The expenses on your income statement can be divided into two groups: period and product.

Bringing an understanding of period and product costs to a value chain or break-even analysis helps you quickly identify what types of expenses are hampering your business’s profitability.

While both cost types are important, we’ll focus on period costs here. Business owners who do their small business bookkeeping need to know period cost accounting in order to write off their business expenses correctly.

Overview: What are period costs?

Since period costs are a broad category, they’re better explained by what they aren’t.

Period costs are everything except:

- Cost of goods sold and inventory costs (which are product costs)

- Prepaid expenses

- Large, one-time purchases categorized as fixed assets

Your business’s recurring expenses, aside from inventories and production expenses, are periodic. That’s not a golden rule, but a good starting point.

Operating expenses, like selling and administrative expenses, make up the bulk of your period costs. Loan interest payments and depreciation are also periodic expenses.

Period costs can be found in the expense section of the income statement.

There’s no period cost formula because the included accounts differ from business to business. However, we’ll cover the most common period costs and how to calculate them.

Period costs vs. product costs: What's the difference?

Whereas period costs cover the selling and administrative side of your business, product costs are expenses closely associated with inventory and production. Product costs are often called inventory costs.

Product costs have a narrower definition and comprise three expenses: direct labor, direct material, and manufacturing overhead.

- Direct labor costs are the wages you pay workers who create your product. Anyone who touches the product in the manufacturing process generally has his or her wages counted. For example, direct labor counts the wages of a person who cuts the leather and attaches it to the rubber sole. The janitor who maintains your manufacturing facility isn’t included. Most service businesses count only direct labor in their product costs. A web developer’s wage for building a client’s website is a product cost because a website is considered a product.

- Direct materials are the goods you buy to create a product. If your company makes men’s dress shoes, your direct materials are shoelaces, rubber, and leather. Businesses that resell products -- called merchandising businesses -- include only direct material in their product costs.

- Manufacturing overhead is the catchall category for costs that aren’t materials or direct labor but are still inextricably tied to the manufacturing process. Think of the rent and utilities for your production facility as well as repairs to your factory equipment. The janitor’s wages count here. Manufacturing overhead can be calculated in many ways and includes fixed and variable cost components. It’s a laborious process, but it’s also one of your manufacturing business’s most critical calculations because of its implications for product prices and cost of goods sold. When an item is sold, your company records the product cost as cost of goods sold on the income statement.

Types of period costs

Period costs take up most of the space on the expense section of your income statement. Let’s explore the most common period costs.

1. Selling

Commissions for salespeople and marketing expenses are the main selling expenses.

While these expenses are logically linked to products, they are still period costs because they can be separated from the inventory purchasing and production process.

2. Administrative

Administrative costs house most of your non-production expenses.

Common administrative expenses include rent and utilities on your office space, but not on your production facility. You also include wages of employees not involved in the production process and their payroll taxes.

Professional service fees, such as your lawyer and CPA fees, are administrative expenses.

3. Depreciation

Fixed assets cannot be expensed all at once when you purchase them. Instead, you depreciate them over their useful life, expensing a portion of your purchase each year. Your depreciation expense counts as a period expense.

4. Loan interest payments

When your business takes a loan, it makes regular payments of principal and interest. Interest is considered a business expense and a period cost.

5. Income tax

Your business income tax is a period cost, even if your business is a pass-through entity that pays tax through your personal tax filings.

How to calculate period costs

The word “period” refers to a timeframe. It follows logically that period costs are expensed in the same timeframe -- or period -- they’re incurred.

In contrast, product costs are expensed as products are sold, not when the business purchases them.

For example, your rent payment on August 1 goes down as rent expense in your books on the same day. You can’t write off your inventory purchase until the item is sold.

The best way to calculate total period costs is to use your income statement as a checklist. Print out your income statement from your accounting software and add a small column to the right. Ask yourself whether each cost incurred is a period cost, and place a checkmark next to each one.

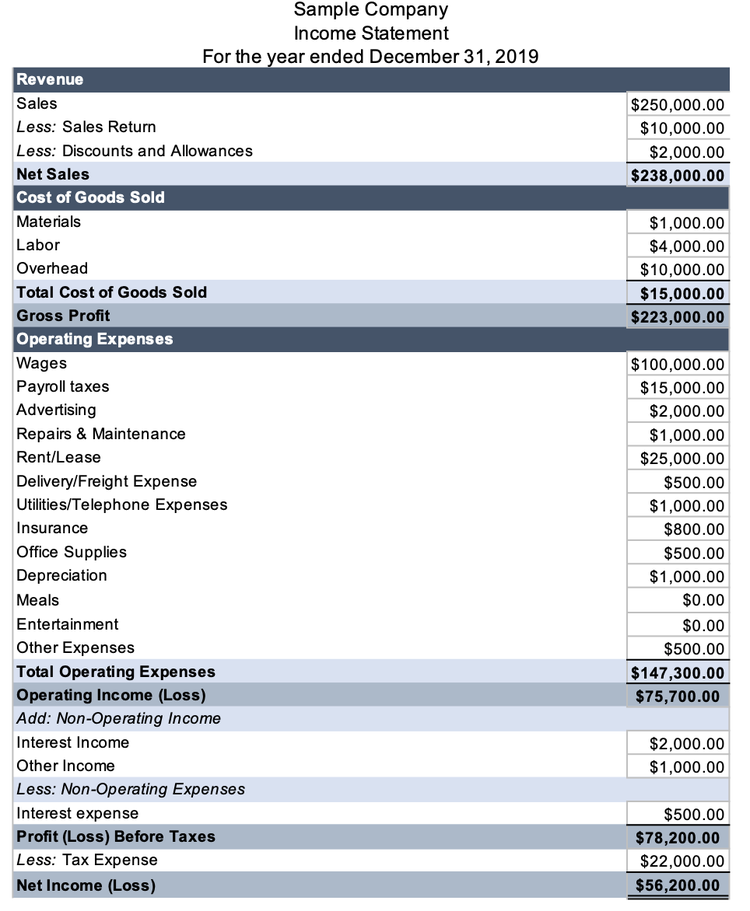

Consider this company’s traditional income statement from 2019.

Go to your company’s income statement to calculate period costs. Image source: Author

The first expenses listed on a multi-step income statement are cost of goods sold, which is a product cost. They are excluded from the period cost calculation.

All operating expenses listed here are period costs. Note that this income statement has more detailed expense accounts than “selling” and “administrative.” Every business’s income statement looks slightly different, so don’t worry about specific terms when determining period costs.

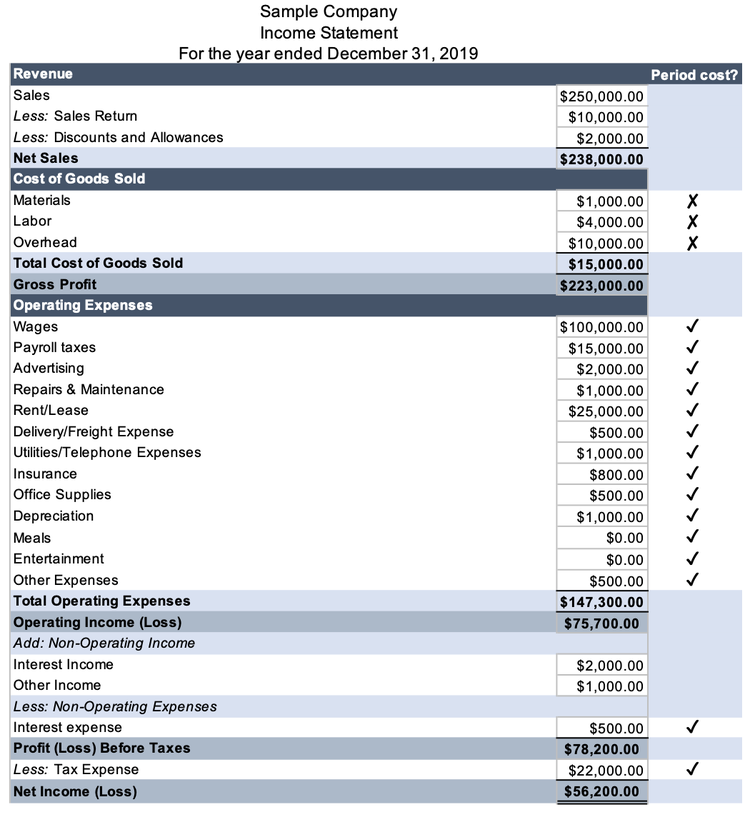

Interest expense on debt and income tax are also period costs. Add checkmarks to these accounts.

To calculate period expenses, place a checkmark next to each qualifying account. Image source: Author

The company’s period costs are $169,800 ($147,300 operating expenses + $500 interest expense + $22,000 tax expense).

Know your period costs

An understanding of period costs helps you analyze your financial statements.

When you differentiate period costs from others, you’re breaking down your expenses to provide insights about where your money is going. From there, you can make decisions that will make your business more profitable.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.