The thought has occurred to most people of a certain age: Why not keep working and collect Social Security early? I'll make a good income, right?

Wrong. Since 1937, recipients have been subject to a Social Security retirement earnings test that cuts benefits for people who make above a certain amount. Read on to learn more about this rule and how it might affect your retirement plans.

How Social Security works

How does Social Security work?

Social Security was established to combat an epidemic of poverty among older Americans during the depths of the Great Depression. According to the Social Security Administration, roughly two-thirds of older Americans who lived alone fell below the poverty line. The first recipient of Social Security was Ida May Fuller, a Vermont woman who received a $22.54 check in January 1940 (almost $499 in 2023 dollars after adjusting for inflation).

The program is funded by a payroll tax. Employers and workers each pay 6.2% of their wages to a taxable maximum of $160,200 (2023) and $168,600 (2024); self-employed workers pay 12.4%.

In 1940, there were 42 workers for every retired person. Because of longer life expectancies and a decline in the U.S. birth rate, the ratio is now three workers for every retired person, leading to calls for reforming the system to ensure that people who have paid taxes receive their benefits, which are determined by a complex formula that considers their lifetime earnings.

Although Social Security is an important element of retirement income for most Americans, it's never served as a major source of money for the elderly. The Center on Budget Policy and Priorities, a Washington, D.C.-based think tank, estimates that Social Security benefits only replaced about 37% of previous earnings for retired people in 2022.

What is the test?

What is the Social Security earnings test?

Almost one in every three Americans collecting Social Security has retired early. For many, it's a financial necessity. Either a layoff or medical condition has made it necessary to use the benefits to stay afloat. But not all Americans who retire early and collect Social Security have stopped working. As a result, many are subject to a Social Security earnings test that determines the amount of their monthly benefit. The Social Security earnings test is the amount you're allowed to earn from working when you claim early before part of your benefit will be withheld.

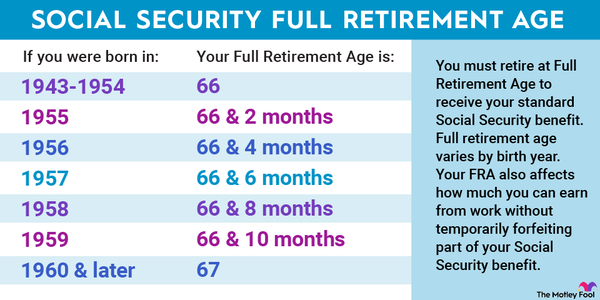

Americans can begin collecting Social Security when they turn 62. Benefits, however, are reduced until recipients reach full retirement age (FRA), currently set at 67 for people who were born in 1960 or later. Those benefits can be reduced even more if a recipient continues to work and earns enough to exceed a threshold set by the Social Security Administration.

Taxable Income

How the test works

How does the Social Security earnings test work?

For people who are under the FRA for an entire year, Social Security deducts $1 from benefits for every $2 earned above the annual limit, which is set at $21,240 in 2023 and $22,320 in 2024. The limit is increased in the year they reach full retirement age, but Social Security will still deduct $1 for every $3 earned above $56,520 in 2023 and $59,520 in 2024.

That's the bad news. Here's some good news:

When you reach full retirement age, you can earn any amount of money, and your benefits won't be reduced. In addition, Social Security will recalculate your benefit to give you credit for the months that your excess earnings caused benefits to be reduced or withheld.

Also, while Social Security includes bonuses, commissions, and vacation pay as part of your earnings, it doesn't count pensions, annuities, investment income, interest, veteran's benefits, or other government retirement benefits.

Here's an example: You decided to file for benefits when you turned 62 in January 2024 and have earned a monthly benefit of $600. But you're still going to be working a bit, and you think your earnings will come to $23,920. That's $2,680 above the current limit, so Social Security would withhold $1 of every $2 over that amount, or $1,340.

Social Security would withhold all benefit payments between January and March to account for the difference. Your $600 monthly benefit would begin in April, and you'd receive $460 of the withheld benefits the next year.

The retirement earnings test works slightly differently in the year that you reach full retirement age. Let's say you wouldn't turn 67 until Nov. 23, 2023, but you've earned $57,000 between January and October. You're still expecting $600 in monthly benefits.

The year you hit full retirement age, you're subject to the higher threshold of $56,520. Since the difference is $480 and Social Security withholds $1 of every $3 earned above the threshold, you'd be short $160. Social Security would hang onto the full amount of your January 2024 benefit check; your money wouldn't start arriving until February. The next year, you'd receive the remaining $440 that was withheld in January.

One more small hitch: If you retire -- and we mean, seriously retire -- late in the year, you may be able to avoid the retirement earnings test with a monthly income that doesn't exceed $1,770. For example, let's say you've made $200,000 between January and October, but you're retiring in November and will take a part-time job that pays $500 per month. Since your earnings are less than $1,770, you'll receive your full benefit amount (although it won't be as much as it would be if you'd waited until you turned 67 or even 70, the age at which the size of your benefits stops rising).

Supplementing Social Security

How to supplement Social Security

Hopefully, you won't have to rely totally on Social Security if and when you retire. As mentioned above, Social Security benefits account for roughly 37% of pre-retirement income. But as we also mentioned above, the government doesn't count quite a few sources of income in its calculations, including:

- Investment income: About 61% of U.S. adults hold stocks. Most of the money is held in mutual funds, index funds, or 401(k)s. Investment income is key to a successful and healthy retirement. The best time to start investing was yesterday; the next best time is today. Use our list of top-rated brokerages and consider adding a little to your account using a dollar-cost averaging approach. Historically, the S&P 500 has grown 10% annually, making a buy-and-hold strategy worth your time (and money).

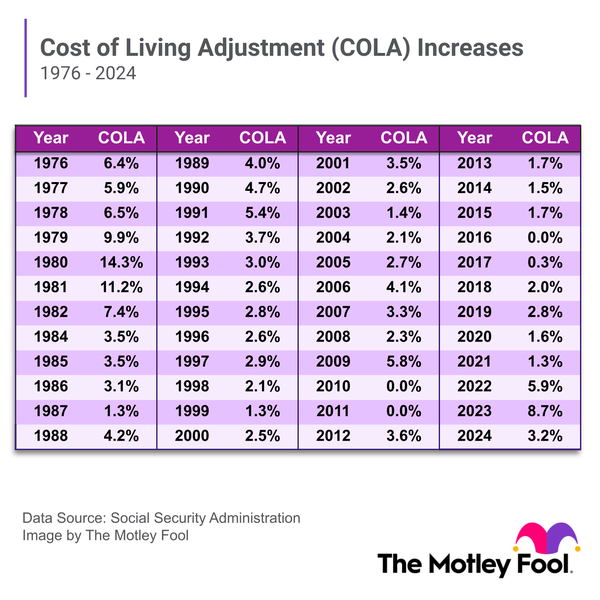

The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years. - Interest: Few Americans are happy about high inflation. Still, there's a silver lining when interest rates rise. True, a mortgage may cost more, but a high-yielding certificate of deposit (CD) or U.S. government-issued I Bond may suddenly become very attractive to people who have stopped collecting a paycheck.

- Retirement benefits: The days of a full, company-sponsored pension may be over, but that doesn't mean your employer can't help you with a bit of financial security after you retire. Many employers offer 401(k) matching amounts; a fairly common match is a 1-to-1 match for every dollar you put into a 401(k), with a limit of 3%. It may not sound like much, but it builds up over time, and one of our Foolish rules is this: Never turn down free money.

Related investing topics

The bottom line on the Social Security earnings test

It's well known that waiting as long as possible (at least to the age of 70) to begin collecting Social Security benefits will result in a larger monthly check. However, not all people nearing retirement are aware that continuing to work before reaching their full retirement age can cut into their benefits.

The bottom line? If you're thinking about starting to collect Social Security before your full retirement age, don't count on getting the full amount right away and plan your budget accordingly.

Social Security earnings test FAQs

What is the Social Security earnings test for 2023?

Social Security deducts $1 for every $2 earned above $21,240 until the year in which you reach full retirement age.

How much income can I make and still collect Social Security?

If you wait to collect Social Security until reaching full retirement age (67 for most Americans), there's no limit on earnings.

How can you determine what your Social Security earnings will be?

The quickest estimate comes from a Social Security calculator. For a more detailed view, you can create an account at its website that should have information about your lifetime earnings and projected benefits.