It can take a lot of time and effort to compare credit cards these days. Not only are there hundreds of credit card options, but there are dozens of features to consider. Is it a rewards card? What's the interest rate? How much is the annual fee?

Simply looking up all these details can be a big job. But the process can be made a little easier thanks to the Schumer box. Home to everything from a card's APR to its transaction fees, the Schumer box is a credit card hunter's best friend.

What is a Schumer box?

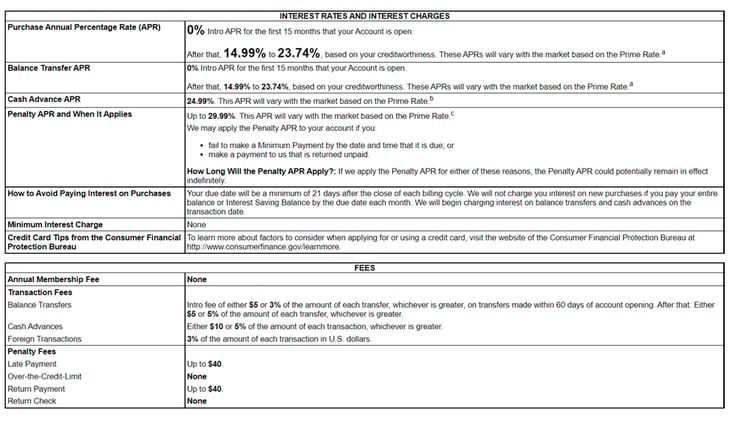

A Schumer box is a table that displays the rates and fees for a credit card. It lists important disclosures like the interest rates and fees, the annual fee, and any transaction fees.

The Schumer box is the result of regulations in the 1968 Truth in Lending Act. By law, a credit card issuer must clearly present a card's rates and fees in all promotions.

The idea is to make it easier for consumers to easily see a card's costs. Literally. The legislation requires disclosures to be both "clear and conspicuous." For example, instead of miniscule fine print, details need to be in a readable font size. Specifically, purchase APRs need to be in a 18-point type. Other key rates and fees should be 8-point or larger, and a 12-point type is suggested.

Every credit card offer you receive will have a Schumer box. It'll be in the envelope if you get an offer in the mail. And there will be a copy in that big packet of papers when you get a new credit card.

The law applies to digital card offers, too. The Schumer box will be linked to on any online credit card offers. This includes checkout offers and credit card landing pages. Most issuers will put the link right near the "Apply" button.

Exact wording on the link to the Schumer box varies, but some of the most common terms include:

- Rates and Fees

- Rates and Disclosures

- Pricing and Terms

- Terms and Conditions

Basically, look for any link that says anything about rates, terms, or pricing. The first thing you see on the new page will probably be the Schumer box.

Why is it called a Schumer box?

It's somewhat ironic that a table designed to add clarity to credit cards has such a confusing name. Rather than calling the table of rates and fees the "Rates and Fees Box," we get the "Schumer box." Why? Well, it comes down to politics.

The Schumer box is named after Sen. Chuck Schumer (who was a congressman at the time). He was the one who proposed the legislation to require clear display of rates and fees. As is typical in politics, the legislation was nicknamed after its advocate. And since finance loves its jargon, the name stuck. Today, the Schumer box is an industry standard.

How to read a Schumer box

At first glance, a Schumer box can be a lot to take in. There are a lot of numbers stacked on top of each other. But you can quickly make sense of it all if you look at it one section at a time.

Although it's referred to as a Schumer box, singular, it actually has two distinct tables. The first table displays the interest rates and charges. The second table is for the fees.

Image source: Author provided.

Interest rates and charges

Your credit card charges interest fees when you carry a balance beyond your due date. Those fees are based on your credit card APR (annual percentage rate).

Read more: How Does Credit Card Interest Work?

A typical credit card can have four or five different APRs. Each APR applies to a different type of transaction or situation:

- Purchase APR: This applies to regular purchases you make with your credit card and will be displayed in large, bold print. If the card has a 0% APR intro offer on purchases, the intro rate and term will also be displayed here.

- Balance transfer APR: This APR applies to any transferred balances. In many cases, it will be the same rate as the purchase rate. If the card has an intro APR for balance transfers, the rate and term will also be displayed here.

- Cash advance APR: This applies to any transaction flagged as a cash advance. This includes using your card to withdraw cash at an ATM. It also applies to cash equivalent transactions like purchasing a money order.

- Penalty APR: Some cards charge a penalty APR if you make a late payment. This APR will overwrite your purchase APR.

Below the various APRs will be a section on the grace period. (It will likely say "How to avoid paying interest" or similar.) If you pay your balance in full during the grace period, you won't be charged interest. The grace period is the time between the end of your statement period and the bill's due date.

Card and transaction fees

As important as interest rates can be, this section is arguably more important to most people. It will list all of the important fees you are likely to face using your card:

- Annual membership fee: This is charged every year to keep your account open. There will always be a line for the annual fee. If your card has no annual fee, it will clearly state "$0" or "None."

- Application or maintenance fees: Some cards charge one-time fees to open an account. Others will charge additional annual or monthly fees. This is most common with credit cards for bad credit.

- Transaction fees: This section lists any extra fees for specific transactions. For example, balance transfers usually have a balance transfer fee. The cash advance fee and foreign transaction fee will also be listed.

- Penalty fees: Most cards charge a late payment fee. You may also be charged a penalty fee for going over your limit. Returned payments or checks may also have an additional fee.

What's not in a Schumer box

Schumer boxes are specifically designed to display interest rate and fee information. They won't contain anything about other card features. So you won't see:

- Purchase rewards rates

- Sign-up bonus offers

- Card benefits

These details are usually listed in a separate document. It will likely be linked with the phrase "offer terms" or simply "additional information."

Reading up on a card's rates and fees in its Schumer box is a great way to get more informed -- and to be prepared for possible charges. And once you're familiar with the format, it's a great tool to get to know the ins and outs of your existing card, or to compare other credit cards you're considering.

Don't you wish you could take a peek inside a credit card expert's wallet sometimes? Just to see the cards they carry? Well, you can't look in anybody's wallet, but you can check out our experts' favorite credit cards. Get started here:

FAQs

-

A Schumer box is a table that lists a credit card's interest rates and card fees. Credit card companies are required to provide you with this information.

-

A Schumer box contains all of a credit card's APRs, as well as important fees. This can include:

- Purchase APR

- Balance transfer APR

- Cash advance APR

- Penalty APR

- Annual fee

- Balance transfer fee

- Cash advance fee

- Foreign transaction fee

- Late payment fee

- Over the limit fee

-

A Schumer box is made up of two tables:

- The first table displays the interest rates for different transactions.

- The second table lists the credit card's fees.

If you're looking for an interest rate or APR, go to the first table:

- The first rate should be the purchase APR.

- Below this may be APRs for balance transfers and cash advances.

- Penalty APRs will also be listed.

- If there is an introductory APR, it will be listed here.

If you're wondering about a specific fee, go to the second table:

- The annual fee is usually listed in the top row.

- Application, program, or maintenance fees should also be listed here.

- Transaction fees and penalty fees each have their own sections as well.

Our Credit Cards Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.