Value investing involves buying stocks that are priced below their fair value. The investor's goal is to hold these assets until the broader investment community realizes their true value. When that happens, the value stock's price will rise and create gains for the investor.

Stocks can be underappreciated and underpriced for several reasons. The company may be working through a temporary issue that is causing lower sales and earnings, the industry or individual stock may be out of favor with investors, or the overall economy could be down.

The challenge for the value investor is to distinguish between stocks priced low for a reason versus those that are true bargains. This typically requires analyzing the company's business model and estimating its intrinsic value. Popular valuation methods include discounted cash-flow analysis and peer comparisons on key ratios, such as the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book value (P/B) ratio.

Truly undervalued companies usually take time to realize their potential. That adds uncertainty to the process since time can introduce new and unfavorable circumstances. Value investors address the uncertainty in two ways:

- Maintaining a long-term outlook. Holding periods for value companies should be long or even indefinite. Value investors look to achieve gains through compounding appreciation over years and decades. This requires the patience to resist selling off during market downturns.

- Incorporating a margin of safety. The margin of safety is the difference between the company's fair value per share and its current stock price, expressed as a percentage. If a stock is worth $100 and is trading for $80, the margin of safety is 20%. A high margin of safety -- say, 30% -- implies lower downside risk and higher upside potential for the value investor.

What makes a great value stock?

The defining characteristic of a value stock is a low price relative to the company's fair value per share. However, the best value stocks often have other attractive qualities, such as:

- A proven business model

- A long track record of profitability during both strong and weak economies

- Steady growth in revenue and cash flow

- Experienced leadership

- Low leverage

- A strong competitive advantage, such as brand loyalty

- Commitment to returning value to shareholders through share buybacks and/or dividend payments

Why invest in value stocks?

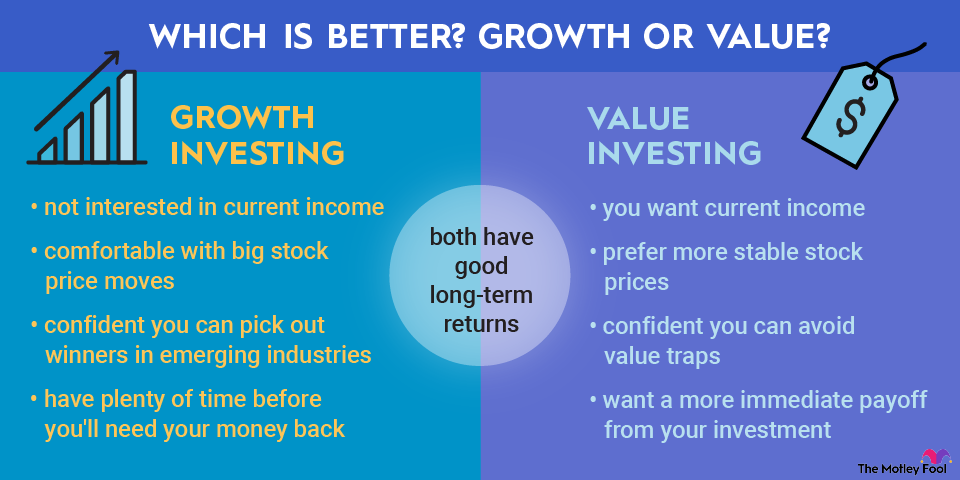

Value investing is often compared to growth investing, which involves buying companies that could potentially grow much faster than the market or their peers. While the two strategies are not mutually exclusive, value investing can deliver more stable returns with less volatility relative to growth investing. Growth stocks can rise quickly but fall just as fast.

Value stocks appeal to investors who:

- Don't trade heavily

- Prefer lower volatility

- Are willing to buy when other investors are selling

- Enjoy research and analysis

- Appreciate regular dividend income

For those who view themselves as defensive investors without much tolerance for risk, a good value stock can protect against losses while offering a reasonable potential for gains.

How to find value stocks

Value investors often begin their search with a stock screener. Stock screeners return a list of public companies that meet set criteria, such as:

- Maximum P/E ratio. P/E ratios vary dramatically by industry, but many value investors like to see this number below 15 or 20.

- Maximum P/B ratio. A P/B ratio below 1 can indicate the company is undervalued, but this number should not be analyzed in isolation. A low P/B ratio could also result from a fundamental problem with the business.

- Minimum ROE. Return on equity (ROE) indicates how well the company produces returns from its net assets. This metric is also industry-dependent, with higher values indicating better performance.

- Minimum dividend yield. Dividends provide some certainty in returns. The minimum dividend yield an investor requires is a personal decision. Often, value investors will target a range of yields that is higher than the average market yield but not so high as to be unsustainable.

- Five-year EPS growth outlook. Value stocks that are expected to grow their earnings per share (EPS) are more likely to gain investors' attention and support.

- PEG ratio. The price-to-earnings-to-growth (PEG) ratio is calculated by dividing the stock's P/E ratio by its expected EPS growth rate. Near or less than 1 is a preferred value here.

Once you have a list of stocks that meet your value criteria, the real work begins. You then review each to estimate intrinsic value and compare those intrinsic values to current stock prices. You may have to repeat this process dozens of times before you find a stock that meets your desired margin of safety threshold.

Avoiding value traps

A value trap is a stock that looks cheap on the surface but is priced fairly, given the company's ability to create value. Here are two situations to watch for:

- Stocks in cyclical industries such as manufacturing and construction. These companies may see their earnings rise substantially during boom times and then fall dramatically when industry conditions cool off. When investors anticipate a possible bust for a stock, its valuation will look very inexpensive compared to recent earnings -- but less so once earnings fall during the weaker part of the business cycle.

- Stocks that rely on intellectual property can become value traps. Consider a drug company with a dominant, high-selling treatment that's patent-protected. When patent protections expire, the drug producer will see revenue and earnings dip unless there are promising replacements in the pipeline. The same can happen for a tech company that's the first mover in a new industry but lacks the ability to innovate further.

Value traps have weak growth outlooks in the short or intermediate term. To avoid them, include a review of EPS outlooks and PEG ratios in your analyses. These items address the company's future, while other valuation metrics, such as the standard P/E ratio, only measure the company's past performance.

Is value investing right for you?

If your primary investing goal is to keep your risk of permanent losses low while increasing your odds of generating positive returns, you may be a value investor at heart. Know that value investing requires resilience. The value-finding process eliminates far more stocks than it uncovers, and this can be frustrating, particularly during bull markets.

Many stocks you eliminate during your search will appreciate in bull markets, even though you found them too expensive at the start. The payback comes when the bull market ends. That's when your margin of safety protects you from the most extreme value losses. The dividend income you earn from value stocks also encourages you to stay invested through downturns, keeping you in contention for recovery gains.

By contrast, if you prefer trading the hottest companies in the market, you may be bored by value investing. Value stocks are not trendy. They may not even be interesting in terms of their business model.

Growth versus value investing

If value investing doesn't sound like a good fit, consider growth investing. Growth investing focuses more on a business's prospects for its revenue and net income to rise dramatically over time. The emphasis is on the fastest-growing companies in the market.

Growth investors care less about intrinsic value. Instead, they focus on the stock's growth prospects. Outsized growth potential can justify higher valuations, which is why growth stocks generally have high P/E and P/B ratios.

How did value investing get started?

The value investing strategy is the product of two Columbia University professors: Benjamin Graham and David Dodd. The pair sought to develop a framework for rational investing that emphasized research and value over market timing and price predictions.

Graham and Dodd began teaching their approach to Columbia University students in 1928. They refined their methodology over time, publishing the now-legendary book Security Analysis in 1934. Graham also published The Intelligent Investor in 1949.

Who are the two most famous value investors?

Graham is considered the father of value investing. The second-most famous value investor is one of his former students at Columbia University, billionaire investor Warren Buffett. In addition to studying under Graham, Buffett also worked at Graham's firm.

Buffett cut his teeth in value investing in his early 20s and used the strategy to deliver immense returns for Berkshire Hathaway (BRK.A -0.94%) (BRK.B -0.97%) investors. As CEO of Berkshire, Buffett has a decades-long record of outpacing the compound annual growth rate of the S&P 500.

Buffett's strategy has evolved over time. Instead of focusing only on undervalued assets, he prefers to invest in high-quality businesses at reasonable prices. In his words, it's "better to buy a wonderful business at a fair price than a fair business at a wonderful price."

Related investing topics

More informed and wealthier through value investing

Value investing requires patience. As economist John Maynard Keynes said, "The market can remain irrational longer than you can remain solvent." While you can occasionally get lucky on timing and realize gains quickly, this is the exception and not the norm -- particularly when investing in value stocks. Practically speaking, the investment community is usually slow to reprice stocks that have fallen out of favor.

Value investing is also time-intensive in the short term. But the effort has its rewards. Understanding and applying value investing concepts is an instructive process. You'll refine what qualities make a stock investable, and you'll have deep knowledge of the companies you choose to add to your portfolio. In short, you'll be a more informed investor -- which should make you wealthier, too.