After the September 11 attacks on New York City and Washington D.C., the U.S. government started issuing Patriot Bonds. If you’re holding a Patriot Bond, you probably want to know exactly what it is, what it’s worth, and how to cash it in. Read on to find out all that and more.

What are Patriot Bonds?

What are Patriot Bonds?

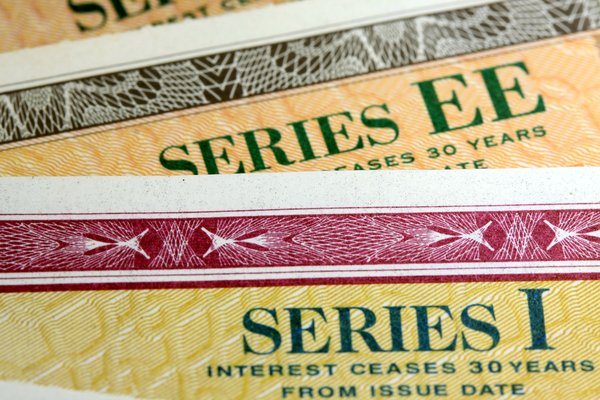

Patriot Bonds are special edition Series EE savings bonds that were issued from December 2001 to December 2011. The U.S. Department of the Treasury printed "Patriot Bond" on these savings bonds and used them to fund anti-terrorism programs.

The government stopped issuing paper savings bonds in 2012, effectively ending the issuance of Patriot Bonds. If you want to buy bonds, you can do so online.

For bond investors and savers, there’s practically no difference between a Patriot Bond and any other Series EE savings bond. The words printed on the paper bond were the defining characteristic with this type of Treasury bond.

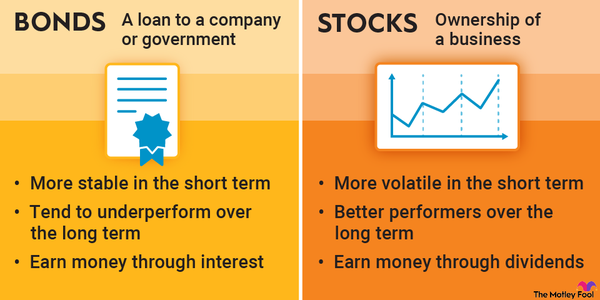

You could buy a Patriot Bond in any denomination between $25 and $10,000. The face value of the bond is twice what was paid, so you would have only paid $50 for a Patriot Bond with $100 printed on it. The fact that you know how much you're getting is one of the advantages of bonds compared to stocks as an investment.

What is my Patriot Bond worth?

What is my Patriot Bond worth?

Every Patriot Bond is guaranteed to double in value after 20 years. So if you have an original Patriot Bond issued in December 2001, it became worth its face value (at least) in December 2021. Patriot Bonds accrue interest for 30 years, unless cashed before then.

If it hasn’t been 20 years since issuance, you can still cash in your Patriot Bond, but it’s probably not a great idea. You can look up the exact value of your Patriot Bond by using the calculator on the Treasury Direct website.

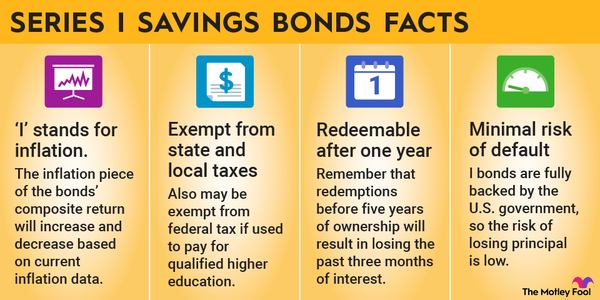

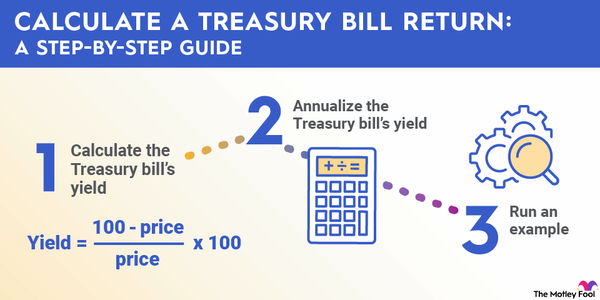

Patriot Bonds issued before May 2005 earn a variable rate of interest that changes every six months. The new rates are announced on May 1 and November 1 of every year and apply to all Series EE bonds issued between May 1997 and April 2005.

Bonds

The rate goes into effect for those bonds starting six months after their last rate change. For example, bonds issued in December will see their rates change in June and December every year.

Bonds issued in May 2005 or later earn a fixed interest rate. You can continue to hold your Patriot Bond beyond the 20-year maturity and earn the fixed interest rate, which you can look up using on the Treasury Direct website.

Patriot Bonds issued between May 2005 and April 2008 earn 3% or more per year. However, the impact of the Great Recession led to a significant drop in interest rates in 2008. If the guaranteed interest rate is appealing, you can continue to hold your Patriot Bond as long as 10 years after maturity. People holding bonds with low interest rates, however, may want to sell bonds right at 20 years.

Interest Rate

How to cash in a Patriot Bond

How to cash in a Patriot Bond

If you’re ready to cash in a Patriot Bond, you can usually do so at your local bank or credit union. Some have stopped accepting savings bonds, though, so be sure to contact your financial institution to be sure you can cash in the bond.

All you have to do is bring your Patriot Bond, your ID, and your bank account information to your bank, and you’ll be able to deposit the bond. The process is similar to depositing a check, and a banker or teller can walk you through it.

If your local bank or credit union will not cash your Patriot Bond, you can send them directly to Treasury Direct. Here's how:

- Fill out FS Form 1522.

- Get your signature certified if you're redeeming more than $1,000 worth of bonds.

- Send the bonds and your documentation to Treasury Direct.

If you’ve converted your Patriot Bond to an electronic bond, you can cash the bond online. Log into your Treasury Direct account and click the link for cashing securities.

Note: You can't cash in a Series EE savings bond within a year of issuance. You’ll also pay a penalty of three months’ worth of interest if you redeem one within five years. But since all Patriot Bonds were issued before 2012, that’s not an issue for Patriot Bond holders.

When you redeem your Patriot Bond, you’ll receive a 1099-INT detailing the amount of interest earned on the savings bond. The interest is exempt from state and local tax, but you’ll owe federal income tax on that amount.

Federal Income Tax

Related investing topics

The bottom line

The bottom line

Patriot Bonds, like all other Series EE savings bonds, will double in value after 20 years. It often makes sense to cash in bonds right at 20 years to maximize your returns, but some carry a good fixed interest rate that may make it worthwhile to hold them for as long as 10 more years until the savings bond reaches maturity.

Patriot Bond FAQs

Patriot Bond FAQs

What is a Patriot Bond?

A Patriot Bond is a Series EE savings bond issued between December 2001 and December 2011. This was a special edition savings bond made to fund anti-terrorism programs, and each one has the words "Patriot Bond" printed on it. It works the same way as any other Series EE savings bond.

How much is a $50 Patriot Bond worth?

The value of a Patriot Bond depends on its face value and its date of issuance. Every Patriot Bond earns interest, which accrues in six-month periods. After 20 years, the Patriot Bond is guaranteed to be worth at least face value. So a $50 Patriot Bond, which was bought for $25, will be worth at least $50 after 20 years. It can continue to accrue interest for as many as 10 more years after that.

Do you have to pay taxes on Patriot Bonds?

Yes, you have to pay taxes on Patriot Bonds. The interest that your savings bond earns is subject to federal income tax, but not state or local income tax. It's also subject to any federal estate, gift, and excise taxes and any state estate or inheritance taxes. You can either report each year's earnings or wait and report all the earnings when you cash the bond.

How long do you have to wait for a Patriot Bond to mature?

It takes 30 years for a Patriot Bond to mature, but you can cash it in before then. Patriot Bonds are guaranteed to be worth at least the face value 20 years after they were issued.

When can I cash in my Patriot Bonds?

If you currently hold a Patriot Bond, you’re able to cash it now. However, you’re unable to cash in a Series EE savings bond within one year of issuance, and you’ll pay a penalty of three months’ interest if redeemed within five years. (Since all Patriot Bonds were issued before 2012, that’s not a concern.)

What is the interest rate on Patriot Bonds?

The interest rate for a Patriot Bond depends on its date of issuance. If issued in May 2005 or later, it has a fixed interest rate. If issued before then, it has a variable interest rate. You can look up the current interest rate of a Patriot Bond on the Treasury Direct website.