Shares outstanding refers to the number of shares of common stock a company has issued to investors and company executives. The number is used to calculate many common financial metrics, such as earnings per share (EPS) and market capitalization.

The number of outstanding shares can be found on a company's most recent quarterly or annual filing with the Securities and Exchange Commission (SEC), usually on its balance sheet in the shareholders' equity section.

Understanding outstanding shares

Understanding outstanding shares

The number of shares outstanding for a company is equal to the number of shares issued minus the number of shares held in the company's treasury. If a company buys back its own stock, those repurchased shares are called treasury stock.

The number of shares outstanding can (and usually does) fluctuate over time. The number of shares outstanding increases if a company sells more shares to the public, splits its stock, or employees redeem stock options. The number of shares outstanding decreases if the company buys back shares or a reverse stock split is completed.

It's worth noting that a company's basic number of shares outstanding can differ from its fully diluted number of shares. The basic number is synonymous with the number of currently outstanding shares, while the fully diluted number accounts for the share equivalent of all warrants, capital notes, and convertible stock the company may have issued. The fully diluted number of shares indicates how many outstanding shares there could potentially be if all existing equity instruments were converted into common stock.

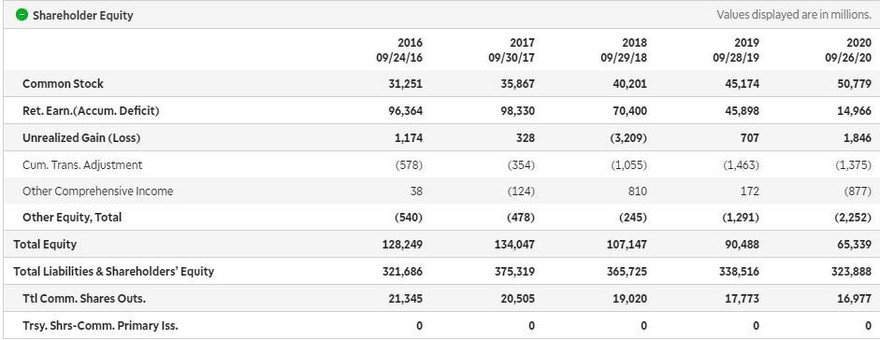

The image below shows a section of Apple's (AAPL -0.35%) balance sheet from 2016 through 2020. The second line from the bottom indicates the number of shares outstanding at the end of each fiscal year, and the bottom line indicates how many new shares were issued by Apple in that year. Total shares outstanding decreased from more than 21 billion in 2016 to less than 17 billion in 2020. The tech company spent billions buying back its stock during these years.

Why shares outstanding is useful

Why shares outstanding is useful

A company's number of shares outstanding is used to calculate many widely used financial metrics. Market capitalization -- share price times number of shares outstanding -- and EPS are both computed using a company's number of outstanding shares.

Recognizing that a company's number of shares outstanding can change is also useful. For example, the difference between the number of shares currently outstanding and the number of shares fully diluted is comparatively likely to be significant for fast-growing technology companies. These companies aggressively fund their growth by using convertible debt and paying employees with stock incentives. By contrast, many older stalwart companies are likely to have a number of shares outstanding that matches its number of shares fully diluted.

Outstanding vs. issued vs. float

Outstanding vs. issued vs. float

A company's number of shares outstanding is the number of shares investors and company executives currently own, while the number of issued shares is the number of shares that have ever been traded in the stock market. A company's number of issued shares includes any shares the company has bought back and now holds in its treasury. The term "float" refers to the number of shares available to be traded by the public and excludes any shares held by company executives or the company's treasury.