Hedge funds are a way for wealthy individuals to pool their money together and try to beat average market returns. Managers often use aggressive strategies in an effort to produce positive returns for investors, and they typically get paid based on performance.

Hedge funds generally have similar legal structures, relatively comparable investment strategies, and charge about the same amount of fees to their investors. To really understand the definition of a hedge fund, though, we need to dig a little deeper.

How do hedge funds work?

How do hedge funds work?

Hedge funds limit their participants to accredited investors. An accredited investor is defined as someone with a liquid net worth greater than $1 million or an annual net income greater than $200,000 (or $300,000 with a spouse). The SEC allows accredited investors to invest in less-regulated securities offerings because it assumes investors with that much wealth will have a level of financial sophistication.

Hedge funds are structured as limited partnerships. The investors are limited partners while the hedge fund company is a general partner. The hedge fund pools money from its limited partners and invests it on their behalf.

Restricting themselves to accredited investors allows hedge funds to take more aggressive approaches to investing since they're not heavily regulated by the SEC like mutual funds. Managers often use advanced strategies, including leverage, short positions, and derivatives such as options, and they can invest across a wide variety of markets, including stocks, bonds, commodities, real estate, cryptocurrency, and more. Virtually any opportunity to make money is on the table.

Investments in hedge funds are often relatively illiquid. You can only buy in or withdraw during certain periods, and there's often a lock-up period of several months to several years after the initial investment. Operating this way allows fund managers to take more aggressive positions without the need to provide liquidity to the investors at all times.

How do hedge funds make money?

How do hedge funds make money?

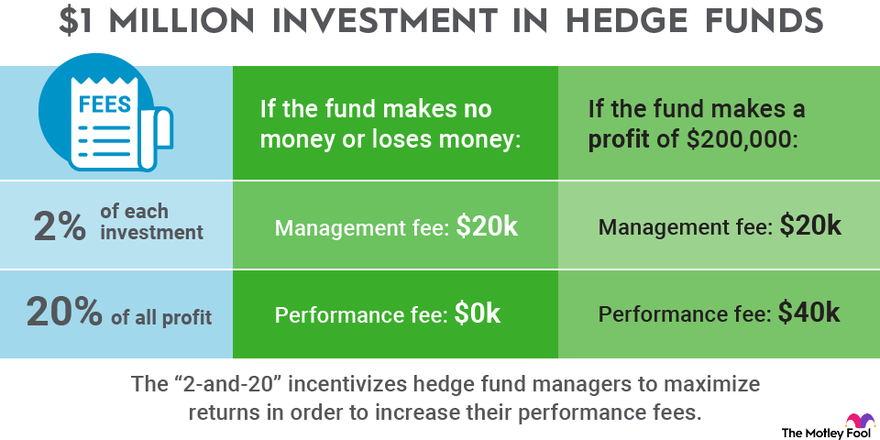

Hedge funds typically charge two fees: management fees and performance fees.

A hedge fund company typically charges a 2% management fee. This fee is based on the net asset value of each investor's shares. So, if you invest $1 million, you'll pay about $20,000 as a management fee that year. This fee goes toward covering the operations of the hedge fund and may be used to directly compensate the fund manager.

The fund manager's job is to develop the investment portfolio and manage inflows and outflows of cash into the fund. They're directly in charge of each investment decision and the strategies the fund will use. Often the fund manager and hedge fund company owner are one and the same.

The performance fee is usually 20% of profits. So, if the hedge fund manager does well, and they increase your investment from $1 million to $1.2 million, they'll take another $40,000 (20% of $200,000). If the fund does poorly and loses money, there's no additional fee.

While "2-and-20" has been standard in the industry for some time, hedge funds' underperformance since the 2008 financial crisis has put pressure on hedge fund companies to lower their fees.

Differences between Hedge funds vs. mutual funds

Differences between Hedge funds vs. mutual funds

While both hedge funds and mutual funds pool investors' money and typically buy diversified portfolios, there are a lot of differences between the two investment vehicles.

Investment objectives

The typical mutual fund has a benchmark index that the fund manager aims to outperform.

Hedge fund managers are incentivized to maximize returns in order to increase their performance fees. The asymmetry in the fee (e.g., the fund company can't owe investors for negative performance) leads to more volatile strategies and results on a year-to-year basis.

Fees

Mutual funds charge an expense ratio that usually falls between 0.5% and 1.5%. If you're interested in index funds, the fees can be much closer to 0%.

Hedge funds typically charge 2% in management fees and an additional performance fee of 20% of the profits. That makes hedge funds extremely expensive relative to mutual funds.

Gross Expense Ratio

Shareholder requirements

Anyone can invest in a mutual fund. Mutual funds may require a minimum investment of $100, $1,000, or more, but as long as you have the money, you can buy shares.

Hedge funds only accept accredited investors. On top of that, hedge funds usually have very high minimum investments, like $1 million. This puts a significant limit on the number of people who can buy into a hedge fund.

Liquidity

Investors can sell their shares in a mutual fund on any day. While their sell order won't execute until the end of the trading day, they can sell or buy more any day the stock market is open.

Hedge funds limit their investors to buying and selling during certain periods every quarter, half-year, or sometimes longer. Additionally, new investors must lock up their funds for a certain length of time, typically one year.

Regulation

Mutual funds are registered with the SEC. As such, they're required to meet all regulations from the agency, including regular financial reporting.

Hedge funds don't have to register with the SEC, and, therefore, there's a lot less transparency. However, the SEC can still sue nefarious hedge fund managers on its investors' behalf in the case of corruption or misleading investors such as in a Ponzi scheme.

Trading strategies

Mutual funds are limited in the strategies they can use to invest. For the most part, mutual funds stick to buying stocks, bonds, and other securities.

Hedge funds can invest in just about anything, and, therefore, can employ a wide variety of strategies. Managers can use derivatives to hedge or leverage positions, they can buy more illiquid assets such as art or private real estate, they can sell short, and they can use debt. These strategies are often more volatile than those available to mutual funds.

List of hedge fund companies

List of hedge fund companies

- Blackrock (BLK 0.69%) is the largest investment management company in the world, with more than $9 trillion in assets under management. Much of that is actually held in mutual funds and ETFs, but Blackrock also offers both institutional and retail investors access to alternative investments through its hedge funds.

- AQR Capital Management was founded in the late '90s and has grown to be one of the biggest hedge funds in the world. It takes a very quantitative approach to finding investments presenting value or momentum.

- Bridgewater Associates was founded by Ray Dalio in 1975. The firm uses a set of principles he developed to deal with various situations and make investment decisions.

- Renaissance Technologies uses automated trading strategies based on statistics and technical indicators. It trades in many different markets, including equities, debt, futures, and foreign exchange.

- The Man Group got its start way back in 1783 as the exclusive supplier of rum to the British Royal Navy. The company now has five investment management businesses using a range of strategies and investing across various markets.

Hedge fund strategies

Hedge fund strategies

Hedge funds can employ a number of strategies including:

- Long/short equity: Fund managers will buy shares in stocks their research finds promising and short shares in stocks they think are overvalued. This strategy reduces market risk since the short positions offset the long positions. Provided the long positions as a group outperform the short positions, the fund makes money. For example, the manager buys Stock A and shorts Stock B. Stock A goes up 20% and Stock B goes up 15%, and the manager can sell Stock A, cover the short on Stock B, and still gain 5% on the trade. Likewise, if Stock A goes down 15% and Stock B goes down 20%, the trade still returns 5%.

- Merger arbitrage: Fund managers will take advantage of opportunities where a merger or acquisition price isn't fully reflected in a security. They can do this by buying shares of the acquisition target and selling shares of the acquiring company based on the announced share-exchange ratio for the acquisition. The trade will succeed as long as the merger is successfully completed as planned, but there's risk that things could change or the deal faces regulatory roadblocks.

- Event-driven: Managers will buy the senior debt of distressed companies or those that have already declared bankruptcy. As the company reorganizes, the manager expects to receive close to face value for the debt they buy while junior debt and equity holders may be completely out of luck in recouping any value.

- Global macro: Hedge funds will analyze how global macroeconomic trends will impact basic financial systems and change exchange rates, interest rates, or commodity prices around the world. They then find investment opportunities most impacted by those changes, typically currency forwards.

- Quantitative: Some hedge funds develop algorithms to analyze large sets of data to find trading opportunities. Oftentimes, the system automatically executes the trade, and management simply analyzes the performance of the algorithm and adjusts it as necessary. High-frequency trading is an example of quantitative trading in action.

Related investing topics

The bottom line

Hedge funds offer access to a specific manager's investment strategy, but the price is very steep. Most individual investors are precluded from investing in hedge funds, and even those eligible to buy shares may be better off with a less expensive investing approach.