Is hourly or salary better?

Seems like a simple enough question, but it’s a tricky one to answer.

Whether you can retain skilled employees and attract top talents hinges, in part, on how your company structures the employee compensation plan. Pay only for hours worked and you might turn off top candidates. Pay everyone a guaranteed monthly salary and you may be jeopardizing your company’s financial health, which is detrimental to employee job security in the long run.

In this guide, we’ll discuss the difference between hourly and salary pay and the factors to consider when deciding how to pay an employee.

What is salaried pay?

A salaried employee is paid a fixed amount for services rendered. They earn a regular paycheck. Some receive a biweekly pay, while others get paid monthly.

An employee who’s paid a salary can be classified as an exempt employee (more on this later), provided they meet certain criteria. Exempt employees receive no overtime pay and may sometimes have to work more than 40 hours a week, such as during the busy tax season in the case of accounting professionals.

There are certain benefits to paying your employees a salary. People look at salaried positions as long-term career options with higher chances for growth. Monthly salaries are seen as a stable source of income, which is one of the main reasons employees stick around longer.

What is hourly pay?

Hourly pay, as the name implies, is for employees who are paid by the hour. How much they earn depends on the number of hours worked within a particular pay period, which is generally the previous week. For example, an interior designer who puts in 10 hours of work on a job will be paid their hourly rate multiplied by 10, while a part-time data encoder who works four hours each day from Monday to Friday will be paid their hourly rate times 20 hours.

Factors affecting hourly rate levels are varied and include the nature of the work, work conditions, the employee’s experience, and education or training. A minimum wage rate is also followed per state.

Although hourly employees often earn less than their salaried peers, they can get paid overtime, which is 1.5 times their hourly rate for every hour in excess of the standard 40 hours per week. Meaning, if they work a lot of overtime, they can earn more than the salaried employees who are not entitled to overtime pay.

Salary vs. hourly pay: What’s the difference?

Between salaried and hourly employees, the latter have more control over their schedules. As such, if their schedule allows, they can work on other jobs or projects. Most hourly employees are non-exempt, meaning under the Fair Labor Standards Act (FLSA), employers are required to pay them a minimum wage plus overtime.

However, there are also exempt hourly employees, such as truck drivers, movie theater employees, and agricultural workers. Be sure to review applicable federal and state laws to be on the safe side.

Salaried employees are paid a fixed amount per year or per week. They are also likely to receive benefits such as paid sick and vacation days, and as they move up the career ladder, they typically become eligible for more and better benefits. Some salaried employees are non-exempt, e.g., certain secretaries or nurses, which means that if they work in excess of 40 hours per week, they will be compensated for overtime.

Most salaried employees, usually those in managerial or administrative positions, are exempt employees, which means they are exempt from the protection afforded by the FLSA to non-exempt employees. As we’ve already mentioned, they don’t receive compensation for overtime and holiday work. In other words, they get paid for getting the job done, not for the number of hours worked.

You might be thinking, "I should just pay everyone a salary and classify them all as exempt since they work 40 hours per week minimum anyway. This way, I don’t have to worry about overtime pay or tabulating each employee’s total hours at the end of the week." Unfortunately, this is not a decision you can arbitrarily make.

There are rules to follow when classifying employees as exempt. The requirements may change from state to state, but example instances are:

- If their job description falls under the following categories: administrative, executive, professional, external sales, or computer

- If they manage at least two employees and can hire or fire those same employees

- If they can make independent decisions and then implement those decisions

- If more than 50% of their time is devoted to business operations or management

Exempt employees under the administrative, executive, and professional exemptions -- also called the white collar exemptions -- are guaranteed a minimum annual pay of $35,568, an amount equivalent to no less than $684 per week. Also, the state of California mandates that exempt employees be paid at least twice the minimum wage based on a workweek of 40 hours.

Now, what happens if you misclassify a non-exempt employee as exempt? The penalties can be costly, whether the misclassification was made knowingly or unknowingly:

- Payment of back pay for unpaid overtime

- Liquidated damages

- Payment of back taxes and their associated fines and interests

- Attorney’s fees, if applicable

- Other penalties, such as meal or rest break penalties

Consult with your HR counsel to ensure each of your employees is classified accordingly.

How to choose between salary vs hourly pay for your business

For many people, employee compensation is a major consideration when job hunting. Hourly and salaried positions both have advantages and disadvantages, the most pressing of which is how they get paid.

So what factors should you consider when determining whether to pay your employees an hourly wage vs salary?

Skill profile

Certain skills are only needed on a one-time or part-time basis, and paying by the hour may be the best option. You may need to employ consultants and some blue-collar workers temporarily, so an hourly wage instead of a monthly salary makes sense.

Importance

Consider how critical an employee’s role is to the business. Will the business function as usual if the role is suddenly vacated? If not, a salary just might be the incentive your employee is looking for. Many employees equate a salaried position to job security, plus a chance to grow their career. A salaried employee, since they usually receive more and better benefits, is more likely to stay in a company than their hourly counterpart.

Supply and demand

Similar to when prices of commodities skyrocket in response to inadequate supply, wages are subject to the mechanics of supply and demand. Experts and skilled employees can be hard to find, and some are unable to render 40-hour workweeks.

This is when you draft a proposal that’s agreeable to both you and the candidate. To find the best rate for a specific job and the baseline for monthly or hourly pay, look at print and online job ads or find resources at professional associations.

The best payroll software for managing both salaried and hourly employees

Now that you’ve determined the best way to pay your employees, it’s time to make sure they get paid right and on time. The right payroll software system can help you do just that. But with so many options in the market, how do you know which one best fits your needs?

Here are some of the best payroll software systems The Ascent has extensively reviewed for your consideration:

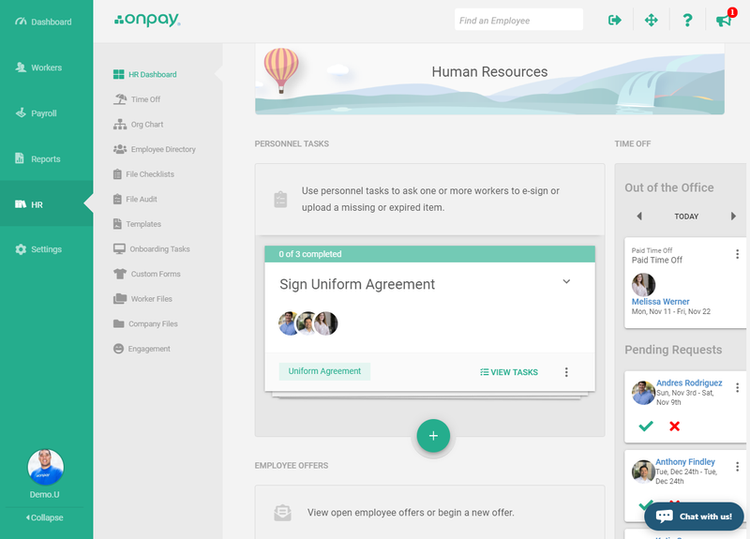

1. OnPay

OnPay is a full-service payroll system designed for small businesses. For one monthly price, you get features such as:

- Unlimited monthly pay runs

- Payments and tax filings

- Account setup and data migration

- Time-tracking and accounting integrations

- Payments via debit card, check, or direct deposit

- Automatic W-2 and 1099 filings

- 40+ payroll reports

- HR portal

OnPay comes with a built-in HR suite at no additional cost. Image source: Author

The system also allows you to pay both contractors and employees. Plus, it’s available in all 50 states. You can use OnPay for free for one month. After that, you pay a base fee of $36 per month, plus another $4 per month per employee or contractor.

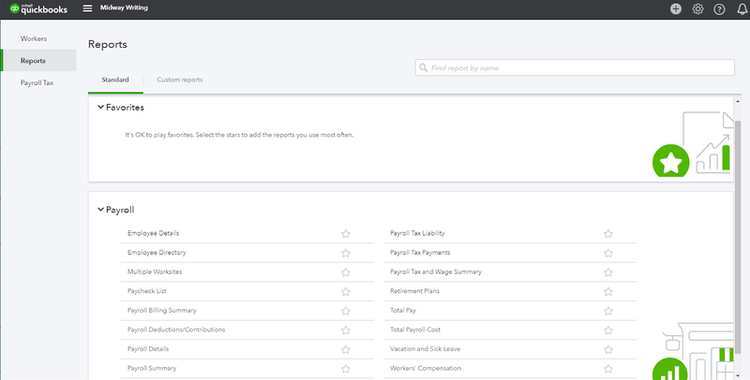

2. QuickBooks Online Payroll

When it comes to accounting software, QuickBooks is a name that’s hard to beat. Also created for small businesses, Intuit’s QuickBooks Online Payroll is an affordable full-service payroll platform that includes essential features such as:

- Automatic tax calculations on each paycheck

- Automated tax filings, including year-end filings

- Unlimited payroll runs

- Workforce portal where employees can view paid time off (PTO) balances and access pay stubs

- Downloadable payroll reports

- Time-tracking on the go

QuickBooks Payroll carries different types of payroll reports you can use right out of the box. Image source: Author

To see if it’s the right payroll system for you, QuickBooks Online Payroll offers a free 30-day trial. Subscription starts at $22.50 per month (a 50% discount as of this writing), plus another $4 per employee per month.

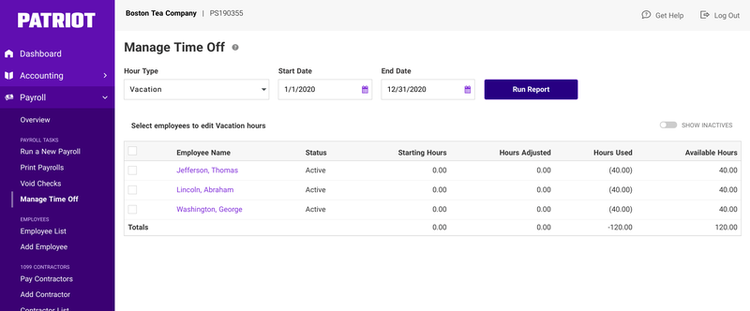

3. Patriot Payroll

Patriot Payroll is the payroll solution ideal for growing businesses. It provides two payroll packages: Basic and Full-Service. Basic is priced at $10 per month, plus another $4 per month for each employee or contractor. Features include:

- Free setup and support

- Customizable deductions and contributions for your health insurance, 401(k), garnishments, etc.

- Printable W-2s

- Automated PTO accruals

- Multiple pay rates

- Multiple locations

- Free employee portal, workers’ comp integration, and direct deposit

With Patriot, you can automate PTO accruals and add accrued time-off hours to each employee’s payroll. Image source: Author

If you need payroll taxes filed and deposited for you, too, go for the Full-Service package. It’s priced at $30 per month, plus another $4 per month per contractor or employee. Both the Basic and Full-Service options offer free 30-day trials.

Devise a winning pay scheme and keep employees happy

Every business has unique needs, and both hourly and salary payment options have pros and cons. Figure out what makes sense for your business. Know the applicable wage and hour laws in your city and state, and consult with a qualified professional when in doubt.

Then, choose a good payroll software system that lets you decide how salaries are paid (via check or direct deposit, for example), integrates with essential accounting and HR apps, and provides setup and data migration assistance should you ask for it.

And if you need to learn exactly how the employee payroll process works so you know what you’re getting into, here’s a quick guide on how to run payroll by The Ascent’s resident accounting expert.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.