For any number of reasons, you might be interested in buying savings bonds for a kid. The good news is that not only can you do it, but it’s very easy to learn how.

Below, we’ll review what savings bonds are and how they work, how to buy them for a kid, the pros and cons of buying savings bonds, and how to cash them in once they’ve hit maturity. Finally, we’ll wrap up with a few frequently asked questions on the subject.

What are savings bonds?

What are savings bonds?

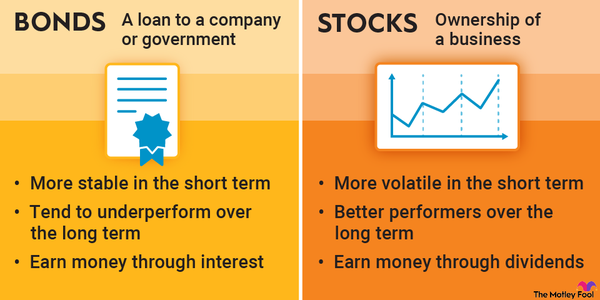

Savings bonds are government-issued debt securities that pay a particular rate of interest. When you buy a savings bond, you loan money to the federal government, and it agrees to pay you back -- with interest -- over a specified period of time.

The different types of savings bonds currently available include:

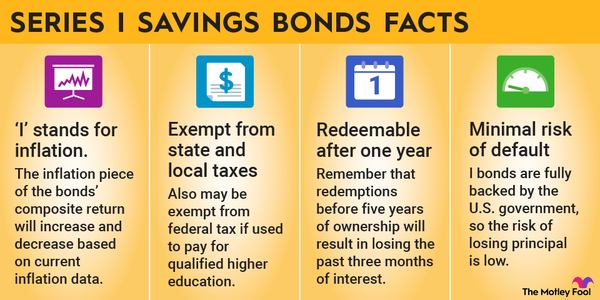

- Series I bonds: Series I bonds, or just simply “I bonds,” are savings bonds that pay a rate of interest equal to a fixed interest rate plus a semiannual inflation rate. The rates adjust every six months. Given recent spikes in inflation data, I bonds have recently come back into the national conversation after being an afterthought for more than a decade. As of this writing, Series I bonds pay interest at a rate of 6.89%. Electronic purchases are limited to $10,000 per Social Security number per year.

- Series EE bonds: Series EE bonds pay a fixed interest rate (set at the time of purchase) for 20 years, but the main draw with Series EE bonds is that they’re guaranteed to double in value if you hold them for 20 years. Series EE bonds currently pay 2.10% annually and are subject to the same $10,000 annual purchase limit per Social Security number as Series I bonds.

- A note on HH bonds: Series HH bonds were issued from 1980 through 2004, but they are no longer available for purchase. The last HH bonds will stop earning interest in 2024.

No matter which savings bonds you buy, the most value comes by holding them to their full maturity. This allows compound interest (or interest on interest) to meaningfully increase your money over time. Redeeming bonds too early will limit their ability to earn interest.

How to buy savings bonds for a kid

How to buy savings bonds for a kid

Follow these steps to purchase savings bonds for a minor:

- Before making a purchase, it’s a good idea to familiarize yourself with the TreasuryDirect website, which is the only site for making savings bond purchases. You can learn more about the different types of bonds available, and you can learn how the website functions.

- Request that the child’s parent or adult custodian open a linked TreasuryDirect account in the child’s name. This is called a “Minor Linked Account,” and it’s necessary to set this up for a child to receive savings bond gifts. If it’s not possible to open an account for the child for any reason, you can still gift savings bonds to them, but you’ll need to hold the bonds in your “Gift Box” until an account is established for the child.

- Collect information about the child to whom you’d like to gift savings bonds:

- Child’s Full Name

- Social Security Number

- TreasuryDirect account number (as described in Step 2)

Fortunately, you can save this information after you’ve entered it once, which can be helpful if you want to make a future additional gift to the same child.

- On the “Purchase” page, select “Add New Registration,” and enter the information collected in Step 3. Make sure to designate the primary owner as the child receiving the savings bonds.

- Enter the purchase amount, select a funding source, and confirm the purchase.

- The savings bonds will be routed to your Gift Box, where they must remain for at least five business days before you can transfer them to the recipient. (Note: If the minor child does not yet have a TreasuryDirect account, the bonds will sit in your Gift Box until they do.)

It’s also possible to purchase paper savings bonds for a child with your tax refund by filling out Form 8888. Since not everyone receives a tax refund, and most people prefer electronic savings bonds for a multitude of reasons, this is considered a secondary method for purchasing these securities.

Related investing topics

Pros and cons

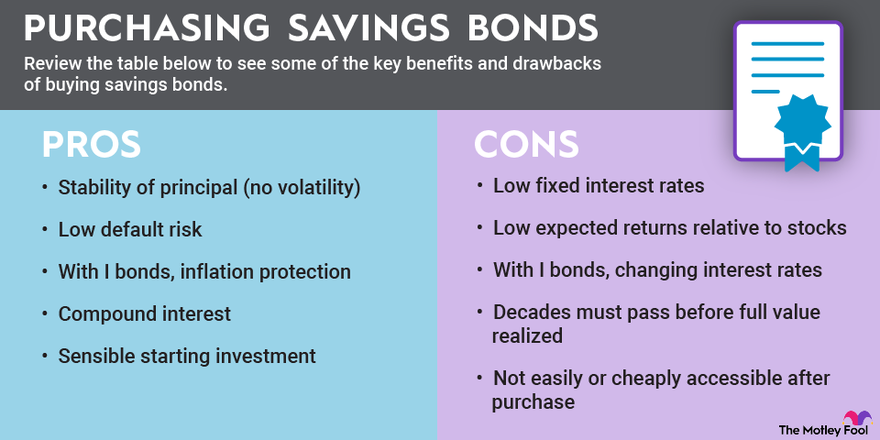

Pros and cons of purchasing savings bonds

How to cash in savings bonds

How to cash in savings bonds

First, you should be aware that you won’t be able to cash in your Series I or Series EE bonds before you’ve held them for at least a year. And, if you decide to redeem them before you’ve held them for five years, you’ll lose the last three months of interest. So there are definitely some limiting factors to consider before you make your purchase, whether it’s for yourself or for a minor child.

Steps to cash in your Series I or Series EE bonds:

- Log in to your TreasuryDirect account.

- Go to ManageDirect.

- Use the link for cashing your savings bonds.

You can specify a portion of your bonds to redeem, or you can cash the entire amount provided you’ve held the securities for at least a year. If you cash only part of what a bond is worth, you must leave at least $25 in your account.

Once you cash your bonds, you’ll receive a Form 1099-INT at tax time reflecting any taxable interest you earned during the redemption year. You’ll then need to enter the information on this form on your tax return.

Subject to certain limitations, you may also be able to use Series EE bond proceeds for higher education expenses. This will make the interest nontaxable. Generally speaking, this option is only available to those with MAGIs (Modified Adjusted Gross Incomes) on the lower end of the scale.

The bottom line on buying bonds for kids

Purchasing savings bonds is not only a very generous thing to do for a child, it’s also a smart financial move. Buying savings bonds for kids allows them to earn compound interest when they’re young, which can help them create a financial foundation long before they turn 18.

FAQs

Buying bonds for kids FAQs

Are savings bonds worth it for kids?

This is a subjective question, but there are a lot of reasons why savings bonds make good investments for kids. First, the probability of losing money is near zero, and the bonds are guaranteed to earn some amount of interest over their respective holding periods. For a first investment, or for a child younger than 10, this can be a great way to start building a financial foundation.

In certain cases, bond proceeds can be used to pay for higher education expenses. But, as with most investments, the major value from savings bonds comes by holding them to their maturity dates.

How much does a $100 savings bond cost to purchase?

Since there aren’t any transaction costs associated with purchasing savings bonds, you could simply buy $100 worth of bonds for $100. Nothing unusual here.

However, if you were to redeem a savings bond before five years have passed since purchase, you will have to forfeit the last three months of interest, which is a cost to consider.

What kind of savings bond should I buy for a child?

There aren’t many possible selections when it comes to buying savings bonds; you’re left with either Series I or Series EE. Series I bonds are still very competitive, offering rates just under 7%. The catch here is that that rate isn’t guaranteed to last longer than six months. I bond rates will fluctuate with the broader economy, and nobody knows what inflation will be even one, three, or five months from now.

Series EE bonds are a bit more predictable. At 2.15%, EE bonds aren’t particularly attractive in the short run, even when compared against a run-of-the-mill savings account. But if you’re committed to keeping them for 20 years, it could be a good idea to have a few sets of EE bonds working in your favor.

Regardless of the type of bond you ultimately choose, it’s the act that really matters. Buying a savings bond for a child is an act of generosity that can affect the recipient for many years to come. As previously noted, they make the best investments for those committed to keeping them until maturity.