The Merriam-Webster dictionary defines intangible as something that is "not capable of being touched or not having physical substance." Intangible assets are just that; assets that have value but no physical substance.

For instance, one of any company’s most valuable assets is name recognition, yet you can’t touch it or see it. In this article, we’ll explain what intangible assets are, how to properly value them, and how to reduce their value over their useful life by using amortization.

Overview: What are intangible assets?

Basic accounting principles tell us that assets are anything of value that you own. Unlike tangible assets such as a building, inventory, or equipment, intangible assets do not include anything that you can touch. Intangible assets can also increase the value of tangible assets.

For instance, a Fortune 500 company may have a warehouse full of inventory, which is a tangible asset, but the name recognition that the company holds, which is an intangible asset, increases the value of that inventory.

In most cases, intangible assets are considered long-term assets because they provide long-term value to a company and cannot be quickly converted to cash.

Intangible assets include intellectual property, such as copyrights and patents, and goodwill, which includes the company's reputation and brand recognition. If you’re still a bit confused about what an intangible asset is, check out the following intangible assets examples:

- Patents

- Intellectual property

- Franchises

- Domain names

- Copyrights

- Trademarks

- Non-competition agreements

- Customer lists

- Licensing agreements

- Goodwill

Anything your company develops that holds value, such as a specific design that your company created or a software program that was developed, are also considered intangible assets. All intangible assets are recorded on your company’s balance sheet.

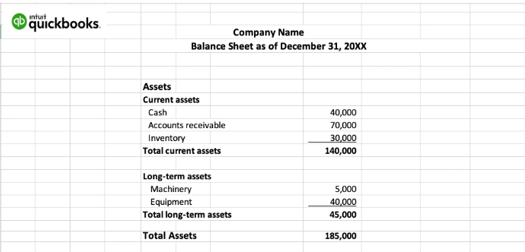

This QuickBooks balance sheet displays long-term assets, which is where most intangible assets would be found. Image source: Author

How do you value an intangible asset?

Placing value on an intangible asset can be tricky, but there are typically three approaches to doing so:

- Cost approach: The cost approach is used by estimating the amount of money that would be required to replace the asset.

- Market approach: The market approach is frequently used by comparing the intangible asset owned to those owned and recently sold by similar businesses. For example, Company A and Company B both sell similar products. Company A recently sold a patent to Company C, so Company B can use the value of the copyright sold to value any similar copyright that it holds.

- Income approach: The income approach converts any expected monetary benefits that will be derived from the intangible asset to a set amount that can be recorded on the balance sheet.

If you purchase an intangible asset from another company, the asset’s recorded value will be the cost of the purchase. It’s important that you record the asset properly before you calculate and record the amortization expense for any intangible asset.

As an example, let's say your company purchases a patent from ABC Design. The total purchase price was $25,000. Using double-entry accounting, your journal entry to record this purchase would be:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 2/28/2020 | Patents | $25,000 | |

| 2/28/2020 | Cash Account | $25,000 |

If an intangible asset such as software is developed in-house, then you would record the cost of developing the software as an intangible asset.

Keep in mind that many intangible assets are never reported on a company balance sheet since current accounting standards do not recognize them unless a transaction such as a purchase, cost of registration, legal fees, or the costs associated with the in-house development of a product can support their value.

How to record the amortization of an intangible asset

Both amortization and depreciation are important accounting terms that you need to understand. While depreciation is the expensing of a fixed asset over its useful life, amortization is the practice of reducing the value of an intangible asset over a set period of time, based on the determined useful life of the asset.

Unlike depreciation, which can use a variety of methods to expense fixed assets, amortization usually uses the straight-line method, which spreads the cost of the intangible asset out over the period of its useful life in equal installments.

There are two types of intangible assets:

Limited-life intangible assets: Patents and copyrights are considered limited-life intangible assets because they have an expiration date. Limited-life assets are amortized over the period of their life. For instance, if the patent mentioned above that was purchased for $25,000 has a useful life of 10 years, the annual amortization would be in the amount of $2,500, or $208.33 per month. If you record amortization monthly, your journal entry would look like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 2/28/2020 | Amortization Expense -- Patents | $208.33 | |

| 2/28/2020 | Patents | $208.33 |

Unlimited life intangible assets: Goodwill is an example of an unlimited-life intangible asset as it does not expire. While unlimited-life intangible assets are not required to be amortized, they do require an annual impairment test, which looks at things such as changes in the market, economic factors, change in consumer demand, or any damage that may impact the current stated value of the asset.

If you’re calculating operating cash flow, be sure to add back your amortization expense, since like depreciation, it’s recorded as an expense on your income statement, but you did not reduce your cash account by actually paying the expense.

FAQs

-

Yes, they are. Intangible assets are assets you cannot touch or that have no physical presence. Goodwill, customer lists, government licenses, and non-competition agreements are also intangible assets.

-

Yes. Intangible assets are recorded on a balance sheet, with most recorded as long-term assets, which is an asset that cannot be converted to cash quickly.

-

Amortization charges the cost or value of an asset to an expense account. Amortization expense is recorded throughout the life or useful period of the asset. Amortization is only used for intangible assets that have a limited life, such as a copyright that expires in 10 years. In this case, the copyright value would be amortized over a 10-year time frame. Not all intangible assets should be amortized; for instance, goodwill and brand recognition do not have expiration dates and should not be amortized.

-

No. For example, accounts receivable is considered an intangible asset since it does not have a physical presence, but is still classified as a current asset, since it can be quickly converted into cash.

Some final thoughts on intangible assets

Intangible assets are an important part of any business and need to be handled properly. While intangible assets don’t have any direct impact on financial projections or closing entries, they do figure into your cash flow totals.

The best way to track and manage intangible assets is by using accounting software. If you’re in the market for an application that can easily track assets and record amortization, be sure to check out our accounting software reviews.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.