Most people have some idea of what Social Security is, but not as many understand the Social Security COLA history or how it affects benefits. Annual increases are designed to help seniors' checks keep up with inflation, although some argue they don't do nearly enough. Let’s take a look at how Social Security benefits have increased over time and why this matters to you.

Social Security COLA increases by year

Social Security COLA increases by year

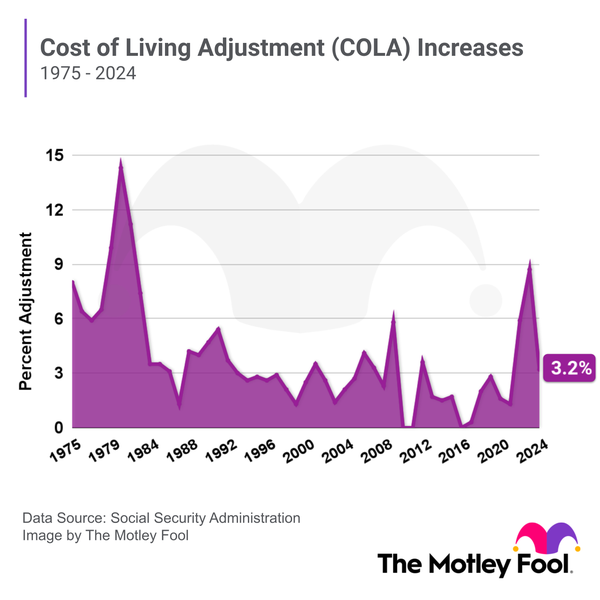

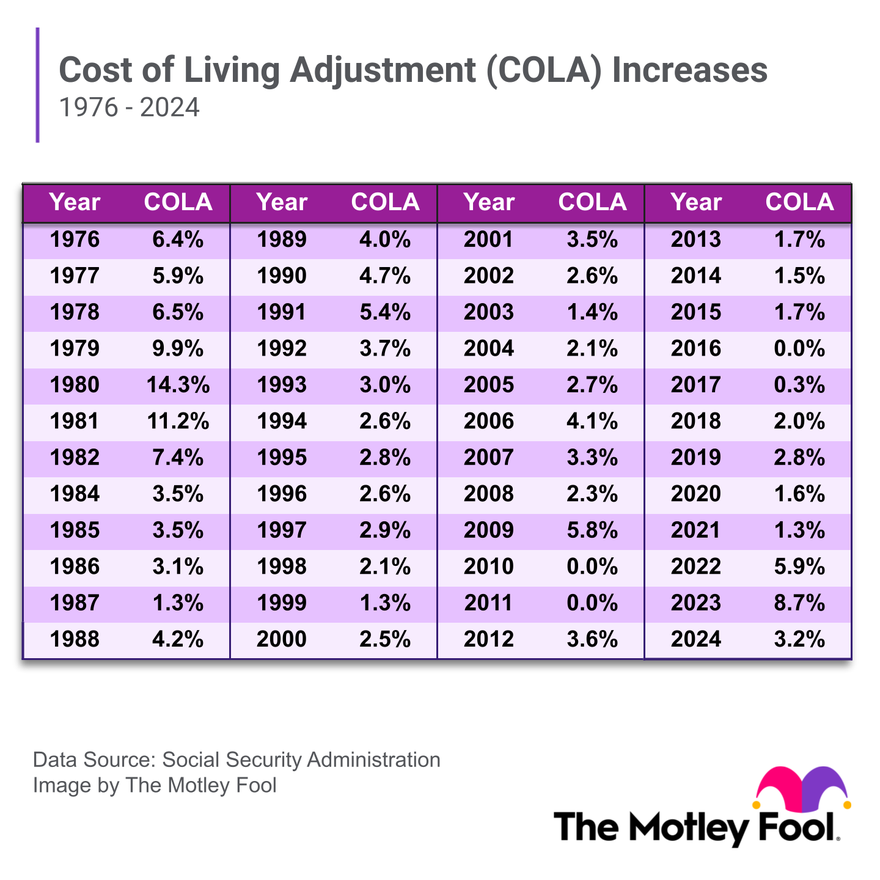

For many years, the federal government passed legislation as necessary to increase Social Security benefits and Supplemental Security Income (SSI). But beginning in 1975, it began setting cost-of-living adjustments (COLAs). The government has issued a COLA nearly every year since, and checks have risen accordingly. The following table shows the COLA for each year from 1976 to 2024.

The government applied the first few COLAs to benefits payable for June or later. But since 1982, COLAs have been effective for benefits payable for December, and they're paid out in January of the following year. For example, the 2023 COLA called for a 8.7% increase to Social Security checks, and beneficiaries began receiving this new, higher amount in January 2023. The COLAs apply to all Social Security beneficiaries, including those receiving spousal benefits. The 2024 COLA is substantially lower at 3.2%, which reflects cooling inflation.

COLAs for Supplemental Security Income (SSI) are generally the same as the COLAs for other Social Security benefits. However, they typically go into effect one month later. So the government first applies the COLA to benefits payable for January of the following year, and recipients get these checks in February.

The Social Security Administration announces the next COLA in October after it's had a chance to review the third-quarter inflation data used to calculate the COLA. In years with high inflation, such as 2022, COLAs are generally higher. When inflation is low, COLAs are also low. In rare cases -- only three times since 1975 -- the government may not issue a COLA at all.

Related Social Security Topics

Why Social Security COLAs are important

Why Social Security COLAs are important

Social Security COLAs are designed to help your benefits keep pace with inflation over time. Without COLAs, seniors and people receiving Social Security disability benefits would find it difficult to maintain their standard of living as expenses rise and monthly checks remain the same.

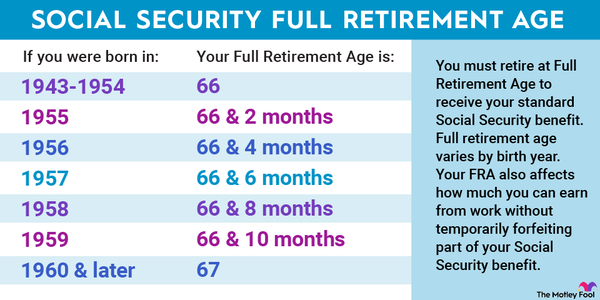

On a practical level, a COLA means more money for all beneficiaries. Everyone will see a slightly different increase to their checks since your COLA is first applied to your primary insurance amount (PIA). This is the amount you're entitled to if you wait until your full retirement age (FRA) to apply. Then the Social Security benefit formula determines whether to adjust your checks up or down based on your age at signup. In some cases, COLAs can add $100 or more to a monthly check.

Some argue that Social Security COLAs don't do their job as well as they should. The Senior Citizens League estimates that Social Security has lost about 40% of its buying power since 2000 despite the COLAs. The argument is that this is because COLAs are based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index tracks the cost of a basket of goods and services over time. But many people feel that it's not an accurate representation of the average senior's spending.

Those unhappy with the current system feel that the Consumer Price Index for the Elderly (CPI-E), which is based on the spending habits of adults 62 and older, would be a better base for Social Security COLAs. But so far, the government hasn't made any effort to change how it calculates the adjustments.

Part of the reason might be the funding crisis Social Security is facing. The program's trust funds are projected to be depleted in a little more than a decade, and if the government doesn't come up with additional sources of funding, it will have to cut benefits. Making a change like basing COLAs on the CPI-E instead of the CPI-W might result in larger benefits in the near future, but it could also speed the rate of trust fund depletion.

Because of this uncertainty around the future of Social Security, there's no way to know what Social Security COLAs might look like in a decade or two. They might be similar to what we experience today, or the government might decide to do something different. Meanwhile, workers and seniors will wait and watch.

The bottom line on Social Security COLAs

The bottom line on Social Security COLAs

Social Security COLAs can be a great help to seniors, disabled workers, and their families. But it's important to understand their limitations as well as their benefits. It's also worth noting that a high COLA isn't always a good thing. It's usually a sign of high inflation, which can put a strain on everyone's budget.

Even with COLAs, it's not likely that Social Security will cover all of your expenses, and your buying power could still decrease over time. So whenever possible, workers and seniors should do their best to reduce their reliance on the program. Save as much as possible on your own, and, if necessary, consider delaying retirement or working part time so you won't have to drain your retirement accounts as quickly.