Warren Buffett and President Barack Obama.

Think you've heard everything about Fannie Mae (FNMA 12.27%) and Freddie Mac (FMCC 12.73%)? Wait until you here why Warren Buffett unloaded the Berkshire Hathaway (NYSE: BRK-A)(NYSE: BRK-B) stake that was once worth nearly $4 billion.

The continual push

In recent years many big name investors -- including Bruce Berkowitz, Carl Icahn, and Bill Ackman -- with billions at their disposal have weighed in on what they believe the government should do with Fannie Mae and Freddie Mac. After all, the companies still sit in limbo as they are controlled by the Federal Housing Finance Agency and return every dime they earn back to the Treasury.

But this isn't a secret. The first sentence of the annual report of Fannie Mae reads:

We have been under conservatorship, with the Federal Housing Finance Agency ("FHFA") acting as conservator, since September 6, 2008. As conservator, FHFA succeeded to all rights, titles, powers and privileges of the company, and of any shareholder, officer or director of the company with respect to the company and its assets.

Yet many are still willing to fight for it and suggest change is coming and the best days are ahead for the two government sponsored entities.

The massive position

With all that in mind, it's natural to wonder what Buffett thinks. And while he's given us the answer for how he feels about Fannie and Freddie currently, as shown in the video below, Buffett has also discussed why he unloaded his stake in Freddie Mac nearly 15 years ago.

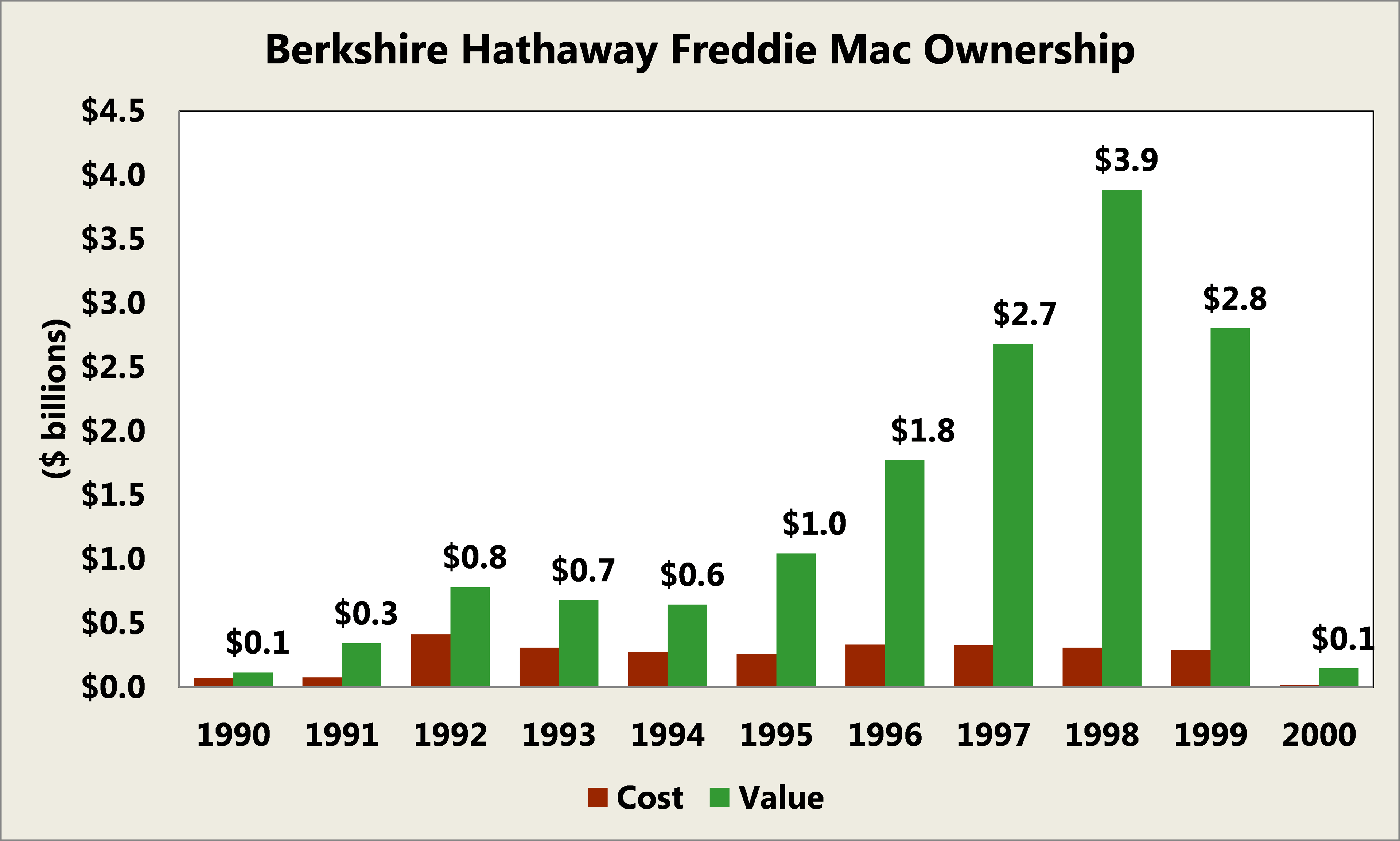

At one point he owned nearly 9% of it, and by 1998, his position had climbed to have a market value of $3.9 billion, representing a return of almost 1200%:

Source: Company investor relations.

But as you can see, that position came to abrupt end, as he noted bluntly in his letter, "in 2000, we sold nearly all of our Freddie Mac and Fannie Mae shares."

So why did he do it? Freddie Mac became too focused on quarterly results, took on too much risk, and more. When he saw these things he noted, "I figure if you see just one cockroach, there's probably a lot."

The lesson learned here extends well beyond Fannie and Freddie, revealing investors must always be aware of those things both great and small at the companies they invest in, as a small sign of trouble can be just the tip of the iceberg.

Yet as it relates to Fannie and Freddie, Buffett notes they were trying to serve the mandates of Congress and the demands of Wall Street, and "that's a tough balancing act." Undeniably that balancing act has ended and now leans exclusive to the side of the government.