Buying bonds is like lending money to a friend. But instead of coming to you and asking to borrow some cash and promising to pay you back after their next paycheck, a corporation or government will issue bonds. A bond is a security that can be sold to investors willing to lend money to a business or government.

Just like you don't trust all your friends equally to pay you back (some are on better financial footing than others), the same is true with bond issuers, so be sure to do your research before diving in and buying bonds. This article will cover how to buy bonds and what to look for when you do.

How to buy bonds

How to buy bonds

You can buy bonds in a similar way to how you might buy stocks. If you have an account at a broker, you can log in and navigate to the bond trading platform. Most brokerages offer a search tool to help you find bonds available for purchase.

You can buy just about any type of bond through a broker: corporate bonds, municipal bonds, Treasury bonds, mortgage-backed securities, and more.

Some bonds offered by your broker may have a minimum order amount of more than a single bond. If you want to build a diversified portfolio of individual bonds, you'll need a significant amount of capital. The par value for most bonds is $1,000. That means the typical price you'll pay for a single bond is about $1,000. Prices will fluctuate based on market conditions, but bond price volatility is usually pretty low.

Bonds

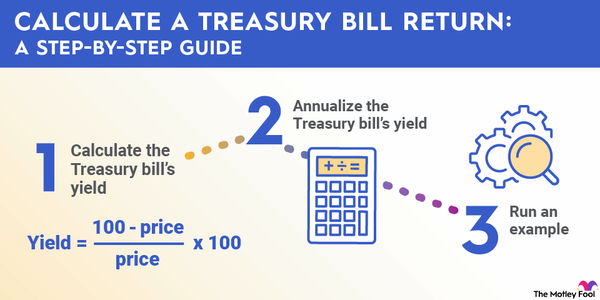

When you find a bond issuance you want to buy from your broker, you'll be able to see some important information. You'll see the current trading price, which usually includes broker fees. The bond price is typically expressed as a percentage of par value. So, a bond trading at $101 will actually cost $1,010 per bond.

You'll also see how much you'll pay in accrued interest, which is the amount of interest owed to the current bond owner. When you take ownership of the bond, you'll receive 100% of the interest paid on the next coupon date, which will offset the accrued interest payment.

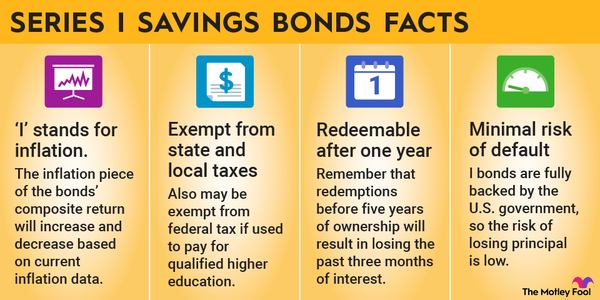

If you're interested in Treasury bonds, you can buy them directly from the U.S. Treasury at its website, TreasuryDirect. Buying bonds directly from the U.S. Treasury will avoid the commissions and fees charged by a broker, which means you'll get a greater yield on your investment.

You'll have to buy new issues from TreasuryDirect, but auctions are happening constantly. Even as yields fluctuate, the effective yield on new Treasury bonds is the same as older issuances trading on the open market. That's because the market pushes the price of past issuances in different directions to account for the change in yield from newly issued bonds.

A third way to buy bonds is to invest in a bond mutual fund or an exchange-traded fund (ETF). A bond fund will hold a broad portfolio of bonds, and it sells shares to investors. Investors earn returns in line with the bond fund's portfolio.

Bond funds can focus on holding a broad range of bonds to mimic the overall bond market, or they can focus on a specific sector, maturation, credit rating, or any other factor. Although bond funds will charge a small fee for managing the portfolio, the advantages for small individual investors looking for a diverse portfolio can be worth it.

If you want to buy a bond mutual fund, you'll need an account with the mutual fund company issuing the shares. If you find a suitable ETF, though, you can buy that through practically any broker, the same way you'd buy an individual stock.

What to look for

What to look for when buying bonds

When buying bonds, there are a number of factors to consider:

- Maturity date: The maturity date of individual bonds will tell you the maximum holding period for that bond. You may find a great deal on a bond, but if it matures next week, it might not be of much value to you. Bond issuers will pay back their principal to the bondholders at maturity. Some bonds have the option to pay back bondholders even sooner. Bondholders can sell their bonds on the open market before that date, though.

- Credit rating: There are three main ratings agencies that will evaluate the creditworthiness of a bond issue: Moody's, Standard & Poor's, and Fitch. Bonds with a lower grade may offer a higher yield, but they come with a greater risk that the issuer will default on their debt, leaving bondholders with nothing. Anything rated above BBB- (S&P or Fitch) or Baa3 (Moody's) is considered investment grade. Bonds with lower ratings are considered junk bonds. Junk bonds can still be a great investment if your risk tolerance is high.

- The issuer: If the underlying company or municipality issuing the bond appears likely to have financial problems, it may be wise to steer clear of the bond or demand a higher yield than its current rating suggests. The market typically already considers any expected challenges, but it can pay to do your own analysis.

- Fees: When you buy bonds from a broker, the fees aren't always very transparent. Be sure to dig into your broker's terms or simply call and ask to see what you're paying in fees. A high fee on a small investment with a short term can really eat into your returns.

- Market conditions: If the market is seeing rising interest rates, the value of current bond issues will decline. Conversely, if interest rates are falling, bonds will increase in value. That said, most bonds are priced based on expectations for the future, making them relatively efficient. So don't try to time the market. Instead, focus on your personal investment goals and whether a bond issue will fit your needs at its current price.

- Tax treatment: Some bonds, such as government bonds, offer preferential tax treatment. You won't have to pay federal income tax on the interest paid by municipal bonds, and they may be exempt from state taxes, as well. Likewise, interest on Treasury bonds is exempt from state and local taxes. If you have investments outside of a tax-deferred retirement account, a taxable account would be an optimal place to hold your government bonds.

Fixed Income

Pros and cons

Pros and cons of buying bonds

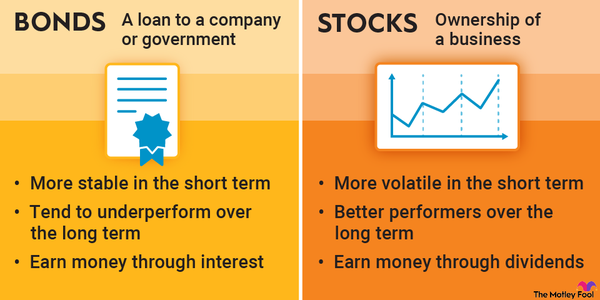

Like every investment, bonds have their advantages and disadvantages.

Pros

- Fixed income and returns: The returns on an individual bond held until maturity are extremely predictable. Investors can calculate exactly how much they'll get paid for holding the bond and when they'll get paid, assuming the issuer doesn't default.

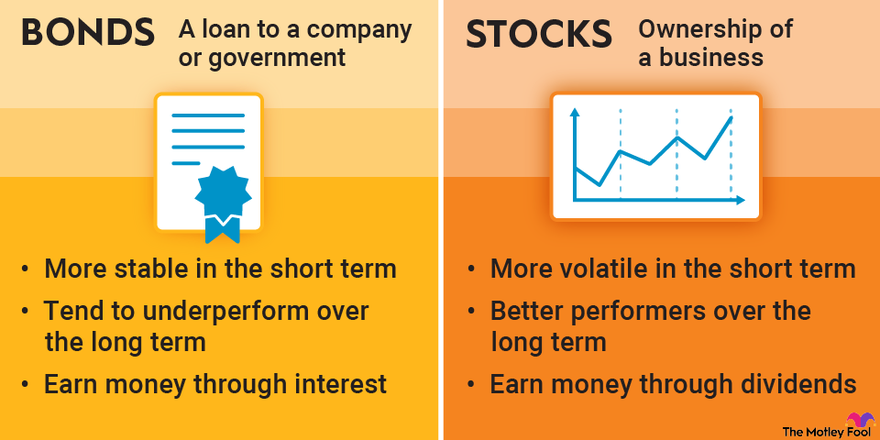

- Often a good diversifier for stocks: Bonds have historically provided a good counterbalance to stocks in a portfolio. The two asset classes have negative price correlation, which means that when one is increasing in value, the other is decreasing in value. That can provide more stable overall returns for a portfolio.

- Clear risk ratings: Unlike stocks and other asset classes, each bond has a clear risk rating provided by the three ratings agencies. This can give investors a better idea of the amount of risk they're adding to their portfolio and whether they're receiving enough of a return to justify the risk.

Cons

- Lower long-term returns than other investments: Although the returns on bonds are extremely predictable, they generally return less than stocks and other investments. If you don't need the money for a long time and can stomach increased volatility, there may be investments that can offer a better return.

- Prepayment risk: Prepayment risk is the risk that an issuer will pay off the debt before its bonds mature. This can happen if the market experiences a drop in interest rates and issuers look to refinance their debts. As such, bond investors who hold callable bonds (i.e., bonds that can be prepaid) can only participate in the downside risk of changing interest rates.

- Low liquidity: Some bonds have very low liquidity compared to stocks and other asset classes. If you want to sell a bond, you must match up with a buyer for that specific bond. That can be difficult if there are other similar but more attractive bonds available.

Related investing topics

The bottom line on buying bonds

There are a few options for buying bonds, and they can all be useful to individual investors. Whether you're buying corporate bonds through your broker, Treasuries directly from the U.S. Treasury, or a bond fund through a mutual fund company, they can all work to provide exposure to bonds in your portfolio. Be sure you understand the risks and benefits of investing in the various types of bonds available and how they can fit into your portfolio and various investment accounts.

FAQ

Buying bonds FAQ

How do I start buying bonds?

You can buy individual bonds through your brokerage, which will provide a search tool to find bond issues that fit your needs. If you want Treasury bonds, you can buy them directly using Treasury Direct, avoiding the fees and commissions from a broker. Alternatively, you can buy a bond mutual fund or ETF.

How much does it cost to buy a bond?

The fees and commissions charged to buy a bond will vary from broker to broker. If you buy a Treasury bond through Treasury Direct, you won't pay any additional fees. Note that most bonds have a par value of $1,000, so the minimum investment required will be about that amount.

Are bonds a good investment?

Like almost everything in personal finance, it depends. If you're looking for an investment with a predictable return that can provide some diversification from stocks, bonds can be a great investment. If you're looking to maximize your returns in the long run without concern for volatility, bonds probably aren't the best investment for you.