Warren Buffett at Berkshire Hathaway has once again provided a unique and critical insight into what he believes is best for government-sponsored mortgage enterprises Fannie Mae (FNMA +1.30%) and Freddie Mac (FMCC 0.48%).

At the latest Berkshire Hathaway annual meeting, Buffett and longtime business partner Charlie Munger continued their tradition of conducting a question and answer session lasting more than six hours. While the two weighed in on countless issues, one of the most fascinating (and longest) discussions resulted from this question:

Do you think we need housing reform? How do you think we should do it, and should Berkshire be involved?

Although Fannie and Freddie weren't going to show up among Berkshire's investments, this question came less than one month after many -- including myself -- speculated whether the holding company would seek to be involved in the mortgage insurance industry through its massive insurance arm.

Buffett took a fascinating stance on the subject, and began by noting:

I think the 30-year fixed-rate mortgage is a terrific boon for homeowners, but it's not a great instrument to own as an investor. It's done a lot for homeownership in the country. Let people get into homes earlier, kept costs down -- the government guarantee keeps the cost down.

As my Fool colleague David Hanson noted, Munger was even blunter, suggesting the Fannie and Freddie "experiment was a total failure."

Munger added:

When private industry was running it, they owned the whole field and you had the biggest bunch of thieves and idiots running things, so I'm not all that trusting of private industry in this field. At the moment, Fannie and Freddie are being pretty conservative, and they're making pretty much all the home loans. I think that's OK.

In all of this we can see one key takeaway in the stance of Buffett and Munger surrounding Fannie and Freddie.

Source: Flickr / Future Atlas.

The critical insight

Buffett and Munger noted that one reason Fannie and Freddie collapsed was the reality that they were private enterprises seeking to deliver profits, and as Buffett said, "to serve their masters and deliver double-digit earnings gains."

Buffett and Munger seemed to suggest that instead of serving shareholders by delivering returns, the two entities are best suited to ensure housing in the United States remains affordable to millions.

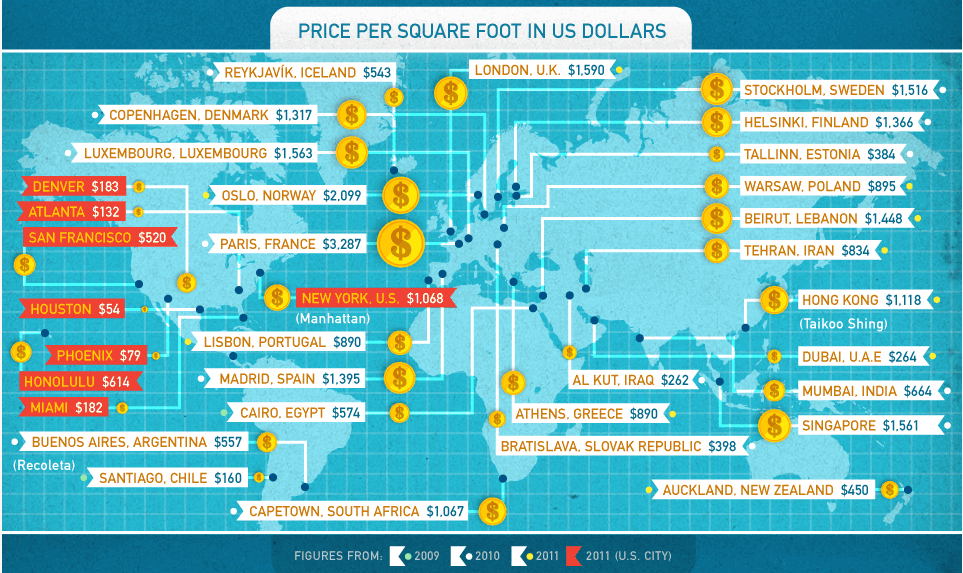

After all, Credit Sesame has pointed out how inexpensive housing in major U.S. cities was relative to other cities across the globe:

Source: Credit Sesame.

As Buffett suggested, part of the reason behind this is "the government guarantee keeps the cost down."

The broader question

Questions still remain about the future of Fannie and Freddie -- Buffett himself said "the question is how to keep the government in the picture without keeping politics in the picture" -- yet Buffett and Munger are apparently comfortable with the government controlling the mortgage industry through Fannie and Freddie.

They believe the benefits and returns the two entities provide shouldn't extend simply to thousands of shareholders, but instead to millions of Americans. Do you agree?