than they saw in during a tough winter. Even though more than two dozen Dow component stocks rose last week, the two top performers in the Dow were IBM (IBM -1.05%) and Visa (V -0.23%), standing well ahead of their peers.

Source: IBM.

IBM climbed almost 4% as the evolving tech giant made some important product releases and also got good news from a key industry report. Analysts at Gartner rated IBM as the leader in security-analysis services, leading its peers both in terms of its ability to execute with useful tools for clients as well as with respect to the completeness of its vision in providing big-picture solutions to the most common challenges its customers face. The news validates the approach that IBM has taken recently as it focuses on mastering areas that have the potential for high-margin sales to enterprise customers. Moreover, multiple efforts in the cloud-computing space helped lift IBM's visibility among shareholders, with new social software products enabling easier collaboration among users. IBM still faces its challenges, especially in emerging markets, but shareholders are hopeful that after a long period of underperformance, the tech giant is back in the game.

Visa gained 3.5%. The credit card network company tends to perform well whenever positive economic conditions suggest that consumers might spend more in the future, and part of this week's gains likely stem from Visa's expected revenue jump from more unemployed Americans getting new jobs and going back to work. Interestingly, though, much of Visa's long-term potential could come not from successfully beating down its competitors but rather from working with them to make credit card and debit-card technology more secure and easier to use. As electronic payments go beyond cards and allow non-traditional companies from outside the typical financial-institution universe to play an increasingly important role in the evolution of the industry, Visa and its card-network peers will keep having to work hard to remain the favored way that people spend money.