While you can make money from bonds by simply keeping them until the maturity date, there are also times when selling bonds could make sense. This largely depends on interest rates and the credit risk of the borrower issuing the bond. In this guide, we'll cover when you should sell bonds and how to do it.

When to sell your bonds

When investing in bonds, buying and holding is normally a good strategy. You'll profit from the bond's interest payments and receive the full amount you originally paid for the bond on the maturity date. However, you should consider selling bonds if any of the following is true.

The market value of your bonds has increased

Sometimes bond prices go up, in which case you could sell a bond for more than you paid for it. In this situation, you'll need to decide if you'd rather take an immediate profit by selling your bond or keep your bond and continue collecting interest payments. Bond prices usually rise for one of two reasons:

- Interest rates have decreased. Bond prices are related to interest rates. If interest rates drop, bond coupons (the interest rate paid on bonds) will also drop. That means older bonds that are paying higher interest rates will become more valuable.

- The borrower's bond rating improved. If the borrower that issued your bond improves its credit, then the bond's market value could increase since the borrower presents less of a risk.

For example, you buy a bond for $5,000. Interest rates go down, bringing bond rates down with them and making your bond more valuable. The market value increases to $5,500. You could sell your bond for a $500 profit, although this also means you'd be giving up future interest payments. If you want to reinvest, you'd either need to do so at a lower interest rate or wait to see if rates go back up.

Interest rates are expected to rise

Your bonds become more valuable if interest rates drop, but they become less valuable if interest rates rise. When interest rates go up, it means new bonds will pay higher rates than old ones. You could benefit by selling bonds and then buying in again once they're paying out more interest.

It's worth mentioning that it's impossible to time the market. By the time an interest rate hike is announced, bond prices adjust accordingly. But if there are strong indicators that interest rates are going up, it could be a good time to sell.

You need the money before the maturity date

Ideally, you should only buy bonds if you won't need the money until the maturity date. But in a worst-case scenario, you might need to sell a bond early.

Let's say you lose your job and run out of money in your emergency fund. Your only options are selling bonds or taking on credit card debt at an 18% APR. Credit card interest will almost certainly cost you much more than you'd earn from bonds, so selling would be the better choice.

The borrower is financially unstable

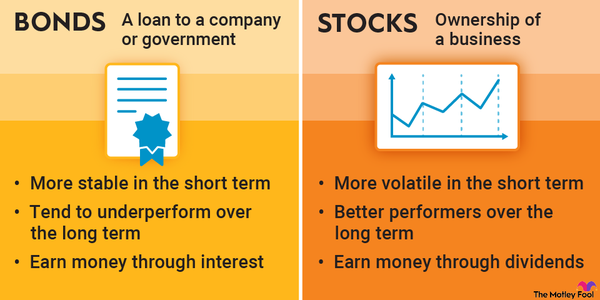

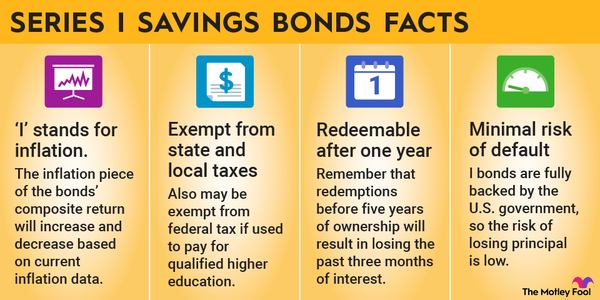

Bonds are generally considered a low-risk investment, but this depends on the entity issuing the bond. Treasury bonds issued by the U.S. government are as safe as it gets. Corporate bonds, on the other hand, come with more risk in exchange for higher interest payments.

If the borrower that issues a bond starts going through financial problems, that could affect your bond's market value and whether you get your money back. For example, if you buy a corporate bond and the company goes bankrupt, you most likely won't get the full value of your bond. Issues like these are rare, but they're still something to watch out for and a sign that selling could be the best move.

Related investing topics

How to sell your bonds

To sell bonds, you need to work with a bond broker. If you purchased bonds through your brokerage account, then you can sell those bonds through the same broker. Here's how:

- Choose the bonds you want to sell.

- Decide if you want to place a limit order, where you specify the price you want, or a market order, where you accept the highest bid available.

- Submit the order.

If you purchased bonds on your own without a brokerage account, you'll need to choose a broker/dealer on the bonds market first. Make sure to compare how much these brokers/dealers charge as a commission on bond sales before you pick one.

Note that the process of selling bonds can vary depending on the type of bond you have. For example, if you have electronic EE or I savings bonds issued by the U.S. Treasury, you'll need to cash those in on the TreasuryDirect website.