Modified duration is an unfamiliar term for many investors, but the underlying idea probably isn’t. The valuation of securities, particularly bonds, changes as interest rates change. Modified duration gives investors a way to measure this change.

Below, we’ll explain in more detail exactly what modified duration is, how to calculate it, and provide an example of how to use it. We’ll also discuss why modified duration is important for investors.

What is modified duration?

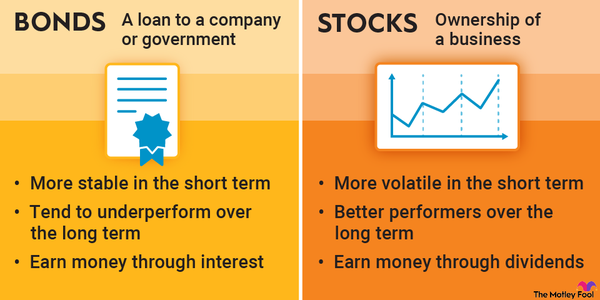

The prices of some securities rise as interest rates fall. And those prices fall as interest rates rise. But by how much? Modified duration is a formula that measures the sensitivity of the valuation change of a security to changes in interest rates.

Modified duration is most commonly used with bonds. However, the formula can also be used with other financial instruments that are sensitive to interest rate changes, including mortgage-backed securities and preferred stocks.

Formula to calculate modified duration

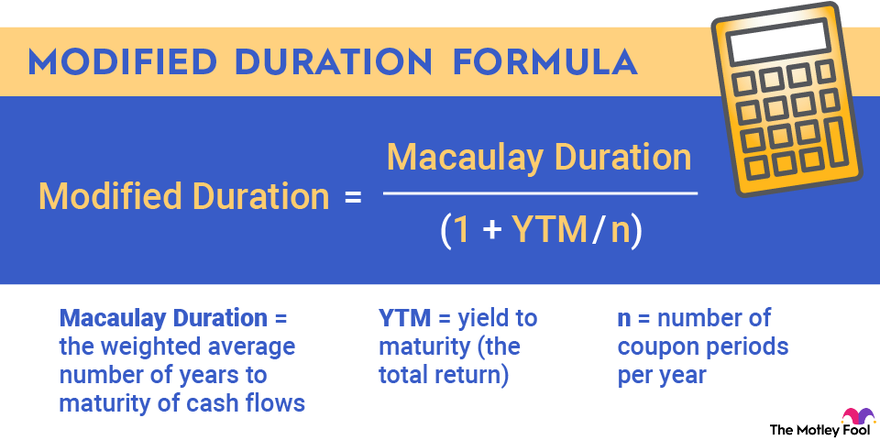

The formula to calculate modified duration is:

Modified Duration = Macaulay Duration / (1 + YTM/n)

Where:

Macaulay Duration = the weighted average number of years to maturity of cash flows

YTM = yield to maturity (the total return)

n = number of coupon periods per year

The Macaulay duration is named after economist and mathematician Frederick Macaulay, who developed the concept of bond duration in the 1930s. Calculating the Macaulay duration is the most difficult part of calculating the modified duration of an asset.

The formula for calculating the Macaulay duration is as follows:

Macaulay Duration = in ti X (PVi/V)

Where:

i = the index for time flows

n = number of coupon periods per year

ti = the time period until the ith payment will be received

PVi = the present value of the time-weighted cash flow

V = the present value of all cash flows

Example of how to use modified duration

Let’s suppose you have a bond with a face value of $1,000 that matures in three years. This bond has an annual coupon rate (the yield paid through maturity) of 5%. Let’s also assume that the current interest rate is 7%.

To calculate the modified duration for this bond, we first need to determine the Macaulay duration. The table below shows how this number can be calculated:

| Time Period (t) | Cash Flow | PV of Cash Flow | PV of Time-Weighted Cash Flow |

|---|---|---|---|

| 1 | Coupon payment = $50 ($1,000 X 5%) | $50 / (1 + 7%) = $46.73 | $46.73 X 1 = $46.73 |

| 2 | Coupon payment = $50 | $50 / (1 + 7%)2 = $43.67 | $43.67 X 2 = $87.34 |

| 3 | Coupon + face value = $50 + $1,000 = $1,050 | $1,050 / (1 +7%)3 = $857.11 | $857.11 X 3 = $2,571.33 |

| Sum | $947.51 | $2,705.40 |

We then divide the present value of the time-weighted cash flow by the present value of all cash flows to determine the Macaulay duration:

Macaulay Duration = $2,705.40 / $947.51 = 2.86 years

Now, we can calculate the modified duration:

Modified Duration = 2.86 years / (1 + 7% / 1) = 2.67

What does this modified duration mean? If interest rates increase by 1%, the price of our hypothetical three-year bond will decrease by 2.67%. Conversely, if interest rates decrease by 1%, the price of the bond will increase by 2.67%.

Why is modified duration important?

Modified duration is important to individual bond investors because it helps them evaluate the impact of interest rate changes on their investments. For example, when interest rates rise, bond prices decline, and vice versa. Investors can calculate the modified duration for the bonds they own to decide whether it’s better to hold or sell, based on the interest rate changes.

Insurance companies and pension funds can use modified duration to manage their risk related to interest rates as well. These organizations often hold bonds in their fixed-income portfolios with prices that can fluctuate based on interest rate changes.

Related investing topics

Making modified duration easier

While the underlying idea behind modified duration is simple, the calculation of the measure isn’t as straightforward as you might like. The good news is that there are tools that make calculating modified duration easier.

For example, Excel spreadsheets include an MDURATION function that calculates the Macaulay duration. Google Sheets also has a similar function. Once the Macaulay duration is determined, calculating the modified duration is relatively simple.

You can also find online calculators that can help you calculate both Macaulay and modified durations. Several websites offer these online calculators that can be used for free.

The bottom line is that you don’t have to shy away from using modified duration because of its complexity. There are plenty of options available to simplify the calculations for determining how interest rate changes might affect your investments.