Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Alcoa (AA +0.00%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Alcoa's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Alcoa's key statistics:

AA Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

12.3% |

Fail |

|

Improving profit margin |

194.1% |

Pass |

|

Free cash flow growth > Net income growth |

(57.9%) vs. 205.3% |

Fail |

|

Improving EPS |

188.5% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

(22.4%) vs. 188.5% |

Pass |

Source: YCharts.

*Period begins at end of Q3 2010.

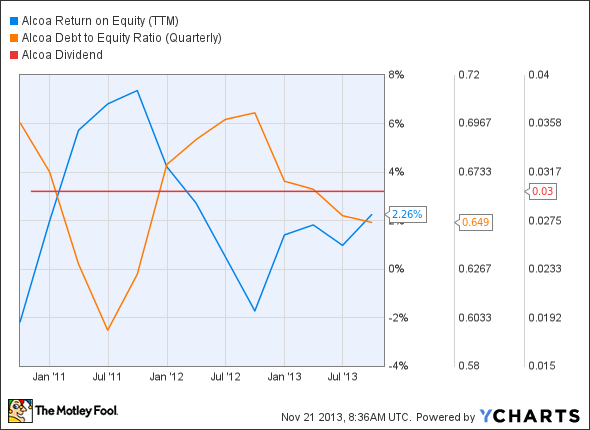

AA Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

203.2% |

Pass |

|

Declining debt to equity |

(6.9%) |

Pass |

|

Dividend growth > 25% |

0% |

Fail |

|

Free cash flow payout ratio < 50% |

55.9% |

Fail |

Source: YCharts.

*Period begins at end of Q3 2010.

How we got here and where we're going

We first looked at Alcoa last year, and it has lost one passing grade in its second assessment, falling to a middle-of-the-pack score of five out of nine passing grades. The primary difference this year is that Alcoa's free cash flow levels have fallen from where they were three years ago -- however, on a nominal basis, Alcoa's free cash flow is roughly one and a half times as large as its net income, which had the benefit of growing from a negative starting point. Can this former Dow component regain its luster? Let's dig a little deeper to find out.

Aluminum producers have been involved in a protracted battle against increased production costs, excessive supply and weakening demand in, but new guidelines set out by the London Metal Exchange, or LME, will put renewed pressure on metal prices. Fool contributor Rich Duprey points out that the LME now plans to operate a global network of warehouses, which will help it cut delivery times in half, forcing metal producers to ship aluminum more frequently. Threats of further downward pressure on metal prices have already caused miners to sell off producing assets: Vale (VALE +0.57%) recently divested its 22% stake in aluminum producer Norsk Hydro for $1.8 billion, while Rio Tinto (RIO +1.52%) sold off its interests in aluminum products manufacturer Constellium for $330 million. This doesn't augur well for dedicated producers like Alcoa.

Fool contributor Matthew Frankel notes that the aluminum producers have been focusing on their core operations to sustain long-term profitability; Alcoa's Chinese counterpart, Chinalco, recently ended work on a $1.6 billion aluminum smelter project in Malaysia. On the other hand, the Chinese government has been encouraging domestic aluminum producers to expand into overseas markets, which could pose substantial threats to Alcoa and its peers. According to Bloomberg, global aluminum consumption should grow at an annual rate of 6% over the next several years, but aluminum production may decrease by 3.2 million tons next year. Fool contributor Rich Duprey notes that Rusal, Alcoa and Chinalco have all announced cutbacks in production, a necessary step toward restoring pricing power to an oversupplied industry -- these moves are expected to boost aluminum prices by approximately 13% through next year.

Several aluminum producers have been tapping new opportunities in the housing industry, which has enjoyed a modest rebound over the past few quarters. Alcoa seems poised to benefit from the installation of new window products, estimated to be a $58 billion opportunity. The company's also hoping to supply materials for Airbus' A330-300 aircraft, which requires advanced alloys, in addition to an existing joint venture with VSMPO-AVISMA to supply aluminum and titanium products to aircraft makers around the world. Fool contributor Reuben Brewer notes that rival plane maker Boeing recently extended its aluminum recycling partnership with Alcoa, which is expected to recycle 8 million pounds of aluminum per year.

Putting the pieces together

Today, Alcoa has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.